Marketing luxury watches in China takes time

Although it might sound easy to sell Swiss luxury watches to the fast-growing number of millionaires in China, the Chinese market has its own peculiarities.

There are differing views on what luxury actually is among the country’s wealthy and therefore one marketing strategy alone does not necessarily apply to all would-be customers, experts say.

Swiss watchmaking exports to China increased sharply in 2010 and the trend is set to continue, against the background of a rise in the country’s rich.

Of the SFr16.2 billion ($17.1 billion) of total Swiss watchmaking exports last year, China accounted for nearly SFr1.1 billion or an increase of 57 per cent over the 2009 figure.

The Federation of the Swiss Watch Industry in Biel describes this as “particularly dynamic”, with China moving up three places to fourth in the overall ranking behind Hong Kong, the United States and France.

But how do you sell a luxury Swiss watch to a Chinese consumer who has the money to buy one but needs some convincing? And which brands attract the buyers?

The questions are intriguing and timely, as Switzerland’s watchmakers prepare for the annual Baselworld trade fair, which showcases the world’s watchmaking and jewellery industries.

To shed light on the topic, Neuchâtel University organised a presentation with two Chinese marketing experts and one of its researchers.

Long memories

The first things to strike you is that being among the first on the market is important and that the Chinese have long memories.

“The first watch brand advertisement in China [on television] was a Rado [from Switzerland] and at the time [in 1979] everyone thought it was something new. But even then it was [only] for people living in Shanghai,” Tingting Mo, a research fellow at the IAE graduate school of marketing in Aix-en-Provence, told swissinfo.ch.

“It was the most westernised city in China at that time and even now leads the trends. People who wanted to buy a watch needed to go to Shanghai because there were no stores elsewhere. You can therefore imagine how valuable a watch was.”

Rado is still popular in China and ranks high among favourite luxury brands (see Brand Popularity, right).

Snobs and pragmatists

In her research Mo found there were several segments of the Chinese watch market, such as conformists, followers of trends, snobs, pragmatists and those who like to indulge.

She says that Swiss watchmakers should consider limited editions because some Chinese want them as an assurance of value.

Mo also argues that they should not only set up shop in the obvious cities such as Beijing, Shanghai or Guangzhou but also look at what she described as second- or third-tier cities like Kunming.

For Yi Xie, a professor of marketing at Beijing’s University of International Business and Economics, the key element is to understand the Chinese market.

“Chinese consumers are changing a lot and I think putting yourself in their shoes is quite important. You have to realise that there are millions in the north, south, east and west of China and they think differently, behave differently and they purchase different things,” she told swissinfo.ch.

“Maybe in the past they bought things with the highest price because they didn’t really know what was good. They couldn’t really appreciate a watch but now they try to find its personality, culture and history rather than looking at the price.”

Brand name

The marketers also have to look at how the brand name will go down in China. Does it need translation, for example? And if so, how? It can be done phonetically, semantically or phono-semantically. It is a complex but nonetheless important factor in achieving brand recognition.

“The watch industry should definitely consider some Chinese elements, especially some cultural factors,” Nicolas Hanssens, a research fellow at Neuchâtel University, told swissinfo.ch.

“However, a real balance should be made when you enter this market, in such a way that you will not become completely Chinese.”

His reasoning is simple. “You are a Swiss brand and represent something mysterious, so you need to keep this part of your DNA.”

Hanssens feels that every brand has its own positioning and should think about its own strategy for the Chinese market.

Some brands should do this in an intensive way, he argues, including Chinese brand name translation or using Chinese celebrities in their printed or television advertising as well as at big events in Beijing or the main cities.

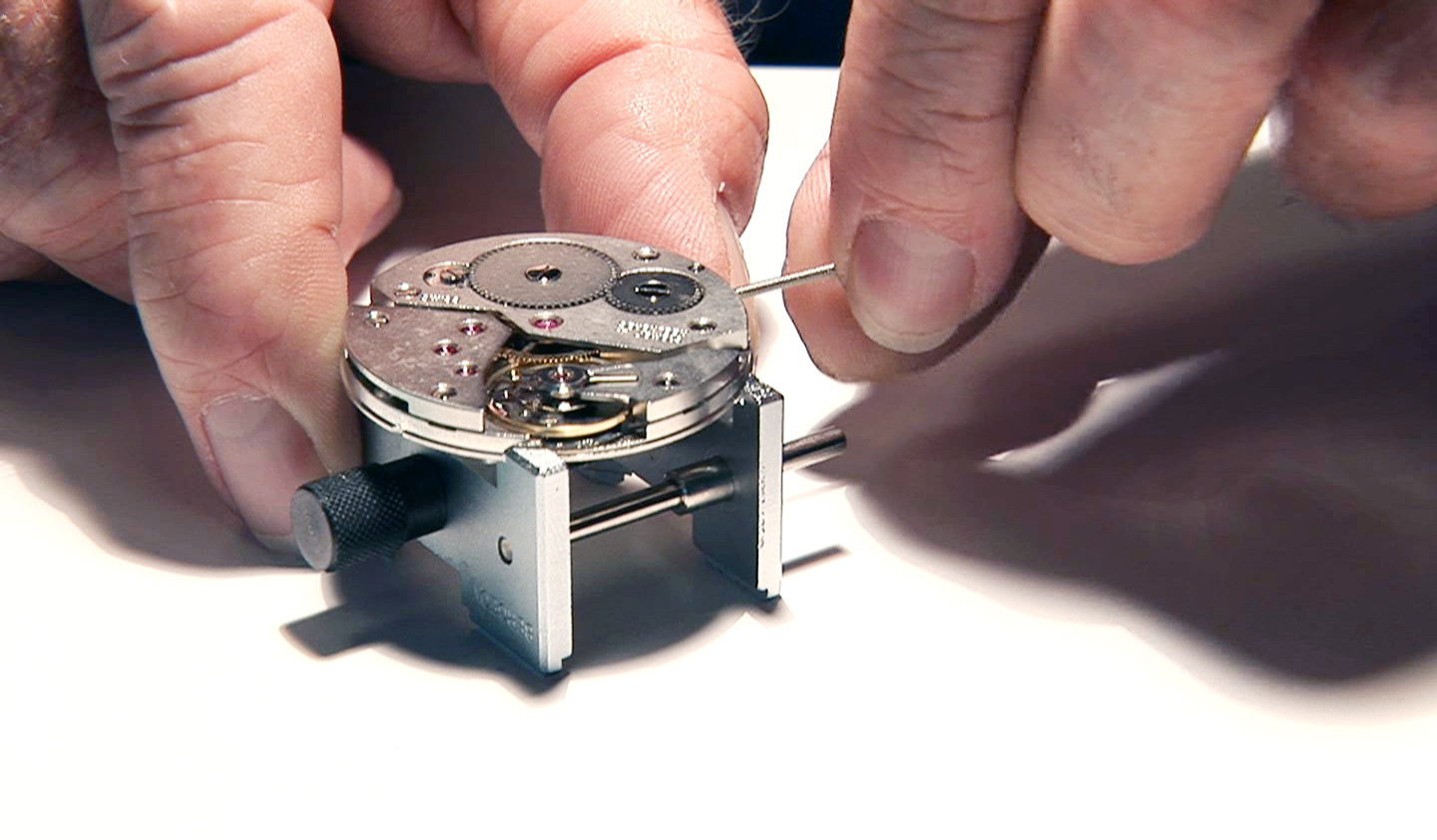

“Something we always forget here if we produce a watch in Neuchâtel or Geneva is that we have our own culture about the watchmaking industry and it’s sometimes hard for other people to understand what is behind the brand, especially for a new market like China.”

In a country with an estimated population of 1.3 billion, there are 875,000 multimillionaires and 55,000 billionaires.

Multimillionaires on average own three cars and 4.4 luxury watches

Billionaires on average own four cars and five luxury watches.

China in 2009 surpassed the United States in luxury consumption by making up 27.5% of the global luxury market. It is expected to take over from Japan in the top spot as early as 2015.

The country is the youngest luxury market. 80% of consumers are less than 45 years old. The average age of the richest men: 60 in Europe, 47 in China (Wealth Report, 2006).

Average of the wealthy changed to 39 in 2010.

Collection is one of the most important investments of Chinese multimillionaires Their collections include:

Watches/jewellery: 44%

Ancient calligraphy and paintings 15%

Wine: 13%

Cars: 12%

Contemporary art 7%

(research by Tingting Mo)

The top luxury Swiss watch brands that the Chinese were most likely to purchase in 2010 were Rolex, Omega and Cartier.

Asked about their favourite luxury brands, the Chinese chose the following: Patek Philippe, Cartier, Rado, Omega, IWC, Tissot, Longines, Jaeger-LeCoultre, Piaget, Montblanc, Chopard and TAG Heuer.

(research by Yi Xie and Nicolas Hanssens)

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.