Switzerland’s labour shortage dilemma: Why tax cuts are not a solution

Increasingly more jobs are unfilled in the Swiss economy. At the same time, progressively more people are working part-time. Could reducing taxes be a solution?

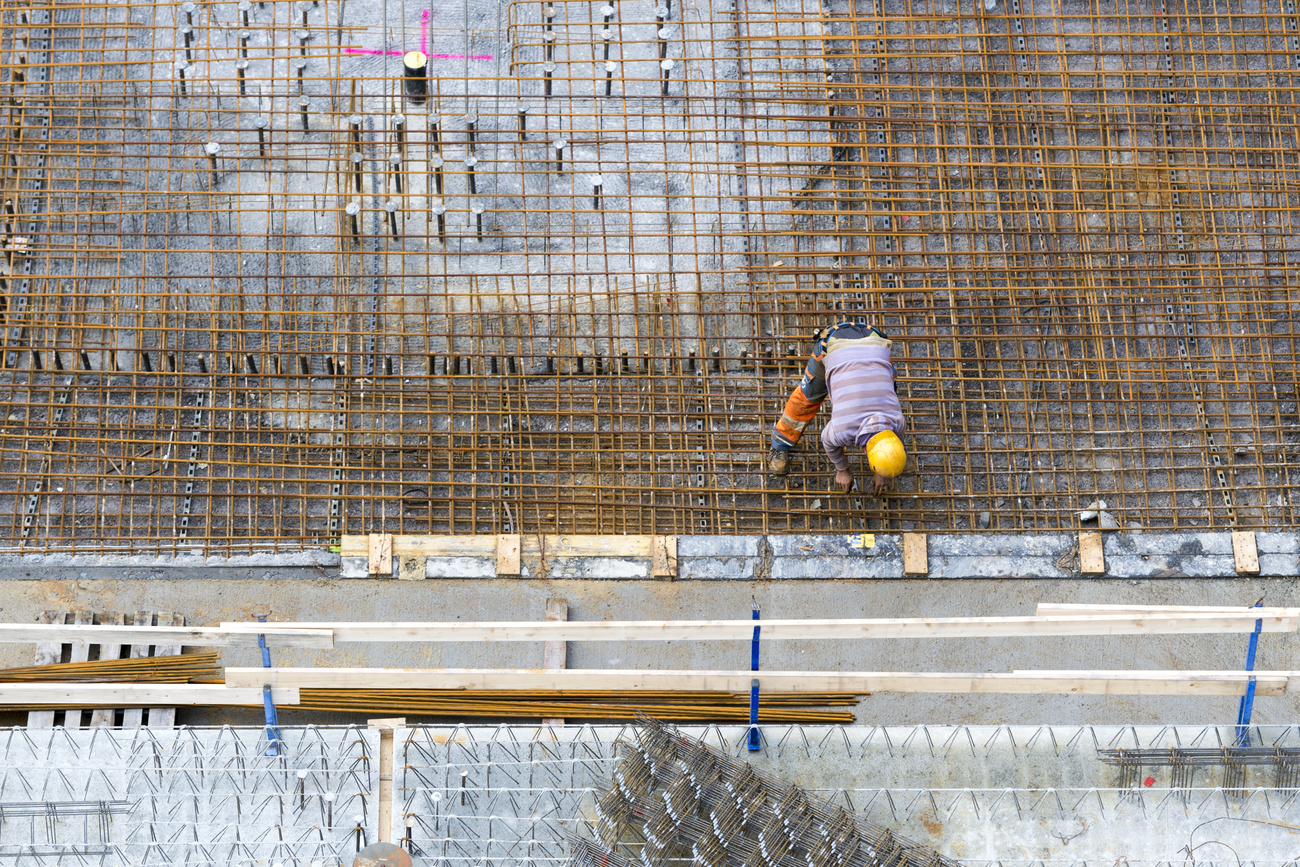

Contractors, foremen, plumbers: In Switzerland vacancies in these professions remain unfilled on average for over two months.

Some jobs remain posted for even longer. One in five carpenter positions remains vacant for over four months.

This results in the Swiss economy to lose around CHF5 billion ($5.67 billion) in net value per year. This according to findings in a study by Boris Kaiser, labour market economist at BSS Economic Consultants.

More people choose to work part-time

Parallel to the skilled labour shortage, part-time work is becoming increasingly popular. According to data from the Federal Statistical Office (FSO),External link around 40% of all employees in Switzerland work part-time.

The proportion of part-time workers is now almost twice as high as it was thirty years ago. This is partly due to more women in the workforce.

Over the last thirty years, not only has the proportion of part-time work increased, but the employment rate has also risen, from around 80% to 85%. Anyone who works less than 90% is considered a part-time employee.

Is the part-time trend exacerbating the shortage of skilled labour? Monika Bütler, honorary professor at the University of St Gallen and guest on SWI swissinfo.ch’s latest podcast episode of Geldcast, sheds light on the situation.

“Working full-time is expensive,” says Bütler. Those who work full-time have less time. “I used to run to the nearest shop when the children needed new shoes because I did not have the time to shop around, and I paid a lot more than my friend who worked part-time,” said the economist in an interview with the Neue Zürcher ZeitungExternal link (NZZ) in March 2023.

Full-time work, fewer state benefits

But that’s not the only reason why working full-time is expensive: parents who have a 100% workload may have to pay for daycare or household help.

Those who work full-time also do not receive state support. The same applies to other state subsidies, such as individual premium reductions.

In addition, the tax rate increases disproportionately with income: Those who earn a high income have to pay a higher percentage of their income to the state.

Does the Swiss tax system exacerbate the skilled labour shortage as it makes full-time work unattractive?

Taxes and the labour supply

There is no clear answer. Previously, lower taxes have increased the incentive to work more. However, the effect is not very strong.

In fact, mainly the rich and the self-employed who end up working more when taxes are lowered; meanwhile, those in the middle-income tax brackets do not generally react to tax reduction.

These are the findings of a study by Isabel MartinezExternal link, an economist at the Economic Research Centre at the federal technology institute ETH Zurich.

Furthermore, lower taxes only motivated individuals employed to increasing their workload. Martinez found no effect on the number of people employed in the workforce.

Another effect of lower taxes

In addition, lower tax rates mean less revenue for the state, an obvious result of which would be the government having to make spending cuts.

It is clear that for many families, daycare would most likely be too expensive if there were fewer state subsidies.

A possible consequence of this is that children in Switzerland would be looked after at home, which means parents will likely choose to work part-time rather than full-time or even one parent leaving the workforce entirely. As a result, tax cuts would not lead to more carpenters and plumbers in the labour market, but to possibly even fewer.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.