Is Switzerland really the country of bankers?

Professions are not usually associated with a particular country, yet everybody has heard of the 'Swiss banker'. The cliché is omnipresent in the news, books or movies. Bank secrecy, tax evasion and US fines have lately been the source of numerous controversies. Is the Swiss banking stereotype nevertheless well-deserved? The answer is contained in the following graphics.

Banks and employment

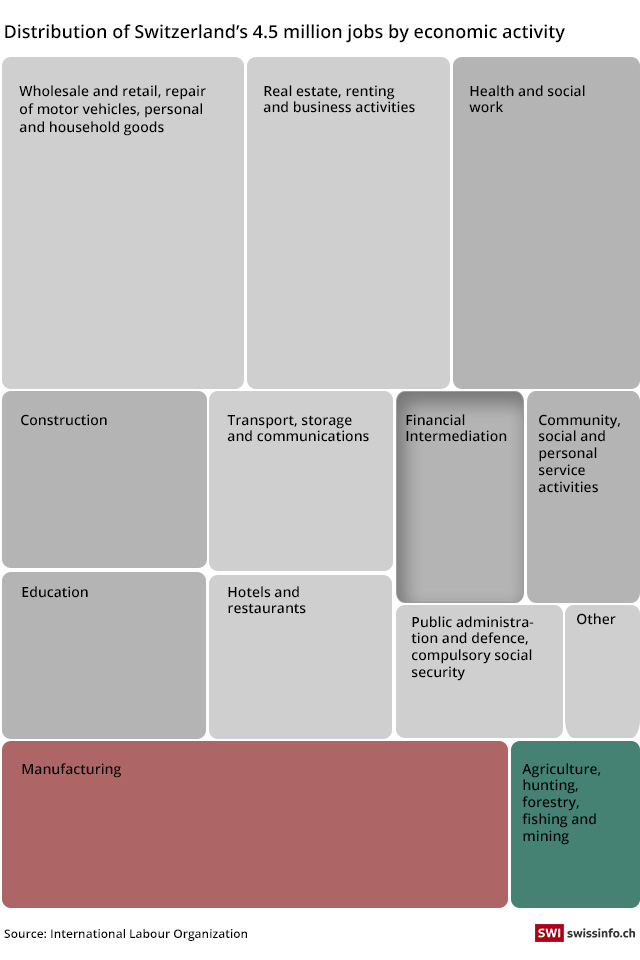

Switzerland may be perceived as the land of bankers but how prevalent are they really? The following graphic depicts employment in Switzerland by economic sector, the size of each box is proportional to the number of jobs:

In the chart above there is no specific category purely for bankers. The term ‘Financial Intermediation’ covers all jobs in financial services: banks, insurance, pension funds and other funds. Out of the total Swiss workforce:

- 5.8% of employees work in financial services, that is one out of 17 jobs. This corresponds to a somewhat smaller workforce than education or the hotel and restaurant industry

- Out of the whole financial intermediation workforce, about a third works for an insurance company, i.e. 1.6% of the total Swiss workforce in 2012.

- Banks employed 105,166 people in 2012, that is a 2.2% share of the total Swiss workforce, i.e. one out of 46 jobs.

How does that compare with other countries? The chart below shows the proportion of jobs in financial intermediation for different countries:

Although Switzerland has one the largest financial services workforces, a country like the US has proportionally nearly as many jobs in the sector.

Economic importance?

With regards to the contribution of financial activities to the country’s economy, the graphic below shows the contribution of banking and insurance to the Gross Domestic Product (GDP):

Estimates of financial activities in the GDP output are disputed . The figures shown here are upper estimates, while some consider the value added by financial institutions to be closer to 6% than to 11% in Switzerland (similar to the construction sector). The UN, OECD, Eurostat and the European Bank have established a joint task force to determine a new method of measuring the contribution of financial activities to the GDP output. The main dispute is the valuation of the risk premium, i.e. interest rate income which obviously represents an important part of banks’ revenues. Some argue that it does not add any value to the GDP and should be not considered.

Unsurprisingly, because of the high proportion of financial jobs, financial activities represent a large chunk of Switzerland’s GDP.

Another way to gauge the importance of the banking sector in the economy is by considering banks’ total assets. Bank assets are typically listed on the left-hand side of a balance sheet and encompass everything that a bank owns: loans, securities, and physical assets such as buildings. The interactive chart below shows the total bank assets by country in absolute terms as well as relative to GDP or capita:

Banking assets usually account for over 100% of GDP in developed economies. But in all European countries, banking assets are measured in multiples of their annual GDP. Here again, Switzerland has proportionally one of the highest banking assets per capita and by GDP.

Swiss banks worldwide

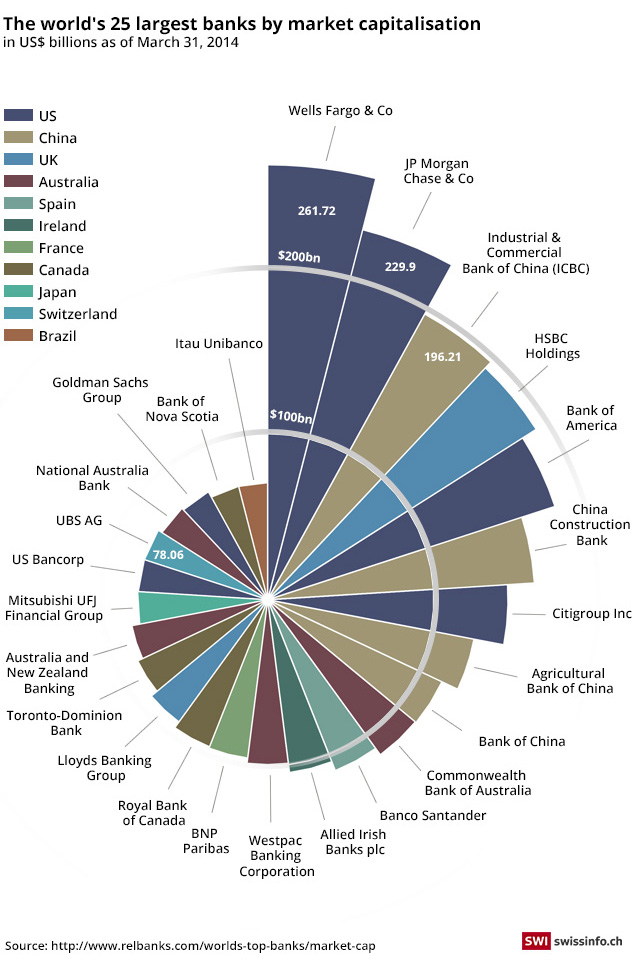

If it is clear that financial activities have a preponderant role in the Swiss economy, how do Swiss financial companies rank internationally? The following chart presents the market capitalisation of the 25 largest banks in 2014:

Individual Swiss banks are no heavyweights when measured by market capitalisation, ranking “only” 21st and 35th (UBS $78 billion and Credit Suisse $51 billion) by global comparison. Switzerland’s insurance companies carry slight more weight in the worldwide ranking, with Zurich $39 billion (CHF36 billion) and Swiss Re $23 billion occupying 7th and 17th places respectively. By comparison, at the end of 2013 Apple had a market capitalisation of $415.7 billion, while flagship Swiss companies Roche and Nestlé were capitalised by up to $202 and $234 billion respectively.

These numbers and the worldwide ranking of Swiss financial institutions begs the question why Swiss banks have gained such notoriety.

The modern banking industry traces its roots to private banks. The first banks in Venice were focused on managing personal finance for wealthy families. Later, private banks took their name to stand out from retail banking and savings banks. Historically, private banking has been viewed as an exclusive niche that only caters to high-net-worth individuals with liquidity over $1 million, but it is now possible to open private banking accounts with as little as $250,000. For private banking services, clients pay either a variable fee based on the annual portfolio performance or a flat-fee usually calculated as an annual percentage of the total capital invested.

Private banking

Private banking, or wealth management, is one financial service where Switzerland is the current world leader. The term “private” refers to a service rendered on a more personal basis than in mass market retail banking, typically via dedicated bank advisers. It does not necessarily refer to a privately owned, non-incorporated banking institution (private banks) although it may also be the case. Such services provide personal investment-related advice but potentially also manage a client’s entire financial situation.

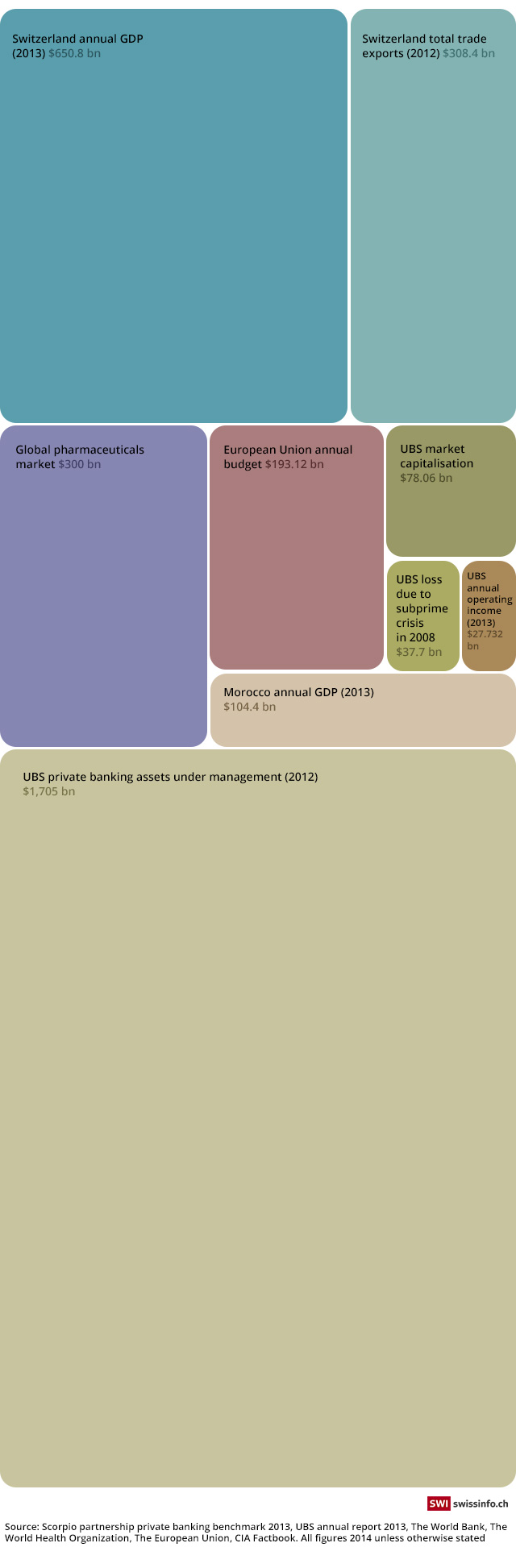

In the international ranking of private banking by assets under management, Switzerland has six private banks in the top 20. In 2013, UBS was the world’s top private banker, managing more than $1.7 trillion for high-net-worth individuals. It is hard to imagine a figure of over a trillion dollars, so this chart puts it into perspective:

Assets under management by UBS’s private banking division total more than 20 times the bank’s market capitalisation, or about triple Switzerland’s annual GDP.

In 2012, it was estimated that the total assets under management in Swiss private banking to be $6.15 trillion (equivalent to more than a third of the annual GDP of the EU or the US), about half of it being managed by the two international banks: UBS and Credit Suisse. More than half of these assets is offshore wealth (capital from an investor with no Swiss tax domicile). Switzerland is currently the world leader in offshore private banking, a market estimated at $8.5 trillion worldwide.

The roots of Switzerland’s cross-border private banking success can be attributed to its long experience in this field, an economically and politically stable environment and of course, its fiercely-criticised banking secrecy law, codified in 1934.

It is impossible to estimate how much private banking wealth has evaded taxation, but the chart above points to a correlation between states with some form of banking secrecy (Switzerland, Singapore, Channel Islands, Caribbean, Luxembourg) and a high global market share in offshore private banking.

The Swiss Bankers Association estimates that 54,000 people were employed in the wealth management business in Switzerland in 2012 (1% of total jobs in Switzerland). The productivity of the sector is also unsurprisingly high, private banking alone accounts for 2.8% of the annual Swiss GDP (CHF16 billion of value added to the economy).

But with eroding international tolerance of tax fraud and growing pressure on the bank secrecy, the question remains how attractive offshore wealth management will be once the international banking and tax regulatory framework are harmonised.

References

1. The Swiss Bankers AssociationExternal link

2. Scorpio partnership private banking benchmark 2013External link

With input from Matthew Allen. Design: Filipa Cordeiro & Duc-Quang Nguyen

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.