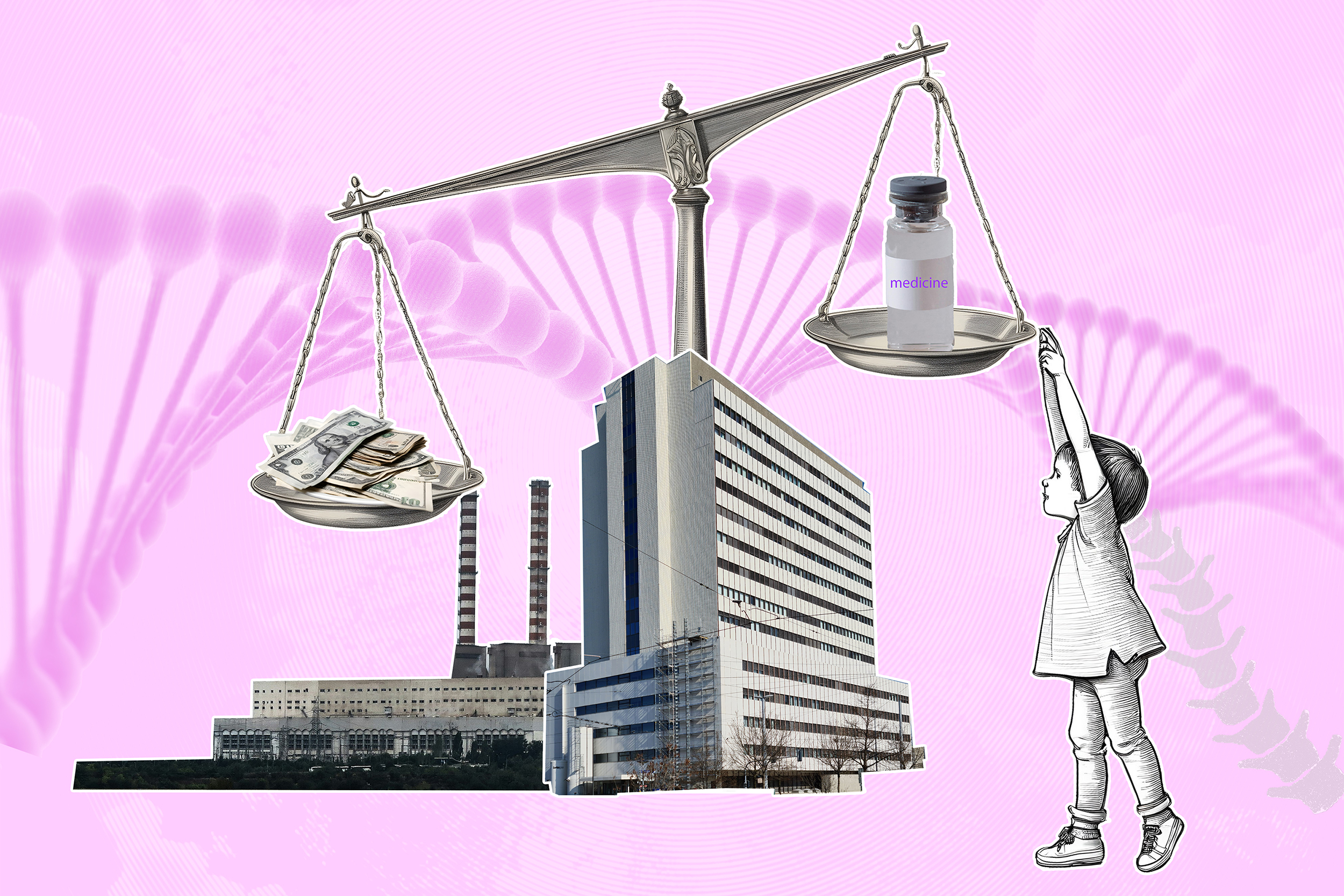

Patent battle in India tests Roche’s grip on rare disease market

An Indian court has cleared the way for low-cost alternatives to Roche’s drug Evrysdi for spinal muscular atrophy. What’s behind the decision and what could it mean for rare disease patients everywhere?

On October 9 the Delhi High Court refused to issue Roche an injunction to prevent generic manufacturers from making and selling a low-cost version of one of the company’s top selling drugs.

The drug risdiplam, sold by the Swiss pharma giant as Evrysdi, was first approved in the US in 2020 for the treatment of spinal muscular atrophy – a genetic disease that leads to muscle loss and wasting. Babies with the most serious form of the disease often don’t live past their second birthday.

What does the Delhi court’s ruling mean for patients in India and beyond?

Alpana Sharma, the founder of the patient advocacy group Cure SMA Foundation India, told Swissinfo via email that the court’s “move has the potential to significantly improve access to affordable treatment options for SMA patients in India”.

The price of Evrysdi, which in India is estimatedExternal link at ₹7 million a year (CHF65,000), has put it far out of reach of most patients in the country, where the average national incomeExternal link per capita is estimated at ₹231,000. Although no precise numbers exist, media reports suggest around 5,000 adults have SMA, and 3,200 babies are born with SMAExternal link each year in India. However, only 270 people received the drug last year through the Indian government and Roche charity programmes, according to Roche.

“Indian patients aren’t able to access this drug, not because it is hard or costs a lot to produce, but because of Roche’s monopoly,” said KM Gopakumar, a legal advisor and senior researcher with the India-based NGO Third World Network. “The Delhi court decision has made affordable access possible.”

More

Rare diseases take centre stage at global health summit

The ruling is part of a long-running battle between the Swiss pharma giant and Indian generic maker Natco, which centres around intellectual property protection. Roche has patents on Evrysdi in India that are valid until 2035, giving Roche an exclusive right to sell the drug in the country. Natco challenged the validity of the patents.

While a patent infringement suit filed by Roche is still pending, by not issuing an injunction, the Delhi court cleared the way for Natco to sell a generic version of Evrysdi.

According to media reports, Natco launched its generic version Natsmart on October 12 at ₹15,900 per bottle (CHF145) – nearly a 97% reduction from Roche’s Evrysdi, which is said to cost ₹620,000 (CHF5,600) per bottle in India. As India is the largest supplier of generics to lower income countries, the decision also has implications beyond the country’s borders.

Sharma emphasised, however, that it will be important that the generic version meets quality standards and that distribution channels are built to ensure it reaches patients.

Does this decision settle the legal conflict between Roche and Natco?

No. Roche had brought a patent infringement case against Natco when the latter took steps to produce a generic version of the drug. Natco pushed back arguing Roche only held a patent in India for a large family of related molecules but failed to file one covering risdiplam itself. It also argued that the patent in India shouldn’t have been granted because it didn’t demonstrate a new invention.

The Delhi court didn’t revoke Roche’s patent rights, but it upheld an earlier rulingExternal link in March that found Natco made a credible challenge to the patent’s validity. The earlier ruling also signalled the importance of public interest in a generic version.

Roche informed Swissinfo that it is appealing the High Court’s decision – a sign of the high stakes for the company. In a statement to Swissinfo, a company spokesperson said they “are extremely disappointed with this development and are considering our options within the scope of the Indian law”.

The company argues patent protection is necessary to create incentives for investments into new cures. Evrysdi’s price reflects the substantial research and development investment made by Roche – costs that Natco does not incur.

Why is so much at stake for Roche?

Despite the small number of patients, Evrysdi has become one of Roche’s top 20 drugs by revenue, generating around $1.8 billion in sales in 2024, an 18% increase on the previous year. It is approved in more than 100 countries and has been used to treat over 16,000 people.

The drug also faces competition. There are currently three drugs on the market for SMA. The other two are Biogen’s Spinraza and Novartis’ gene therapy Zolgensma. Data shows that all of the drugs improveExternal link motor function and survival to varying extents, depending on the severity of symptoms and the patient’s age.

More

Whatever happened to the world’s most expensive drug?

However, Evrysdi is the only drug taken orally – as a liquid or pill – making it much easier to administer in low resource settings. Roche is also the only company that has registered its SMA therapy on the Indian market.

Roche has signed tailored pricing deals with at least 22 national health payers including China, France and Brazil according to the agreement libraryExternal link of Lyfegen, a health software company. Roche has been “actively collaborating with local authorities in India to implement tailored pricing,” said a spokesperson but an agreement has not been reached.

How does this legal battle fit into the bigger picture of rare disease treatments?

This ruling in India is the latest example of the huge hurdles to access new treatments for rare diseases – a diverse group of over 7,000 known illnesses. While these diseases affect one in 2,000 people or fewer, they collectively affect over 300 million people in the world according to the World Health OrganizationExternal link.

The arrival of the first treatments that tackle the underlying genetic cause of SMA was a watershed moment for patients and their families. Around 95% of rare diseases don’t have any approved treatment. The high price tags for the drugs, that are available, have kept them out of reach though, and led to countless stories of parents launching crowd-funding campaigns out of desperation to save their children’s lives.

Patient advocacy groups face a delicate dilemma. On the one hand, they want to encourage pharmaceutical companies to invest in new rare disease treatments while at the same time calling for them to be more affordable.

In May WHO member states adopted a resolution recognising rare diseases as a global health priority for the first time. The move was celebrated by the rare disease community, but health equity campaigners said the resolution didn’t do enough to pressure pharmaceutical companies to lower prices.

“Incentives for research and development are essential to stimulate the discovery of new therapies for rare diseases, where unmet medical needs remain vast,” wrote Alexandra Heumber Perry, CEO of Rare Diseases International, to Swissinfo. “Yet innovation only fulfils its purpose when it reaches those who need it, regardless of geography or income.”

Edited by Benjamin von Wyl/ac

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.