S&P 500 Climbs Most Since May as Dip Buyers Emerge: Markets Wrap

(Bloomberg) — A renewed wave of dip buying lifted stocks, with traders sifting through solid earnings amid bets the Federal Reserve will soon cut rates. Treasuries wavered ahead of a heavy slate of US debt sales.

As equities halted a four-day slide, the S&P 500 climbed over 1%, the most since May. Tech megacaps, which bore the brunt of the recent selling, led the bounce. Corporate results also buoyed sentiment, with 82% of the companies in the US benchmark so far beating estimates.

Subscribe to the Stock Movers Podcast on Apple, Spotify and other Podcast Platforms.

Investors should buy into the selloff in US stocks because of the robust earnings outlook for the coming year, said Morgan Stanley’s Michael Wilson. At Goldman Sachs Group Inc., David Kostin noted executives had so far sounded confident in their ability to mitigate the impact of tariffs on profits.

S&P 500 firms are on track to post a 9.1% jump in profits, far above analysts’ projection of 2.8%, according to data compiled by Bloomberg Intelligence. The share of companies beating estimates is also the highest in four years.

“This week is a quiet one on the economic calendar, so traders may be taking their cues from earnings, along with any new tariff and trade developments,” said Chris Larkin at E*Trade from Morgan Stanley.

Larkin also noted that a key question now is whether traders will view any signs of economic weakness as a market negative, or as a catalyst for the Fed to cut rates sooner rather than later.

Action in the bond market was fairly muted as the US is set to auction $125 billion of new three-, 10- and 30-year debt this week. The dollar was little changed. Oil prices fell in choppy trading as traders took stock of OPEC+’s latest bumper supply increase while US President Donald Trump’s stepped up threats to penalize India for buying Russian crude.

“This week will be a telling one: a tug-of-war is unfolding between traditional institutional seasonality, which suggests weakness, and retail investors who may see a dip as a buying opportunity,” said Mark Hackett at Nationwide. “It’s a good test for who’s really in control.”

Looking ahead, the setup into fall favors the bull case with potential rate cuts and strong corporate earnings laying the groundwork for a renewed rally into year-end and a fresh slate for 2026, Hackett added.

“The incoming batch of economic data will provide clues on which direction we’re going, but for now, the equity market has voted loud and clear, and investors are enthusiastic about profit momentum going forward,” said Jose Torres at Interactive Brokers. “Time will tell.”

While S&P 500 earnings are crushing second-quarter expectations, with stocks near all-time highs, the question is whether this recovery still has legs, according to BI strategists Gina Martin Adams and Wendy Soong.

“Management sentiment is at an eight-year high, yet guidance tells a more cautious story with concerns about tariffs and rising costs,” they noted. “The market shows this tension: misses in large caps and small are punished sharply, beats draw only modest applause.”

Following a broad flight from risk assets at the end of last week, equities also bounced amid bets the Fed will cut rates this year.

Investors see around 85% odds that the Fed will lower rates by a quarter point in September, based on swaps tied to policy-meeting dates. While that’s down from Friday’s peak of 90%, it was around 40% before the Friday’s weak payroll data was published.

“If the Fed starts to cut rates at its September meeting, we believe this would be supportive for markets,” said David Lefkowitz at UBS Global Wealth Management. “In combination with our positive view on earnings, we expect further upside for US stocks over the next 12 months.”

Societe Generale strategists Manish Kabra and Charles de Boissezon see US stocks extending their climb into next year, lifted by the Fed’s looming rate cuts.

“Fed cuts to shape the index,” they wrote, adding that gradual cutting would be positive, while aggressive cuts could drive markets to a valuation bubble.

While Friday’s jobs report doesn’t mean we are entering a recession, it shows that companies are freezing hiring and firing until there is more policy certainty and business confidence, according to Robert Ruggirello at Brave Eagle Wealth Management.

“The slowing labor market makes a Federal Reserve rate cut easier than it was a week ago, and echoes some of the warnings that Jerome Powell has been sounding about how tariffs could slow the economy and cause too much uncertainty for small business hiring plans,” he said.

As investors across Wall Street eagerly piled into US stocks in July, sending the S&P 500 to 10 all-time highs in a month, a notable group was heading in the opposite direction: corporate executives.

Insiders at just 151 S&P 500 companies bought their own stocks last month, the fewest since at least 2018, according to data compiled by the Washington Service. And while July’s selling by corporate insiders slowed from June’s pace, purchases dropped even more, pushing the ratio of buying-to-selling to the lowest level in a year, the data shows.

“In the near term, risk-on sentiment may need to contend with an economic outlook of slowing growth, elevated inflation, and ongoing policy uncertainty. So far, companies have navigated the tariff noise without much visible strain, but pressures are likely to grow,” said Seema Shah at Principal Asset Management.

On the tariff front, President Donald Trump said he would be “substantially raising” the tariff on Indian exports to the US over New Delhi’s purchases of Russian oil, ramping up his threat to target a major trading partner.

Meantime, the European Union is expecting Trump to announce executive actions this week to formalize the bloc’s lower tariffs for cars and grant exemptions from levies for some industrial goods such as aviation parts, according to people familiar with the matter.

“Our base case remains that US tariffs will eventually settle around 15%. While this would be the highest since the 1930s, and six times higher than when Trump returned to office, we do not expect it to cause a recession or end the equity bull market,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management.

“However, in the near term, the “handshake” nature of trade deals agreed so far means that tensions could resurface as the details are negotiated,” she noted.

Corporate Highlights:

Tesla Inc. approved an interim stock award worth about $30 billion for Chief Executive Officer Elon Musk, a massive payout meant to keep the billionaire’s attention on the automaker as a legal fight over a 2018 pay package drags on. American Eagle Outfitters Inc. jumped as President Donald Trump came out in support of a controversial ad from the company. The spot, with the actress Sydney Sweeney, is the “HOTTEST ad out there,” Trump said in a social media post. He added American Eagle jeans are “flying off the shelves.” Tyson Foods Inc. raised its full-year earnings forecast as strong US chicken demand and cheap feed costs help it withstand losses it its beef business. Spotify Technology SA announced it’s raising premium subscription prices across many markets outside the US. Workers at Boeing Co.’s St. Louis-area defense factories are striking for the first time in almost three decades after union members rejected the company’s modified contract offer. Warren Buffett’s Berkshire Hathaway Inc. took a $3.8 billion impairment on its Kraft Heinz Co. stake, the latest hit to a bet that’s weighed on the billionaire investor’s company in recent years. CommScope Holding Co. reached a deal to sell its broadband and cable equipment arm to Amphenol Corp. for about $10.5 billion in cash, the second such deal it’s done with Amphenol as part of a series of divestitures aimed at paying off debt. Joby Aviation Inc. said it plans to buy the helicopter rideshare business of Blade Air Mobility Inc. for as much as $125 million in stock or cash as the electric aviation firm seeks to expand its battery-powered air taxis into a ready-made market for its aircraft. Harley-Davidson Inc. appointed the head of Topgolf Artie Starrs to be its new chief executive officer, as the motorcycle manufacturer grapples with tariffs and tepid consumer demand. Lyft Inc. said it’s partnering with China’s Baidu Inc. to launch autonomous vehicles in Europe starting next year, an agreement that comes after the US rideshare company finalized its first expansion into the continent.

What Bloomberg Strategists say…

“With more than two Fed cuts priced by year-end and high odds for a cut in September, macro bears need fresh data shocks to regain control of the tape, as the ‘Powell Put’ narrative is now building. While Tuesday’s services PMI data may provide that, it’s more likely the ongoing debate between better-than-expected earnings and cooling economic data will continue for some time. This will allow trend-followers, volatility-control and buy-the-dip discretionary money to stay active and limit pullbacks to tactical buying opportunities.”

—Michael Ball, Macro Strategist, Markets Live

For the full analysis, click here.

Some of the main moves in markets:

Stocks

The S&P 500 rose 1.3% as of 1 p.m. New York time The Nasdaq 100 rose 1.7% The Dow Jones Industrial Average rose 1.2% The MSCI World Index rose 1.1% Bloomberg Magnificent 7 Total Return Index rose 1.9% The Russell 2000 Index rose 1.7% Currencies

The Bloomberg Dollar Spot Index was little changed The euro fell 0.1% to $1.1572 The British pound was little changed at $1.3286 The Japanese yen rose 0.2% to 147.06 per dollar Cryptocurrencies

Bitcoin rose 0.8% to $115,349.45 Ether rose 5.6% to $3,689.12 Bonds

The yield on 10-year Treasuries declined one basis point to 4.20% Germany’s 10-year yield declined five basis points to 2.62% Britain’s 10-year yield declined two basis points to 4.51% The yield on 2-year Treasuries advanced one basis point to 3.69% The yield on 30-year Treasuries declined three basis points to 4.79% Commodities

West Texas Intermediate crude fell 1.5% to $66.30 a barrel Spot gold rose 0.2% to $3,370.75 an ounce ©2025 Bloomberg L.P.

European Stocks Rebound, Swiss Stocks Dip on Shock US Tariffs

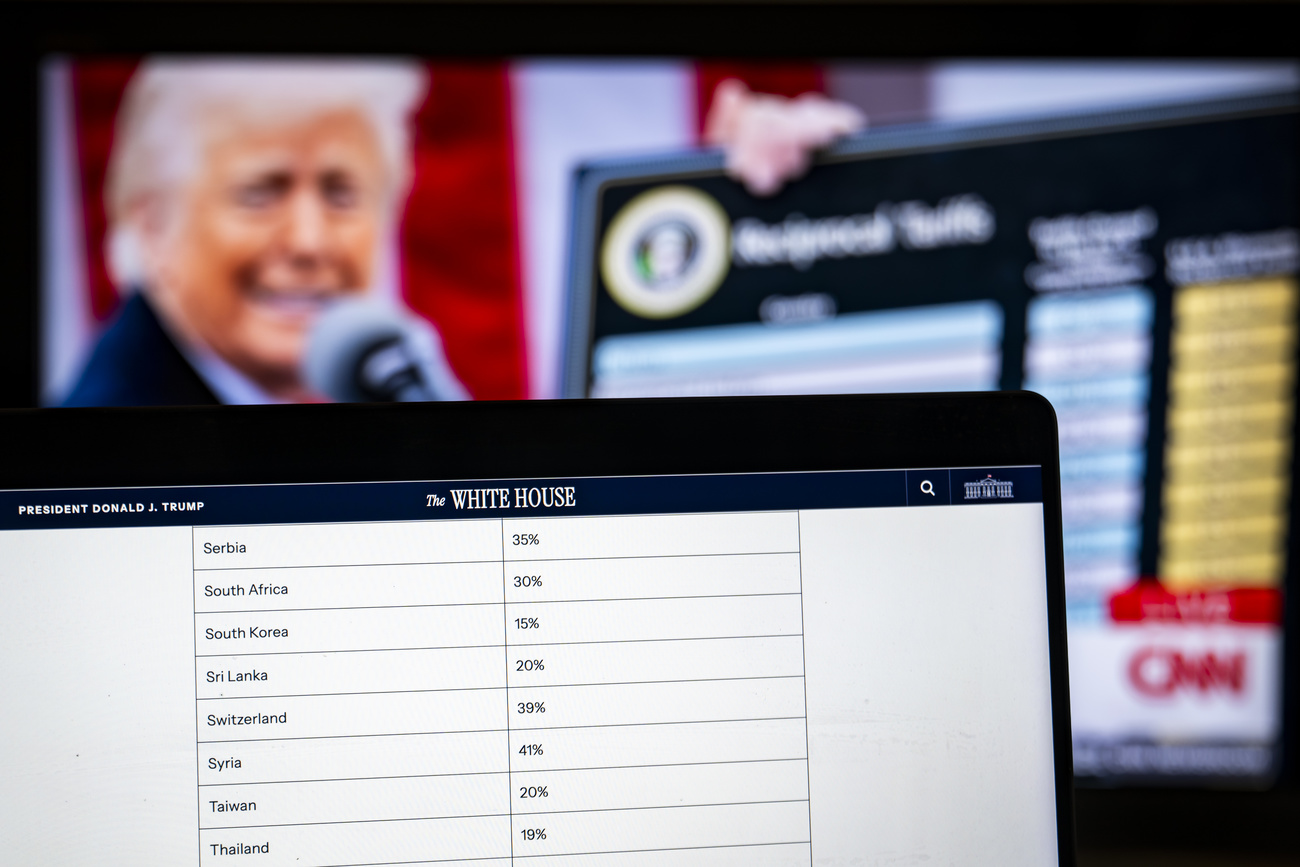

(Bloomberg) — European shares recovered after sliding by the most since April in the previous session, while the Swiss market retreated as traders had their first opportunity to react to a 39% US export tariff.

The Stoxx Europe 600 Index gained 0.9% by the close, with banks and insurance stocks outperforming the most. Automakers and retailers were among the laggards.

Switzerland’s benchmark SMI Index fell as much as 1.9% before paring declines to 0.2% as trading resumed following Friday’s public holiday. The tariff announced last week is one of the steepest globally, and the Swiss government said Monday it was determined to give the US better trade terms as it seeks an improved deal.

“It remains to be seen what impact the Swiss tariffs will have,” said Daniel Murray, chief executive officer of EFG Asset Management. “This is partly because there is always the possibility that Switzerland is able to negotiate improved terms.”

UK lenders rallied after they won a major reprieve in a pivotal UK car finance case. Close Brothers Group Plc jumped 23% while Lloyds Banking Group Plc climbed 9%.

Despite Monday’s upbeat session, the Stoxx 600 has kicked off August with questions around the impact of US tariffs. In addition to Switzerland, Trump also announced a slate of duties on countries including Canada, New Zealand and South Africa last week. The pharma sector is also in focus as the US president pushes for lower drug prices.

The benchmark index could face further volatility as it navigates historically weak seasonal trends over August and September.

For more on equity markets:

A Summer Correction Would Hardly Be a Shock: Taking Stock M&A Watch Europe: Vodafone Spain, MasOrange, Prosus, Cuvva US Stock Futures Unchanged You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

–With assistance from Sagarika Jaisinghani and Charles Riley.

©2025 Bloomberg L.P.

‘Knives out’: Switzerland descends into blame game after US tariff shock

President Karin Keller-Sutter is under fire for failed trade talks with Trump administration

A blame game has erupted in Switzerland after the US announced an unexpected 39% tariff rate on the Alpine country on its national day.

Swiss President Karin Keller-Sutter is accused of grossly miscalculating the trade deal she thought she was able to secure with the Trump administration. Other critics are rounding on the country’s vast pharmaceutical industry for having sparked the ire of the US president.

“It’s knives out,” a former Swiss diplomat said.

Late on Thursday, Keller-Sutter held a “disastrous” phone call with Donald Trump, according to multiple people familiar with the situation.

The 30-minute conversation capped more than three months and hundreds of hours of negotiations in which Swiss officials believed they were on track for securing a deal similar to the UK — a 10% tariff rate. Instead, Trump announced a 39%, one of the highest in the world — on Friday, when Switzerland was celebrating its national day.

The Swiss media roundly criticised Keller-Sutter, with SonntagsZeitung calling the failed talks her “biggest fiasco” and tabloid Blick going as far as saying this was Switzerland’s greatest defeat since 1515, when it lost a battle against the French.

Swiss officials were blindsided because they were led to believe their talks with US trade representative Jamieson Greer and Treasury secretary Scott Bessent were going well and a provisional deal had been reached, the people said. In April, Switzerland said it was confident about securing an early trade deal as it was willing to pledge nearly $150 billion in US-bound investment.

Keller-Sutter, finance minister and president this year as part of the country’s rotating system, in July said she had found “access to Trump” — unlike many other countries struggling to secure meetings with US officials.

The Swiss side was ready to agree to a tariff rate of 10%, Trump’s baseline rate, according to two people familiar with the situation. This negotiating position was approved by Bern on July 4.

But on Thursday’s phone call Trump only cared about one thing: Switzerland’s $39 billion trade imbalance with the US and what more the “very wealthy” Alpine country could offer.

“The call did not go well in the sense that from the very first minute Trump made it clear 10% was not enough and all he could focus on was Switzerland stealing money from the US,” said one of the people. “There was nothing Keller-Sutter could say.”

Greer on Friday described as an “overstatement” Bern’s belief that it had secured a text that was just awaiting Trump’s signature. “Nothing is agreed until everything is agreed,” he told Bloomberg.

The result was a shocking 39% tariff rate. Not only was it one of the highest globally, it was markedly higher than the 31% levy on Switzerland Trump had announced in April on what he called “liberation day”. By comparison, most other countries received a lower rate on August 1 compared with April.

The Alpine country itself has already abolished all industrial tariffs and the US is the country’s top export market for goods including watches, chocolate and machinery. It is also a huge investor in the US, with Nestlé, Roche and Novartis employing thousands of Americans.

Gold exports — often transiting through Switzerland for refining or trade — are largely responsible for the country’s trade imbalance with the US. Yet both gold and pharmaceutical products are exempt from Trump’s “reciprocal tariffs”, adding to the bewilderment in Bern over what more it could offer.

“The problem is the Swiss believe we have to make reasonable and honest offers. We are not good at international power politics,” said one person close to the discussions. “There was uneasiness at making large pledges like other countries have that are not realistic. It was a painful lesson.”

But while Keller-Sutter received most of the blame, some corporate voices lashed out at the influential pharmaceutical sector for torpedoing the talks.

Swiss watchmaker Breitling’s chief executive Georges Kern said his country was being “held hostage” by the pharmaceutical industry that had irritated Trump.

Switzerland’s pharmaceuticals sector sends about 60% of its exports to the US. Novartis and Roche’s US subsidiary Genentech were among the pharmaceutical companies that received letters from the Trump administration this week demanding that they lower drug prices. The Swiss companies have pledged billions in US investment this year.

Greer on Friday also homed in on pharma: “They ship enormous amounts of pharmaceuticals to our country, we want to be making pharmaceuticals in our country.”

The Swiss stock market, which was closed on Friday, is bracing itself for losses when trading resumes on Monday. Novartis, Roche and consumer goods group Nestlé, as well as luxury watch companies Richemont and Swatch are all listed on the Swiss exchange.

The Swiss-American Chamber of Commerce, meanwhile, insists that Switzerland’s investment pledges could still result in a better deal.

“We have nine million people in Switzerland, yet our investment pledge per capita is much more than what Japan or the EU have pledged. If we talk about a $40 billion trade deficit, one has to put that [in] perspective,” said Rahul Sahgal, chief executive of the Swiss-American Chamber of Commerce.

Sahgal, whose group was part of a number of rounds of negotiations between the two countries, said Switzerland needed to “try to figure out what else we can offer. We are seeing if we can have a meeting.”

Copyright The Financial Times Limited 2025

Swiss government to make more attractive offer in US trade talks

The Swiss government is seeking to make an even more attractive offer in talks with the US as it announced on Monday. No countermeasures are currently planned.

+Get the most important news from Switzerland in your inbox

The Swiss government is determined to continue talks and negotiations with the US beyond the present Memorandum of Understanding and, if necessary, even after August 7, 2025.

As part of its contacts with the Swiss business community, the government has developed new approaches for the talks with the US in hopes of reaching an agreement.

Switzerland is in favour of equal treatment with its most important competitors “in order to be able to continue to offer its economy good framework conditions”.

More

‘We will manage to avoid 39% tariffs’, says Swiss-US business leader

According to the figures up to March 2025, the Swiss trade surplus in goods is by no means the result of “unfair” competitive practices. On the contrary – Switzerland unilaterally abolished all customs duties on industrial products as of January 1, 2024. This means that over 99% of all goods from the US could be imported into Switzerland duty-free.

Redundancies unavoidable

Layoffs are likely to be unavoidable due to the new tariffs, the report continued. In order to avoid these in the event of temporary job losses, the short-time work compensation scheme is a tried and tested instrument. Its maximum period of entitlement was again extended from twelve to eighteen months as of August 1 of this year. The government decided on the extension in view of the tense economic conditions.

The national government is constantly analysing the further development of the situation and its impact on the Swiss economy and will be able to take measures quickly if necessary, it added.

Switzerland ranks sixth in terms of foreign investment in the US and “even first” in terms of investment in research and development. Bilateral trade has quadrupled in the last two decades. The government wants to maintain these “dynamic economic relations”.

What is your opinion? Join the debate:

Translated from German by DeepL/jdp

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch.

Swiss Stocks Decline on US Tariffs, Push for Lower Drug Prices

(Bloomberg) — Swiss stocks dropped as the market reopened after a holiday, on worries about the impact from US President Donald Trump’s punitive 39% export tariff and a push for drugmakers to lower prices.

The Swiss Market Index fell as much as 1.9% Monday, although it pared declines to 0.5% as of 3:47 p.m. in Zurich on optimism that the levies will ultimately be a tool to drive trade negotiations. The benchmark is now up about 1.6% for 2025.

Drugmakers Novartis AG and Roche Holding AG, which account for almost 30% of the index, dropped 0.3% and 1.6%, respectively. UBS Group AG fell 0.5% after earlier sliding as much as 3.4%, while shares of Cartier owner Richemont SA declined 1.5%. London-listed Watches of Switzerland Group Plc rebounded 6.4% after slumping 6.8% on Friday.

The Swiss franc fell for a second day against the euro, sliding 0.3%. It had weakened 0.5% on Friday, the biggest drop since May, after Trump’s announcements late last week. The equity market was closed Friday.

“The Swiss market is proving resilient and that’s because there’s hope that a deal will eventually be made with the US,” said Frederik Ducrozet, chief economist at Pictet Wealth Management.

The Swiss government said on Monday it was determined to make the US a more attractive offer on trade terms.

European stocks dropped on Friday by the most since April after Trump unveiled the broad slate of levies, including on Canada, New Zealand and South Africa. The president also sent letters to 17 of the world’s largest drugmakers, insisting they immediately lower what they charge Medicaid for existing drugs.

Switzerland, known for its luxury watches, rich chocolates and banking giants, is one of the US’s biggest trade partners. Last year, it exported more than $60 billion of goods to the US, including medical devices and Nespresso coffee. Pharmaceuticals are also a key export and one of the main reasons the Alpine nation has a bilateral goods trade surplus with the US of about $38.5 billion.

Risks to Pharmaceuticals

Drugs are exempt from the new tariffs for now, but Swiss officials said the sector will still be burdened and could face separate levies. Both Roche and Novartis have been making overtures to the US, pledging in recent months to invest more than $70 billion in research, manufacturing and distribution in the country to address the Trump administration’s concerns about local production.

Roche’s US subsidiary, Genentech, and Novartis were among the 17 drugmakers to receive the letter from Trump last week. He also asked them to guarantee future medicines be launched and stay at prices on par with what they cost overseas.

“Even if pharmaceutical products are exempt from tariffs for the time being, the US government is putting the global supply of innovative medicines at risk,” the trade group Interpharma, which represents the Swiss industry, said Friday. “This also affects research-based pharmaceutical companies in Switzerland and the supply in Switzerland.”

After a strong start to the year, the Swiss Market Index has trailed the Stoxx Europe 600 partly due to the Swiss market’s heavy exposure to defensive stocks. Investors have instead piled into so-called cyclical sectors on optimism around resilient global economic growth.

If the US tariffs are confirmed, it will mean Switzerland has the fifth-highest tariff worldwide, after Brazil, Syria, Laos and Myanmar. It will also be significantly more than the European Union and the UK.

“What we’re facing this week in Switzerland is very similar to what happened at the beginning of April with the first announcement of US tariffs,” said Arthur Jurus, head of the investment office at Oddo’s private wealth management unit in Switzerland. “Visibility on tariffs, notably on what will apply further down the road on pharmaceuticals, is a real problem.”

“That said, counter-intuitively, the safe haven provided by the Swiss franc might edge off some of the pressure on the equity market,” he said.

–With assistance from Allegra Catelli, David Goodman and Naomi Kresge.

(Updates to add economist comment in fifth paragraph. A previous version was corrected to show that Switzerland has a goods trade surplus with the US)

©2025 Bloomberg L.P.

Switzerland Today

Dear Swiss Abroad,

Tariff panic has gripped Switzerland after American President Donald Trump’s decision to impose tariffs of 39% on Swiss exports to the US.

From revelations about Trump’s ‘disastrous’ meeting with President Karin Keller-Sutter to the Federal Council’s willingness to continue negotiations, there is little room for anything else in the Swiss newspapers today.

Enjoy the read!

A whopping 39% tariff on Swiss exports to the United States was announced by American President Donald Trump following talks with Swiss President Karin Keller-Sutter. A phone call that the Sunday newspapers dissected and which the whole of Switzerland is now discussing..

According to SonntagsZeitung and SonntagsBlick, the call began politely, but then Trump harshly criticised the trade deficit with Switzerland, judging the proposal for 10% tariffs envisaged in a declaration of intent reached between a Swiss delegation and representatives of the US administration to be insufficient. All that was missing was Trump’s signature.

But in those 30 minutes on the phone something went wrong. Trump reportedly asked for “significant concessions”, implying that for a “very rich country” like Switzerland there would be no agreement without new perks. Keller-Sutter would have tried to explain the causes of the trade imbalance and to defend the technical agreement reached in the previous months. According to reconstructions, Trump reacted with growing irritation, branding the Swiss president’s tone as “pedantic”. Trump’s entourage even sent an SMS to the director of the Secretary of State for Economic Affairs, Helene Budliger Artieda, suggesting that the call be terminated. The conversation would have been interrupted a few minutes later.

The Swiss stock market opened lower – though not as much as feared – on Monday following Donald Trump’s announcement of the 39% tariffs he intends to impose on Switzerland. The measure hits key sectors of the Swiss economy hard, in particular watches, chocolate and jewellery.

Chocolate makers such as Lindt and Barry Callebaut opened in the red with losses of 1.5% and 2.9%, respectively. Companies in the sector risk a sharp erosion of margins, aggravated by a strong Swiss franc.

The watch industry is also vulnerable: the US accounts for 15% of turnover and there are fears of a 20% drop in volumes. Swatch and Richemont recorded significant declines. Swatch CEO Nick Hayek urged President Karin Keller-Sutter to travel to Washington to negotiate a more favourable trade agreement with Trump.

The pharmaceutical sector, along with Roche and Novartis, has been relatively spared on the stock market so far thanks to U.S. reliance on medical exports, but remains under pressure from Washington’s demand to reduce prices.

According to analysts, tariffs could reduce Swiss GDP by 0.6% as early as 2025, putting the projected growth of 1.3% at risk. Tens of thousands of jobs are at risk after Trump’s decision, says Urs Furrer, director of the Swiss Association of Arts and Crafts (USAM). “If these customs duties come into force on Thursday, there will not only be an increase in partial unemployment, but a general increase in unemployment,” he told news agency Keystone-SDA.

Technically, Switzerland still has until August 7 to find a solution to the problem of US tariffs, the day on which they should come into force. How to do it? In the Swiss press, there is speculation that a solution could come through gold trading.

Although it does not make sense from an economic point of view, according to specialists, the reason for Trump’s discontent seems to be the fact that the trade balance between Switzerland and the United States is tilted in favor of the Confederation. Gold in particular weighs heavily, according to the newspapers of the Tamedia group. The precious metal could be a solution, they write.

The United States buys gold mainly in the United Kingdom, but this is largely refined in Switzerland, a country that then ships the precious metal directly to the American buyer, finding itself charged the export value, explain the Tamedia publications.

Radical Liberal Party parliamentarian Hars-Peter Portmann proposes to send the refined golf back to the UK. It would then be up to them to get it to the United States, “operations that would make everything more expensive for overseas customers, but at least gold would no longer appear in our trade balance“.

Another possibility conjured up by the newspapers to circumvent the gold problem is to have its sale passed through the banks. In this way, it would become a capital shift and would no longer weigh on Swiss exports to the United States.

For now, the Swiss government wants to continue negotiations rather than take countermeasures to prevent the 39% US tariffs from coming into effect. However, according to Cédric Dupont, professor of international relations and political science at the IHEID in Geneva, Switzerland has little room for manoeuvre.

Negotiations with Washington will continue, the government said in a statement released after an extraordinary session on Monday. The governing Federal Council “remains in close contact with the affected sectors of the Swiss economy and with US officials. Switzerland is committed to securing fair treatment compared with its key competitors to safeguard favourable conditions for its economy,” the statement said.

However, “little Switzerland doesn’t have much to put on the table to satisfy the ogre,” Dupont told RTS. “Buying liquefied natural gas [as Economics Minister Guy Parmelin suggested on Saturday], talking about gold or strategic stocks are just vague attempts that won’t work with the Trump administration.”

“We cannot even promise 200 billion in investments over four years when today we are hovering around 20. It is neither feasible nor desirable, especially with such an unpredictable partner,” he adds. According to the expert, the solution is to start thinking about diversification so as not to remain so dependent on one country or one sector.

More

‘Knives out’: Switzerland descends into blame game after US tariff shock

More

‘We will manage to avoid 39% tariffs’, says Swiss-US business leader

More

How semiconductors are made

More

Part-time Swiss Abroad: the challenges of working in two countries

More

The Toblerone Trail: a unique walk through Swiss history and nature

More

Migrants in Switzerland speak of gratitude, pride – and setbacks

More

Green vote failure: ‘Swiss voters don’t like bans’

More

Swiss voters reject green overhaul of economy

More

February 9, 2025 vote: the result from across Switzerland

More

From emigration to arrival: How to successfully integrate abroad

More

Tax information when emigrating from Switzerland: what you need to know

More

Voting from abroad: How to register for Swiss elections

Switzerland in pictures

More

Switzerland in pictures

More

Picture of the day

More

Picture of the day

More

Switzerland in pictures

More

Switzerland in pictures

Let’s talk

News from Switzerland

Switzerland in pictures

After the ‘red river’ of the Swiss fans at the European Women’s Football Championship last weekend the streets of Bern took on rainbow hues on the occasion of the Pride parade.

Swiss Are Ready to Make More Attractive Trade Offer to US

(Bloomberg) — The Swiss government said it is determined to win over the US on trade after last week’s shock announcement of 39% tariffs on exports to America.

“Switzerland enters this new phase ready to present a more attractive offer, taking US concerns into account and seeking to ease the current tariff situation,” it said in a statement on Monday, highlighting its foreign direct investments and research and development push in the US. It also excluded countermeasures for the time being.

With the new levies — the highest among industrial nations — scheduled to go into effect on Thursday, President and Finance Minister Karin Keller-Sutter convened an emergency meeting of the governing Federal Council to discuss how to proceed.

Negotiators with the Swiss State Secretariat for Economic Affairs have already reached out to their US counterparts to try and find a way forward. Bern is focusing on getting at least a longer timeline than Thursday, according to an official close to the talks, adding that anything improving the current situation would be a win.

Washington’s move came as a surprise as talks ahead of the Aug. 1 deadline had looked promising. A Thursday night call instead focused on Switzerland’s trade surplus in goods with the US.

The Swiss government stressed on Monday that the overhang “is not the result of any ‘unfair trade practices’.”

Switzerland’s outsized gold exports are partly to blame for the distorted trade balance. The country is the world’s biggest refining hub for the precious metal, with billions of dollars worth of gold constantly flowing into and out of the nation.

Pharmaceuticals, coffee and watches are the other main drivers.

Keller-Sutter, who was criticized in the Swiss press over the weekend for allowing Trump to blindside her without a backup plan, said she would be willing to make a last-minute trip to Washington if she thought there was a chance a deal could be made.

“I don’t rule out such a visit, but first, the two sides should come closer together in their positions,” she told the newspaper Schweiz am Wochenende. It’s not clear what, if any, response there has been from the US government.

Despite the backlash, the Swiss president doesn’t face any immediate danger of losing her job. The system is designed for continuity, and the presidency rotates on an annual basis, meaning her term running the country will come to a close at the end of the year.

Switzerland ran a $38 billion bilateral trade surplus with the US last year, according to US Census data, which was the 13th biggest for the world’s largest economy. While Swiss exports to the US collapsed after the introduction of tariffs in April, they rebounded in June, suggesting that trade between the two countries remained robust.

What Bloomberg Economics Says…

“We estimate that this represents a tariff shock of around 23 percentage points for the Swiss economy, putting roughly 1% of its GDP at risk over the medium term.”

-Jean Dalbard, economist. For full React, click here

There aren’t many routes available to Switzerland, but one is to offer to buy liquefied natural gas from the US. While the landlocked country is focused on hydroelectric and nuclear power, it does use a small amount of gas, primarily in the winter to cushion swings in its energy supply. Should Switzerland choose to import more gas, it would have to travel through neighboring countries, which could potentially increase transit costs.

So far, the expectation appears to be that Keller-Sutter and the government will secure a better deal. The Swiss market benchmark SMI was down just 0.5% as of 3:15 p.m. on Monday.

“We expect negotiations to bring the 39% Swiss tariff rate closer to the 15% agreed with the EU,” Lombard Odier investment strategists said in a research note. “In the unlikely event that this trade dispute is not resolved,” they added, they will revise their forecast for gross domestic product.

Given the “volatility of decisions we’ve seen from the US,” there’s hope that a solution may be found, Franziska Ryser, a lawmaker of the Green party, told Bloomberg.

“On the other hand, we must draw political conclusions from the situation and acknowledge that — at least under the Trump administration — America is no longer a reliable partner,” she said. “This means that we should strengthen cooperation with the EU and coordinate more closely with our European partners.”

–With assistance from Jana Randow, Dylan Griffiths and Anna Shiryaevskaya.

(Updates with gold in seventh paragraph)

©2025 Bloomberg L.P.

UN optimistic about reaching agreement on plastics in Geneva

The United Nations (UN) is convinced that an international agreement to limit plastic pollution can be reached within 10 days in Geneva after further negotiations. “The time is right,” said UN Environment Executive Director Inger Andersen on Monday.

+Get the most important news from Switzerland in your inbox

“This is a treaty that the world wants and frankly needs,” said the Dane on the eve of the resumption of crucial negotiations, for the first time in Geneva. After more than three years of discussions, an arrangement is within reach, even if there are “clearly divergences”, she told the various players involved in the process, which will involve more than 170 countries from Tuesday.

“We have come to Geneva with the conviction that something can happen, that we can have an agreement,” said the Executive Director of the United Nations Environment Programme (UNEP). She remains in favour of a treaty that covers “the whole cycle” of plastics, from production to waste management, and that allows for sustainable production and consumption.

More

UN in Geneva calls for reform of tariffs on plastics

But it will be necessary to convince the few oil-producing countries that blocked the process less than a year ago in South Korea. Since that meeting, the other countries, including Switzerland, have made concessions, abandoning the idea of imposing a quantitative limit on production in an attempt to reach a consensus on the objective of stabilising production.

The chairman of the negotiations, Ecuadorian ambassador Luis Vayas Valdivieso, and the executive secretary, Jyoti Mathur-Filipp, called on civil society to influence the governments. “This is a historic opportunity” to improve the situation of future generations, said the former.

Swiss step up

“This is a historic moment,” said Felix Wertli, head of international affairs at the Federal Office for the Environment (FOEN) and chief Swiss negotiator. He called for “commitment” , “collaboration” and “efficiency” .

Plastic “affects all our societies and all of us”, added the Swiss ambassador. “We have the science, we have the right time and we have the platform here in Geneva,” he also insisted, even if much work remains to be done.

FOEN Director Katrin Schneeberger will be present on Tuesday for the opening of the negotiations. Wertli will then lead the Swiss delegation until the arrival of government minister Albert Rösti on August 13 and 14, alongside around 70 other ministers.

In almost 25 years, plastic consumption has more than doubled, reaching 500 million tonnes in 2024, of which almost 400 million tonnes will end up as waste. If the situation is not stabilised, it will exceed 1.2 billion tonnes by 2060. And waste will exceed 1 billion tonnes.

What is your opinion? Join the debate:

Translated from French by DeepL/jdp

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch.

Swiss multinationals urge calm in response to tariff blow

A few days after the news of the 39% tariffs imposed by the US on Switzerland, Swiss watchmaker Swatch urged calm. Some companies that produce a lot in the US said they expected limited effects.

+Get the most important news from Switzerland in your inbox

“No hasty reactions, negativity and speculation and, above all, no hyperventilation, especially by journalists: stay calm,” urged the Swatch watch group, prompted by the Awp news agency.

The electrical giant ABB points out that the company strategy aims to be self-sufficient in every region: already today, 75-80% of products in the US are manufactured locally, in Europe the share is 95% and in China 85%. “A central component of our strategy is to further increase localisation rates as part of our investments,” the company says. ABB is, however, monitoring the situation “very closely”. The company generates 27% of its turnover in the US and over the past three years more than $500 million (CHF403 million) has been invested in American operations, for example in new production facilities or research centres.

Even at Lindt&Sprüngli, the high-quality chocolate giant, there is no let-up. “The vast majority of products sold in the US are manufactured locally at the Stratham, New Hampshire production plant,” explained a spokesperson. “Items from Europe represent only a small portion of the total volume.”

What is your opinion? Join the debate:

Translated from Italian by DeepL/jdp

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch.