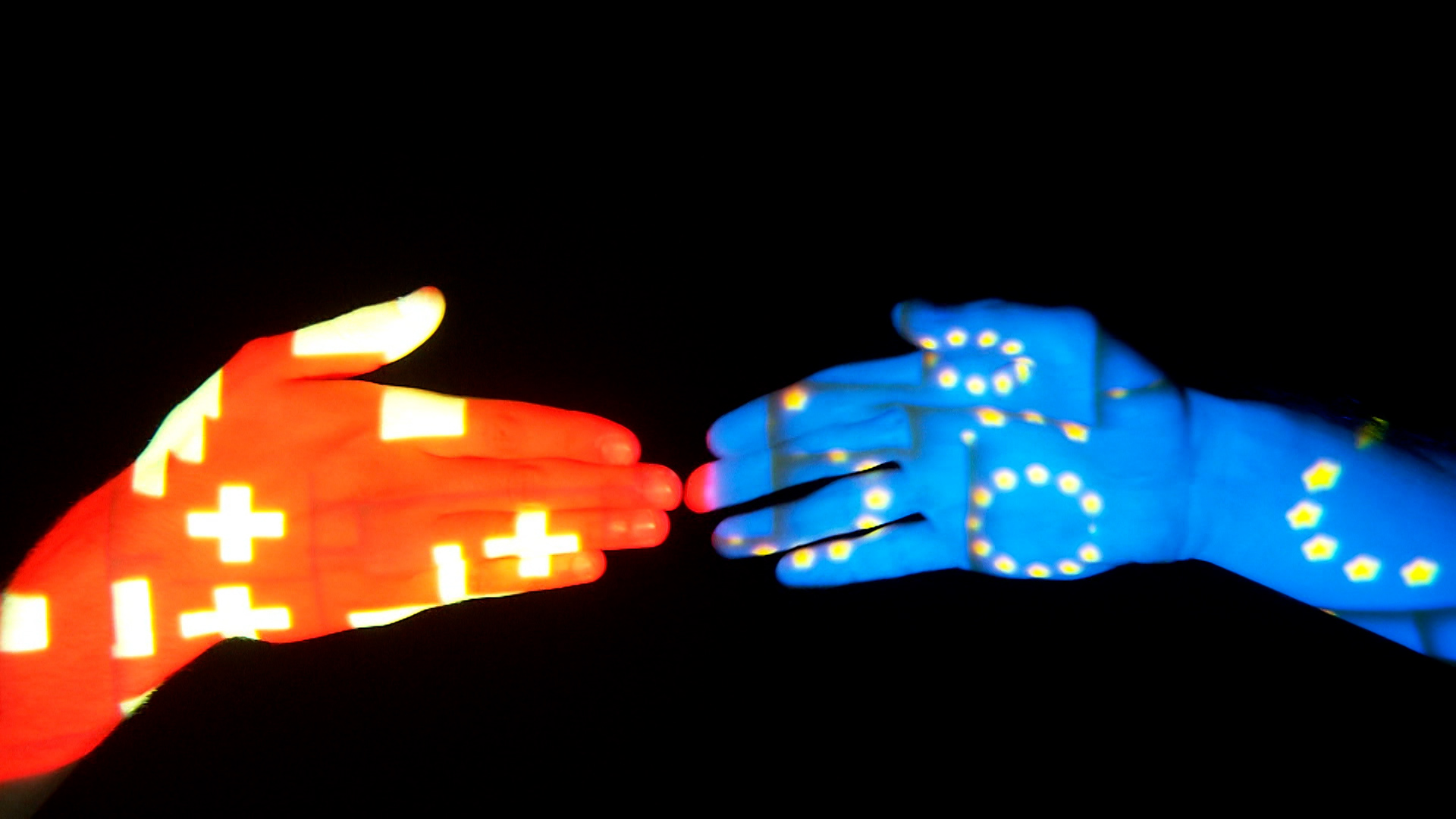

New European pharmaceutical rules met with scepticism in Switzerland

Switzerland is keeping a close eye on a major overhaul to rules governing pharmaceutical products in Europe that have become a showdown between industry calls for more incentives for innovation and member state demands to make medicine more affordable.

The European Commission released their long-awaited draft revisionExternal link of the legislation on pharmaceutical products on April 26. The rules are an attempt to rein in drug prices, improve access to innovative medicine such as gene therapies across the bloc, and avoid drug shortages that have worsened over the last few years.

The proposed changes are wide-ranging, covering everything from reducing the approval time for new drugs and improving transparency of public funding in drug development to speeding up the delivery of drugs during emergencies.

More

The end of affordable medicine

The reaction in the European Union (EU) has been a mixed bag. The pharma industry argues the new rules risk hindering innovation in the EU while some public health campaignersExternal link say that the rules represent progress but some key provisions have been watered down by pharma lobby groups.

Even in Switzerland, which isn’t part of the European Union, the draft has been greeted with cautious optimism. NGOs, politicians and industry groups have said they welcome the desperately needed update but have different views on whether the rules go far enough to address the problems.

“The intention to strengthen the continent’s competitiveness and prepare for the future of the European regulatory framework has been well received by the industry,” René Buholzer, who heads the Swiss pharma association Interpharma, wrote in an op-edExternal link in the French-language paper Le Temps on Friday. “However, the resulting proposals risk complicating the regulatory framework and weakening the incentives to invest in innovation.”

The draft legislation, the first revision in around 20 years, comes at a time of fierce debates over how to encourage innovation without sky high prices that could push healthcare systems to their limits.

The carefully crafted language reflects the delicate balancing act European leaders are trying to strike in keeping the pharmaceutical industry in check without pushing them off their soil. Several industry leaders have only reinforced these fears by arguing that Europe risks lagging behindExternal link the rest of the world on innovation if the rules are too stringent.

More

Why Switzerland is running out of pharmaceuticals

In February, Novartis CEO Vas Narasimhan told the press that cost-cutting measures in Europe were of great concern and that they were eroding the attractiveness of the innovation ecosystem.

In an emailed message after the legislation was released, a Roche spokesperson said that the company hopes any “new EU legislation for pharmaceuticals ensures that Europe remains a go-to destination for life sciences investment amid rapidly increasing competition around the world”.

Give and take

This balancing act is seen in the language around the period of exclusivity, which gives a company a monopoly over the sale of a drug. If the rules go forward, companies will only have 8 years (combination of data protection and market protection) instead of 10 years of exclusivity. This is beneficial for patients and payers, such as insurance companies, who would see cheaper versions of drugs come in earlier. Industry though vehemently resists changes that allow competition to cut into their profits.

In a nod to industry, the EU rules though state that if a product is marketed in all EU member countries and meets various conditions, the exclusivity can be even longer than 10 years. This reflects a compromise says Patrick Durisch who leads public health policy at the NGO Public Eye. “The EU could have been much more stringent to make pro-access measures and rebalance the profits companies make thanks to their monopolies.”

The industry is still sceptical. In a statement after the legislation, Nathalie Moll, who leads the trade group the European Federation of Pharmaceutical Industries and Associations, said “penalising innovation if a medicine is not available in all Member States within two years is fundamentally flawed and represents an impossible target for companies.”

Switzerland from the sidelines

Swiss politicians and industry are keeping a close eye on the new rules. Not only is the EU a major market for Swiss companies, but it is also a source of talent. Roche has around 44,000 employees (around a fifth of total) in Europe and it invests around CHF6 billion or around 40% of its global R&D spend on the continent.

But Switzerland is pursuing its own balancing act. The Swiss government doesn’t want to reject new rules and rattle relations with the EU that are already on shaky ground after Switzerland threw out plans for an overarching framework agreement in 2021 that was intended to replace more than a hundred bilateral deals.

More

Will Switzerland sort out its differences with the EU in 2023?

A key priority for Switzerland in the ongoing talks is entry into Horizon Europe, the bloc’s largest research programme with a budget of €90 billion (CHF88.3 billion).

There are also several areas where Switzerland depends on the EU including common patient safety protocols and coordination around managing drug shortages. Swiss pharmaceutical companies are also keen to maintain unfettered access to the EU market.

At the same time, Switzerland is keeping its own competitiveness in mind. Switzerland grants drugs exclusivity for up to 20 years, which helps attract innovative companies. Adopting EU rules that reduce the time period would put the country at a disadvantage relative to lower cost manufacturing locations in Europe, say some politiciansExternal link.

Some industry groups argue that Switzerland could be seen as an alternative to the EU if companies start to see the bloc as less innovation friendly.

“Switzerland now has the opportunity to strengthen its good reputation as a place of innovation,” wrote Buholzer.

The draft revision will now head for discussion in the European Parliament and Council. No deadline has been set for the rules to be finalised and come into force.

Edited by Virginie Mangin

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.