Lofty ambitions for Swiss-British banking pact

Switzerland and the United Kingdom aim to raise the bar on cross-border financial services trade, says a senior British minister involved in negotiating a deal between the two countries.

John Glen, Economic Secretary to the Treasury and City Minister, is confident that a Mutual Recognition Agreement (MRA), to align common standards and supervisory goals, can be thrashed out by the end of this year.

This would set the foundation for banks and insurance companies in Switzerland and Britain to boost business in each other’s markets. The MRA will be followed by an updated free trade agreement, which will outline the precise terms of future cross-border trade across a variety of industries. The current FTA was rolled over from the 1972 Swiss-EU trade treaty when Britain left the EU.

“The focus will be on Swiss banks being able to access high net worth business in the UK and our insurance companies being able to access new market opportunities in Switzerland,” Glen told SWI swissinfo. “We can demonstrate enormous progress between two jurisdictions with a shared appetite for competition and market access in a stable, regulated environment.”

More

Swiss-UK financial services pact antidote to EU intransigence

Fund managers and mortgage lenders are also keen to take advantage of such a deal, but Glen would not be drawn on the details of market access, that are still being negotiated. “The exact calibration and parameters of each sub-sector is ongoing work,” he said.

Alignment on principles

Mutual recognition accepts differences in legislation and regulations, provided each country has the same supervisory objectives in mind. This means that regulators in each country can still tailor day-to-day supervision according to their own specific needs. The alignment of principles is more important than the precise manner that each country chooses to implement the rules of financial trade.

This contrasts with the European Union’s insistence on ‘equivalence’, or the full harmonisation of rules. The stricture of equivalence is the reason that neither Switzerland nor Britain have been able to agree financial services treaties with Brussels, despite both countries being major global banking hubs.

But mutual recognition is a trade-off. Tolerating differences in the details of regulatory regimes will impact how much extra market access each country is willing to concede. For example, if Switzerland gives banks more leeway to pursue certain business lines it could give them an unfair advantage to offer the same services in Britain, where regulations are tighter.

“Within the Swiss financial services industry, the fusion of asset management, high net worth business, private client work and banking is differently configured, regulated and organised to the UK,” said Glen. “We have to make sure that the access we seek to give Switzerland does not go beyond what our domestic providers could achieve in the UK – and vice versa with respect to insurance.”

Finalizing a financial services pact between Switzerland and Britain by the end of the year will require months of intensive negotiation. This includes areas such as industry qualifications. Many Swiss bankers, like former UBS CEO Sergio Ermotti, started their careers as apprentices before working their way through the ranks. Britain relies more heavily on formal academic qualifications to signify expertise.

Abundant optimism

And the two countries must agree on common rules for sustainable finance, the management of data and an arbitration procedure that can iron out disputes once market access is expanded.

More

Brexit explainer: visiting, studying and working in Switzerland

“I see nothing but goodwill, confidence and optimism about the progress being made,” said Glen.

The two countries have already signed a deal to allow service providers, such as consultants and IT workers, access to each other’s labour markets. With respect to bankers and other financial specialists, Glen said the agreement should be “as ambitious as possible” but would give no specific details.

Negotiations on the MRA were announced two years’ ago. In April, Switzerland and Britain agreed to kickstart discussions on a free trade agreement that will detail how the two economies will cooperate in future, including financial services.

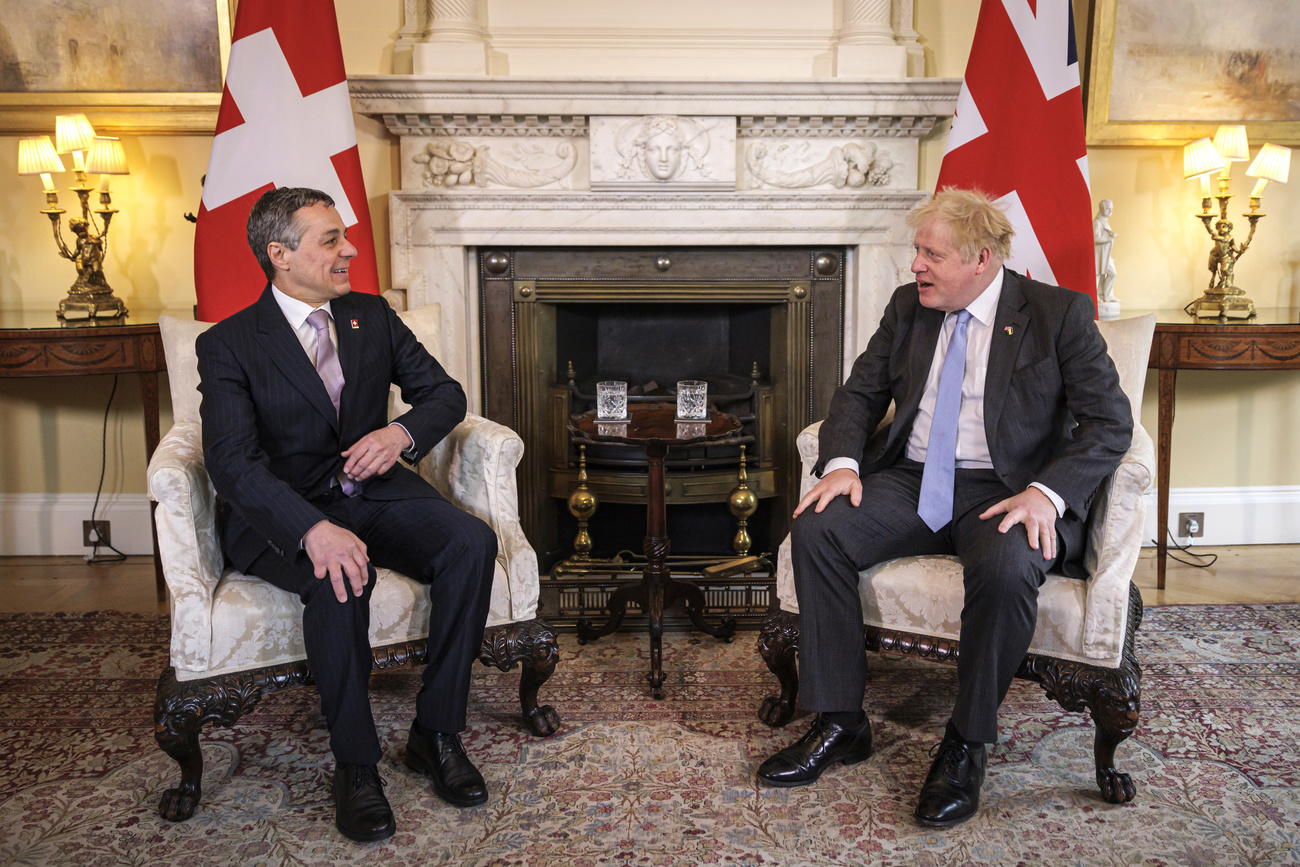

“We are both home to important financial centres and it is therefore imperative that we find an agreement to exchange financial services without hindrance,” said Swiss President Ignazio Cassis in April.

The Swiss Business Federation is anticipating great things from the proposed treaty. “If this succeeds, Switzerland and the United Kingdom would present the world’s most comprehensive market access agreement in the financial sector between two countries,” the lobby group states. “Together with a speedy ratification in domestic politics, this would also be a strong signal against international fragmentation.”

Switzerland is the UK’s 10th largest trading partner worldwide. Conversely, the UK is Switzerland’s eighth largest trading partner (excluding precious metals).

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

Join the conversation!