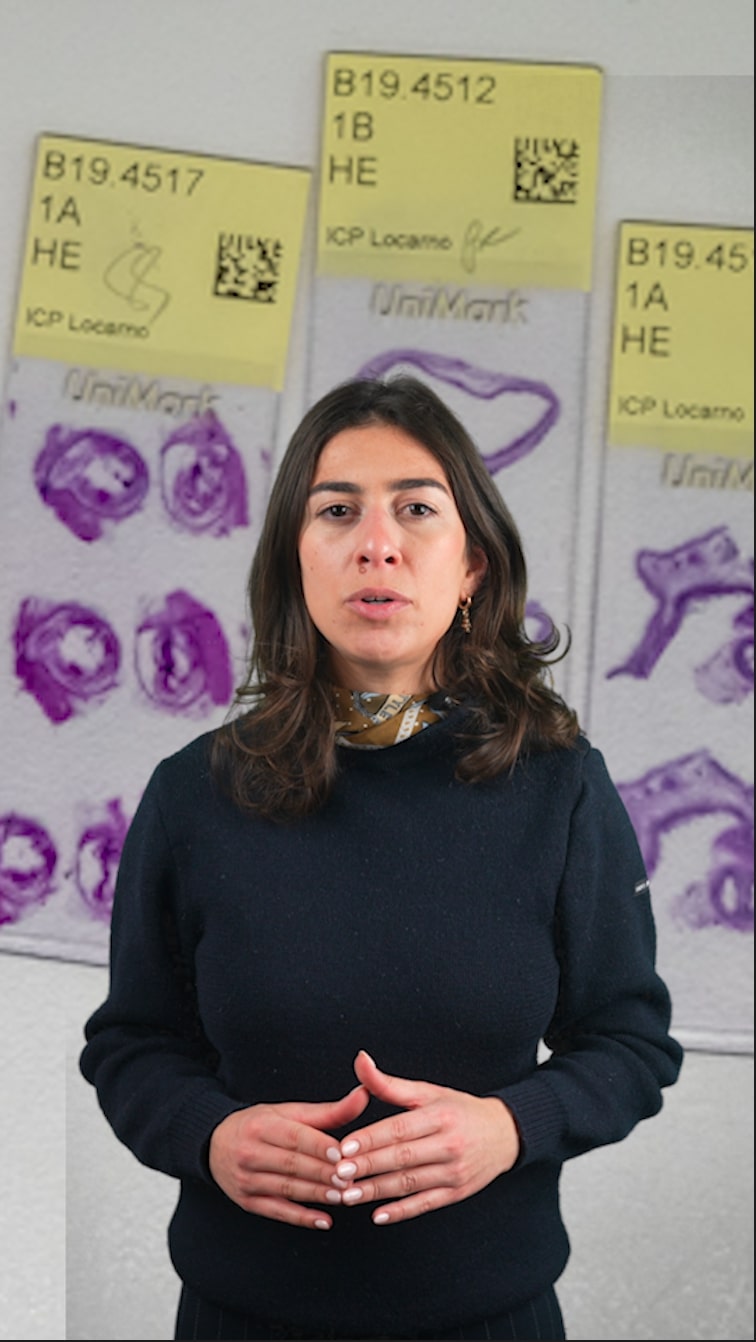

Diversity is needed to make business smarter, says CEO

Women remain few and far between in top positions in the world of finance. Fiona Frick, CEO of asset management company Unigestion, is an exception. SWI swissinfo.ch spoke to the Geneva executive, one of the most influential women in European finance, who is standing down as CEO at the end of the year.

SWI swissinfo.ch: You climbed the career ladder at Unigestion, whereas in your native France, top graduates from the elite institutions start in high-level positions. Which is the better model?

Fiona Frick: I favour a mix of career profiles. In our field, team members should come from all sorts of career backgrounds: engineers, historians, people who have done a practical apprenticeship, and yes, people from elite institutions as in France. I believe that this diversity is needed to make businesses smarter.

SWI: The world of finance is still very male. Was it a struggle for you to get to where you are?

F.F.: The world of finance has been very male, but it is changing, and you find more and more female CEOs. I have never had a struggle to make my way at Unigestion because the company’s leadership has always made decisions on the basis of merit, commitment to the company, and enthusiasm at work.

It is interesting to note that – in finance as well as other industries – leadership has developed with the greatest diversity at the CEO level. There are now several kinds of corporate leadership, including one that is more collaborative and empathic and allows people to be vulnerable.

More

Swiss women make inroads in executive positions

SWI: The financial industry doesn’t exactly have a brilliant reputation. How do you find meaning in the work you do?

F.F.: Yes, unfortunately, finance has a bad image due to the excesses of the past. This being so, I aspire to develop a positive role for finance in society, that is, as a meeting point between investors who need to make money and businesses which need capital. At a time when the challenges about climate change are huge, the financial industry can do its bit by channelling capital investment to projects that humanity needs and that also make money for our customers.

SWI: Unigestion employs some 200 people and manages about $19 billion (CHF17.6 billion) worth of assets. You also say that you serve about 427 customers. What kinds of customers, and where are they geographically?

F.F.: 95% of our customer base consists of institutional investors – mostly pension funds, insurance companies and financial institutions. We also cater to some wealthy families. Geographically, 13% of our customers are based in Switzerland while 60% are elsewhere in Europe (Britain included). The rest (20%) are in North America and a few other parts of the world.

SWI: Unigestion calls itself an ‘independent’ asset manager. Independent of what?

F.F.: We call ourselves independent because we are not a publicly-traded company and our ownership has always been private. Our main owner (with a 55% share) is the Famsa Foundation, which was set up by Bernard Sabrier, the founder and president of Unigestion. Less than a quarter is then held by about 30 employees, while a similar amount is held by a few institutional partners.

Thanks to this structure of ownership, we can afford to have a long-term vision and we are not under the usual stock-market pressures. This is important because in our business, cycles are long and it takes 18 to 24 months to secure a new customer. Finally, our colleagues definitely appreciate the philanthropic aims of the Famsa Foundation.

SWI: Your firm has an international presence with ten offices in Europe, North America and Asia. What do these offices do?

F.F.: All our offices around the world have two tasks. They are management centres and are staffed by financial analysts and portfolio managers. They are also responsible for customer relations at the local level.

SWI: It is said that research is in Unigestion’s DNA. How do you collaborate with the academic world?

F.F.: I would say that today’s research is tomorrow’s performance. In this context, building bridges between applied finance and academic research is particularly important. We work with Masters or doctoral students who are completing their theses. We agree on topics of common interest, for example the role of machine learning in investment management. It is not uncommon for us to take some of these students on board once they have completed their degrees. Furthermore, we organise conferences at the Federal Institute of Technology Lausanne (EPFL) and Imperial College London.

SWI: When it comes to quantitative risk management, do you rely more on mathematical models than on human decision-making?

F.F.: Both. Mathematical models are useful for dealing with a large quantity of data based on past experience. On the other hand, human decision-making is needed to make future projections and to integrate new data – such as a pandemic or a war in Ukraine.

SWI: To make good investments, is privileged access to corporate leaders also required?

F.F.: It is very important to combine the analysis of facts and figures with a dialogue with corporate leaders. What these leaders have to say about the future needs to be listened to seriously. Of course, any trading of privileged information is out of the question, as that would be illegal.

SWI: When you invest in a company, do you have a minimum degree of participation in order to have real influence on environmental, social and governance issues?

F.F.: What we do is focus on a shared commitment. For example, we are involved in ClimateAction 100+ External link. The goal of this initiative – supported by a large number of investors – is to ensure that the world’s largest corporate greenhouse gas emitters take steps to combat climate change. Only if we adopt these common positions and unite our forces can we have a real impact.

SWI: Why did you decide to resign as CEO?

F.F.: After 32 years with Unigestion, I wanted to give myself time to pursue other professional interests that have been close to my heart for some time.

SWI: What are your plans for the future?

F.F.: I have always enjoyed talking to our institutional clients about the macroeconomic environment and its impact on financial markets and asset allocations. In addition, for the past 20 years I have been passionate about the potential contribution of finance to sustainability and a more environmentally friendly energy transition. Thus, my future activity will focus on assignments – as a board member and consultant – on investment allocation and sustainability issues. Finally, I also want to spend time building bridges between the financial industry, sustainability and academia.

Fiona Frick, 55, holds a Masters degree in business from the Paris International Business School (ISG) and a Bachelors degree in literature and philosophy from the University of Dijon. She has also taken executive courses at the IMD Business School in Lausanne.

Frick began her career with Unigestion as a fundamental analyst. Twenty years later, in 2011, she was appointed CEO of the Geneva-based company, which was founded in 1971. She comments on the financial markets for Bloomberg TV and CNBC and appears regularly at international conferences.

Edited and checked by Samuel Jaberg. Translated from French by Terence MacNamee

More

Call to tap potential of professional working women

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.