Crypto exchanges must face up to responsibilities as they mature

Cryptocurrency exchanges are developing to look more like their traditional peers as the market matures, but some warn the pace of change is more baby steps than giant leaps.

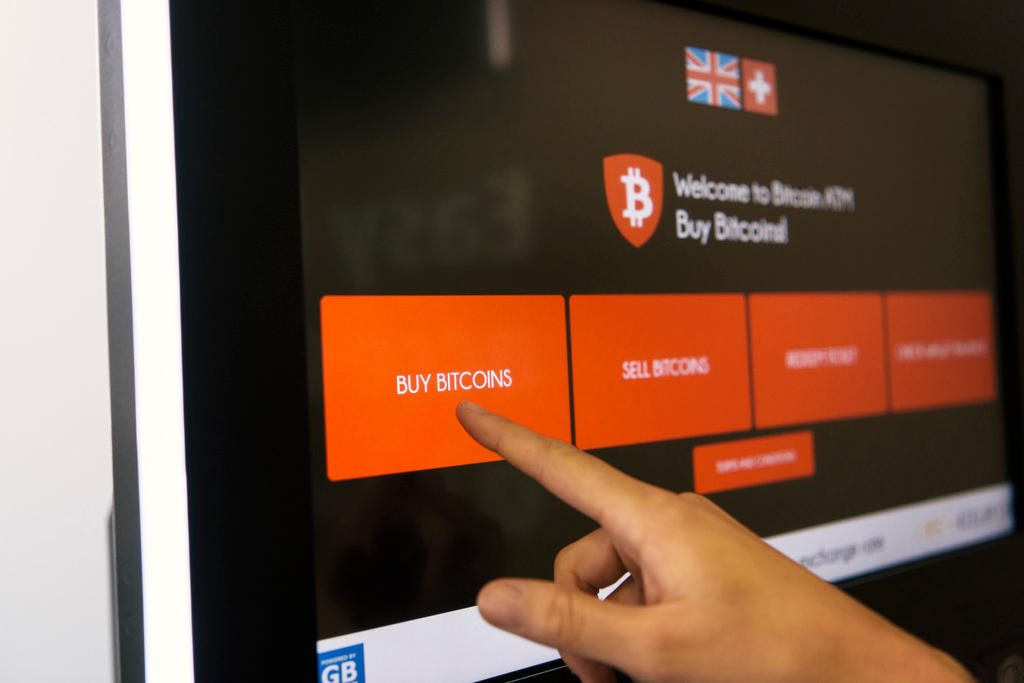

Most crypto exchanges offer retail investors a level of access to crypto assets they may not have gained with other assets, such as shares — often with little to no paperwork and just a few clicks of a button. “The difference between traditional finance and crypto-finance is that someone with just 10 bucks can access the market,” says Alexis Roussel, co-founder and chief executive of Swiss crypto broker Bity.

Towards the end of last year, some cryptocurrency exchanges were generating more turnover than all but the biggest exchanges, as speculators rushed to take advantage of rocketing crypto prices.

More

Financial Times

External linkEstimates from Bloomberg put the fees generated by some of the largest players at millions of dollars a day.

Still, the crypto market is only at the early stages in its maturation. It is possible, for example, for a platform to operate as an exchange, a broker-dealer, a money transmitter, a proprietary trader or asset owner, all at the same time.

More

Realigning fintech to match the needs of bankers

The situation creates potential conflicts of interest, a report last month by the New York Attorney General found.

The attorney-general also found that some platforms lacked “robust real-time and historical market surveillance capabilities”, amid concerns that the market is highly manipulated. Research firm Blockchain Transparency Institute estimated in August that more than $6bn of daily trading volume was being faked.

Regulators and lawmakers have also warned that the freewheeling crypto sector was vulnerable to hacks, fraud and money laundering, although many of this new breed of exchange have begun to reinvest the windfalls they received during the height of crypto fever into safeguards to help protect investors. For example, Gemini Trust Company, the US crypto exchange, recently hired Nasdaq to monitor its trading venue.

Originally, some exchanges operated by holding customers’ assets on their ledger, in effect a centralised pool, making them an attractive target for hackers. Now the development of so-called “cold storage” capabilities and custody services that hold the private keys to digital assets offline in physical vaults has accelerated, with some exchanges building services in-house while others have outsourced them.

Oliver von Landsberg-Sadie, founder of London-based cryptocurrency brokerage BCB Group, says he is “encouraged to see many credible custodianship solutions emerge, backed by a combination of capital adequacy, smart technology and insurance”.

Several so-called “decentralised exchanges” — which facilitate peer-to-peer trading without taking deposits of any of the funds — have also begun to spring up, including Bancor and ShapeShift.

Meanwhile, just as regular stock exchanges have been upended by technology — new venues include dark pools and other over-the-counter trading platforms — the crypto space has similar trading venues competing for business.

“In many ways, I think the crypto market’s structure will eventually mirror that of traditional markets,” says Zeeshan Feroz, chief executive of the UK division of Coinbase, one of the biggest crypto exchanges by volume traded. Coinbase announced in May it was introducing “low latency” to its trading systems — speeding up the time it takes to trade — in a bid to accommodate ultrafast traders on Wall Street.

“However, this is a unique asset class and so there will mostly likely always be some key differences, including 24/7 markets, almost instant settlements and automated compliance,” he adds.

Recent change has been “mostly driven by the crypto industry’s self-regulation and on the institutional side [including] the segregation of custody [and] introduction of brokers and OTC markets,” says Maya Kumar, head of the UK division of crypto exchange Luno.

Traditional services that support trading infrastructure are also warming to the space, says John Lore, managing partner at US law firm Capital Fund Law Group.

“Service providers, such as fund administrators, auditors, and IT providers, have become much more adroit at handling crypto issuers,” he says.

Regardless of market quality, the fragmented nature of the marketplace means there is no lender of last resort able to step in if there was a liquidity crunch, as in a traditional structure.

“In a crypto asset world, it’s not clear that there is that function to step in and provide liquidity. Who would do that?” says Peter Randall, founder of share trading platform Chi-X Europe. “At the end of the day, I think it’s unlikely that the current environment with crypto assets is able to provide the operational resilience that complex markets and financial systems require.”

Copyright The Financial Times Limited 2018

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.