How retiring baby boomers could crash Swiss property market

Once baby boomers start selling their houses, the Swiss real estate market could face a serious shake-up, says a demographer in Basel. In the United States, a so-called “silver tsunami” is also expected. Could this mean the younger generation will finally see a drop in house prices?

Property prices have fallen recently in neighbouring countries like Germany, France and Austria. But in Switzerland the price spiral continues undeterred.

The reason behind this is an ever-growing population in the small Alpine country. A new forecast published by the Federal Statistical Office (FSO) anticipates that the number of residents will climb from nine million to 10.5 million over the next 30 years. So, investing in a home, it seems, is a good idea.

Hendrik Budliger, founder and director of Demografik, an independent competence centre for demographics, questions this narrative of “concrete gold”, which is the belief that investing in property is a safe bet. Together with his team, he is exploring how an ageing population and labour migration affect the Swiss property market.

“The prices we see today are misleading,” Budliger explains. “They suggest that property prices will continue to rise.” He expects the market to correct itself in the near future.

Many pensioners, no children

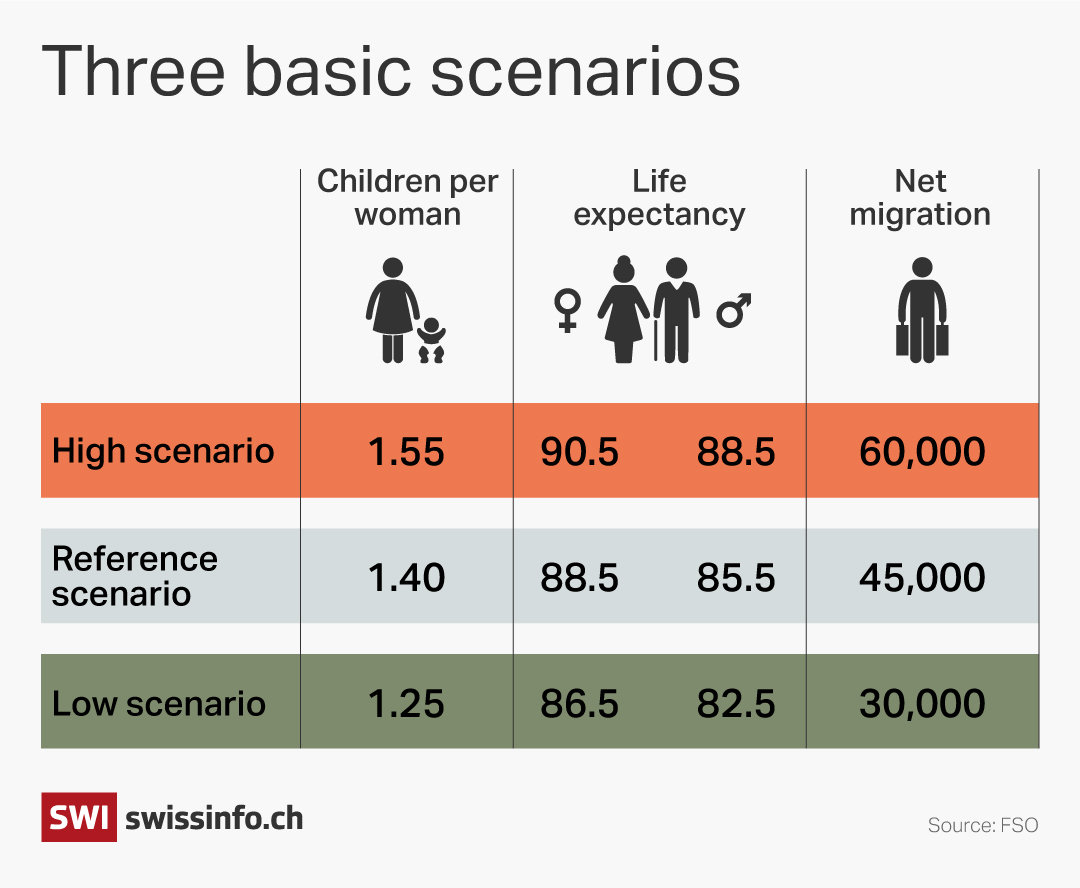

Budliger’s forecast is based on two assumptions. First, he views the federal government’s population-growth prediction, the so-called reference scenario, as overly optimistic. The more likely scenario is the FSO’s more conservative prognosis, which expects the Swiss population to start shrinking in 2043.

This forecast is shaped by trends across the European Union. Countries like Germany and Italy are currently grappling with a dwindling workforce and a growing shortage of skilled labour. “Italy and Portugal are already offering tax breaks and other incentives to retain their citizens or lure them back,” says Budliger. And this trend is only expected to grow.

More

How are you, Switzerland? Let us know in our 2025 survey

The population forecast of the United Nations takes this competition between countries into account. “The UN uses a balanced model, and for Switzerland, the median projection is very close to the low-growth scenario of the Federal Statistical Office,” explains Budliger.

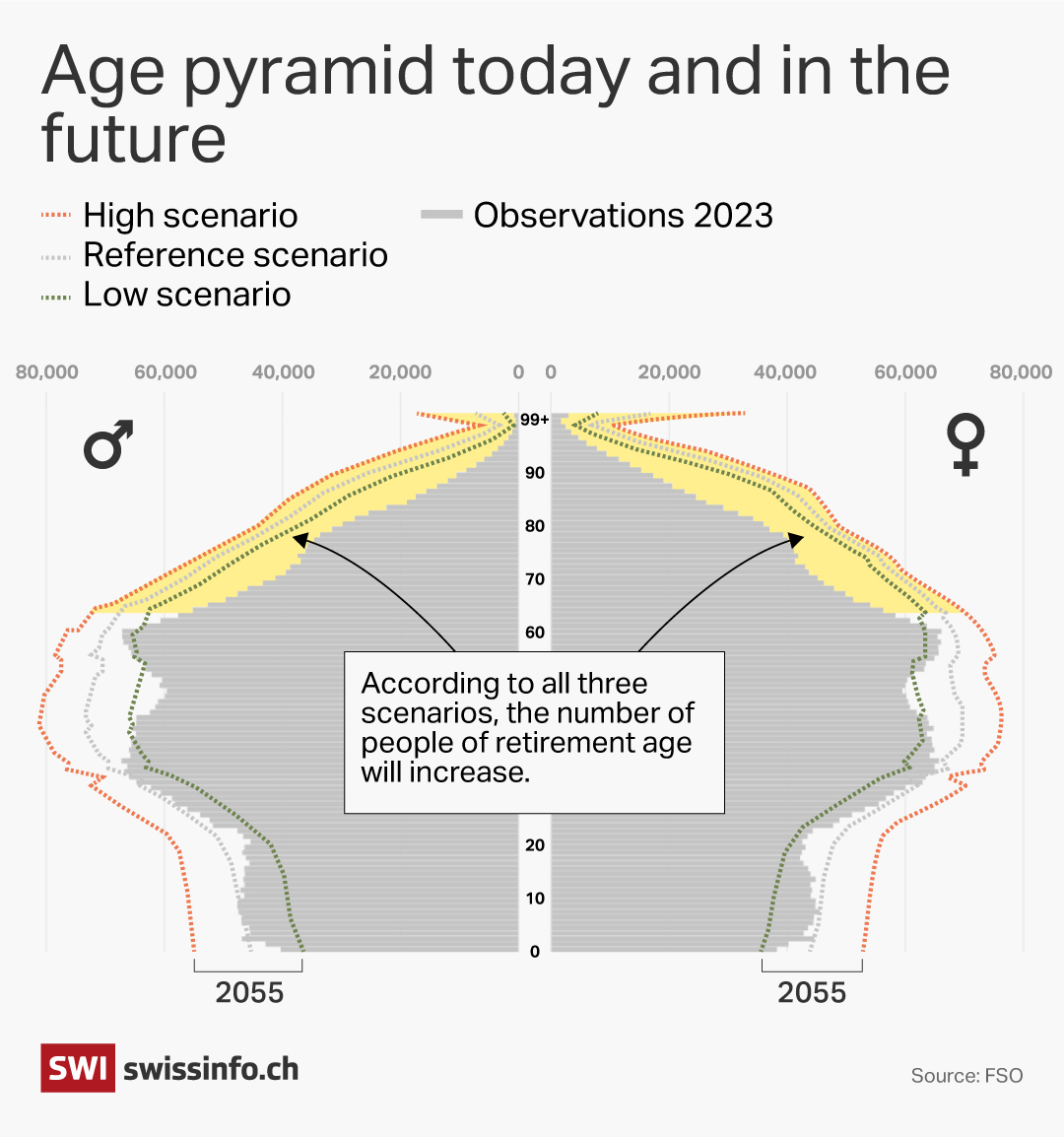

Secondly, Budliger expects that a shift in the age structure will result in there being many more sellers than buyers. Even under the government’s reference scenario, the share of people over 65 is set to increase from 20% to 25% by 2055.

“People over 60 tend to sell their homes,” says Budliger. “That’s why we will soon see more people putting their properties on the market. The 60-year-olds also belong to the generation with the highest rate of home ownership.”

By contrast, the younger generation tends to live in smaller households. In 2024, Switzerland’s birthrate dropped to a record low of 1.28 children per woman. “Sooner or later, we will have too many single-family homes and not enough families to buy them,” says Budliger.

The first signs indicating a shift in the market are already on the horizon. Budliger expects this trend to accelerate from 2030 onwards, as many homeowners will be so heavily indebted that their pensions will not be enough to renew their mortgage.

“If the market tips – and it will tip – it can happen quickly, and then people will be keen to sell sooner rather than later,” says Budliger.

Tsunami will not affect everyone

The impact, however, will vary widely by region. The major urban areas, Budliger says, will be the last to feel the shift.

The notion that urban centres are more crisis-resilient is widely accepted amongst experts. A recent study by the real estate platform ZillowExternal link backs this up with hard numbers for the US. There, a looming demographic-driven dip in the property market is known as the “silver tsunami”. However, the study concludes that this “silver tsunami” will not ease soaring property prices, largely because many of the homes hitting the market are in less desirable areas.

Sarah Dickerson of the University of North Carolina, who researches the social aspects of the real estate market, supports this finding. “Many baby boomers live in suburbs or rural areas, so the homes entering the market may not match the needs of working-age people who want to live closer to cities.”

According to Switzerland’s largest bank UBSExternal link, Swiss regions facing both an ageing population and outward migration risk “a scenario of rising vacancies and falling property prices”. This applies particularly to mountain regions in Graubünden and Bern, and to the southern canton of Ticino.

Claudio Saputelli, head of real estate analysis at UBS, believes that this trend only affects certain regions. He does not see a “silver tsunami” sweeping across central Switzerland in the near future.

“Pensioners will not just die from one day to the next,” he says, adding that they need to be replaced on the labour market. “This more than compensates for the baby-boomer effect.” Saputelli admits that single-family homes may no longer be the most popular form of housing. “On the other hand,” he says, “the scarcer they become, the more expensive they will be.”

Saputelli believes that economic factors are more likely to determine price trends and trigger a market correction. He sees a prolonged recession, especially in combination with high interest rates, as the real risk.

More

Social issues reported by SWI swissinfo.ch

A small relief, at most

Ursina Kubli, head of real estate research at Zürcher Kantonalbank (ZKB) does not agree with the idea of a “silver tsunami” either. “As more people retire, we will need to bring in more workers,” she says.

She points to the real issue, which is a shortage of new housing, especially in high-demand areas where construction cannot keep up with immigration. “We are still a long way away from a wave of ageing homeowners flooding the market,” she says.

Kubli adds that an oversupply of single-family homes is unlikely in the near future: “There is a strong trend towards densification, with many single-family homes being replaced by apartment buildings.” This could lead to a slight easing of prices.

Robert Weinert, chief analyst at Wüest Partner consulting firm, says that baby boomers’ sales could slow down price growth in a few years. “But I don’t expect prices to fall, as housing in Switzerland is likely to remain a limited resource for years to come.”

What may come in 20 years

According to the Federal Statistical Office, the Swiss population will continue to grow until 2043 before gradually declining, even under the lowest-growth scenario. This means that demand for housing is likely to continue to rise for close to the next two decades.

Budliger says that today’s property buyers must keep this timeframe in mind. After all, most people live in their houses for around 20 years. If prices crash more than expected, the current generation, which is used to mortgages of one million Swiss francs or more, could face a hard financial landing, but they would not be the only ones.

At around CHF1.3 trillion ($1.58 trillion), Switzerland’s mortgage volume is only one-third lower than that of Germany, a country nine times its size. From a demographic point of view, Budliger considers this to be a massive risk. But for now, his warning remains a lone voice in Switzerland, the land of concrete gold.

More

Edited by Balz Rigendinger. Adapted from German by Billi Bierling/gw

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.