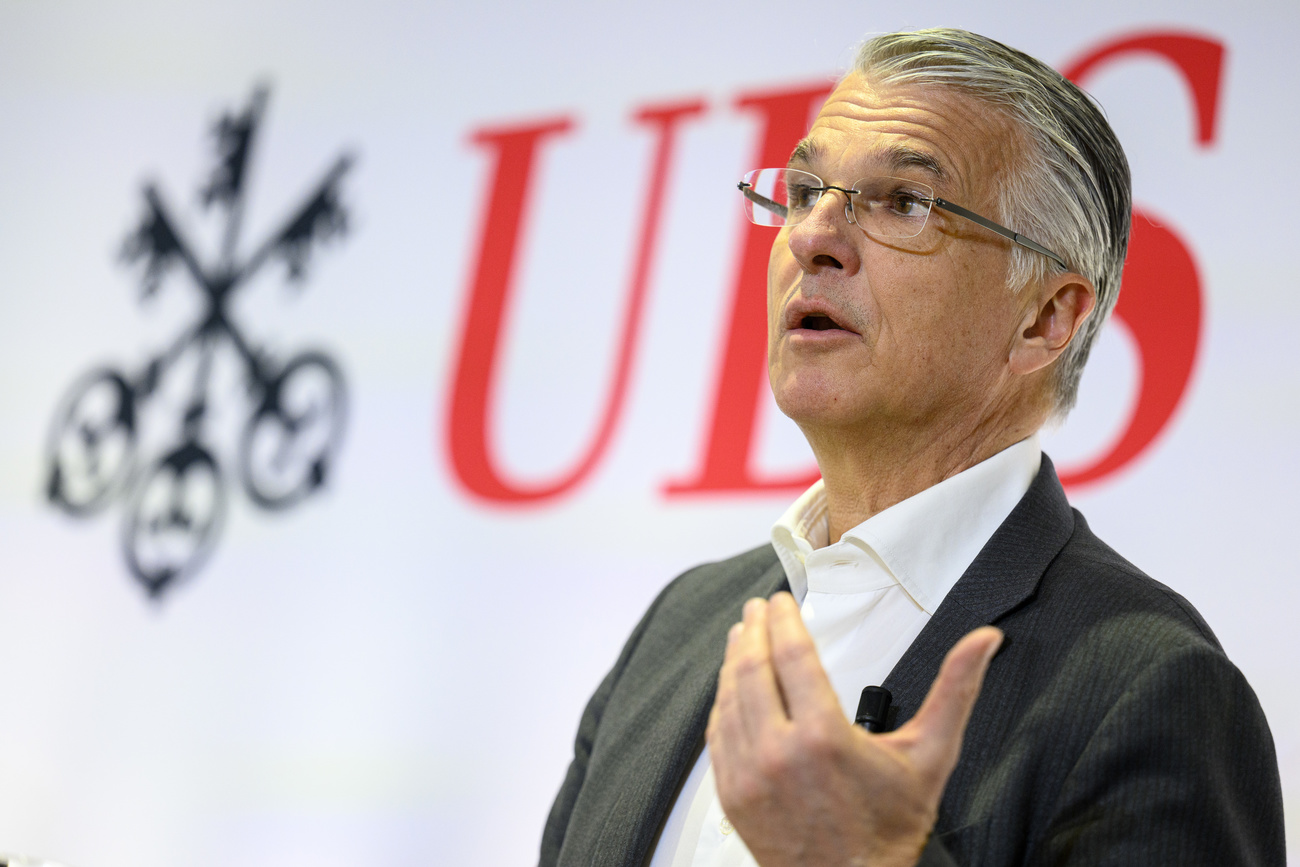

UBS rules out external successor to chief Sergio Ermotti

UBS has ruled out an outsider as the successor to chief executive Sergio Ermotti, instead planning to choose from a shortlist of three internal candidates when he steps down in about three years’ time.

Check out our selection of newsletters. Subscribe here.

The Swiss bank could signal the identities of the potential successors as early as next year’s annual meeting, according to people with knowledge of the plans, having decided against looking outside the group for a future leader.

The candidates, who are expected to be drawn from the current executive board, would then be given additional responsibilities or changes to their roles in order to broaden their experience ahead of potentially replacing Ermotti.

“It’s about giving them a greater purview,” said a person with knowledge of the plans. “They will need time to prove themselves.”

Ermotti returned to UBS as chief executive just over a year ago within days of the bank rescuing its arch-rival Credit Suisse, in a shotgun marriage arranged by the Swiss authorities.

More

UBS re-appoints CEO Ermotti for Credit Suisse takeover

At the time, the 64-year-old former investment banker committed to spending three to five years in the role, according to people briefed on the agreement, in order to oversee the three-year integration of Credit Suisse and develop a growth strategy for the combined group. Ermotti has also been charged with nurturing a pool of successors.

Succession race

UBS chair Colm Kelleher fired the starting pistol on the succession race last year when he said the bank was looking to follow the example set by his former employer, Morgan Stanley, at the Financial Times’s Banking Summit.

Morgan Stanley had several internal candidates to choose from when longtime chief executive James Gorman stepped down last year. They eventually settled on Ted Pick. Gorman announced on Thursday that he would leave his position as chair at the end of 2024.

More

UBS CEO earned salary of CHF14.4 million in 2023

But UBS’s organisational structure is different to Morgan Stanley’s, which allowed Pick and another candidate, Andy Saperstein, to share responsibility for much of the group in co-president roles.

At UBS, divisional heads sit on the group executive board and report directly to the chief executive. In order to prepare potential successors better, UBS’s board had considered tweaking the structure or changing executives’ roles, according to people briefed on the discussions.

Possible contenders

Though no final decision has been made about who would make the shortlist, Iqbal Khan, head of wealth management — UBS’s most important division — is expected to be included.

Rob Karofsky, head of the investment bank, is viewed as another potential contender, as is Bea Martin, who oversees UBS’s non-core and legacy unit, which is responsible for disposing and winding down parts of Credit Suisse that are deemed undesirable. She was recently given additional oversight of sustainability.

Sabine Keller-Busse, who runs UBS’s Swiss business, is also seen as a potential candidate.

While succession plans have been mapped out by UBS’s board, the management team is preoccupied with integrating the two businesses, including merging the legal entities by the end of May.

Ermotti is also focused on dealing with Swiss authorities over incoming rules that could include additional capital requirements on UBS, which the bank is pushing against.

UBS declined to comment.

Copyright The Financial Times Limited 2024

© 2024 The Financial Times Ltd. All rights reserved.

More

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.