Swiss bank takes plunge into the metaverse

Swiss digital assets bank Sygnum will open a branch in the metaverse to reach more clients seeking blockchain-based financial services.

Sygnum was one of two banks that were awarded licenses in 2019 to connect traditional finance with cryptocurrencies and the blockchain.

Blockchain and other Distributed Ledger Technology (DLT) databases provide a home for digital currencies and other assets, such as company shares, collectibles and art.

More

From high street to metaverse: finance embraces ‘bank killer’ technology

The decentralised technology aims to transform finance by granting users more control over their assets and direct access to trading partners, rather than through intermediaries.

Blockchains also underpin a new version of the internet called Web3 and provide the financial infrastructure for virtual worlds known as metaverses.

Sygnum said on Thursday that it has become the first Swiss bank to open a virtual metaverse branch, where it will join other international banks such as JP Morgan and HSBC.

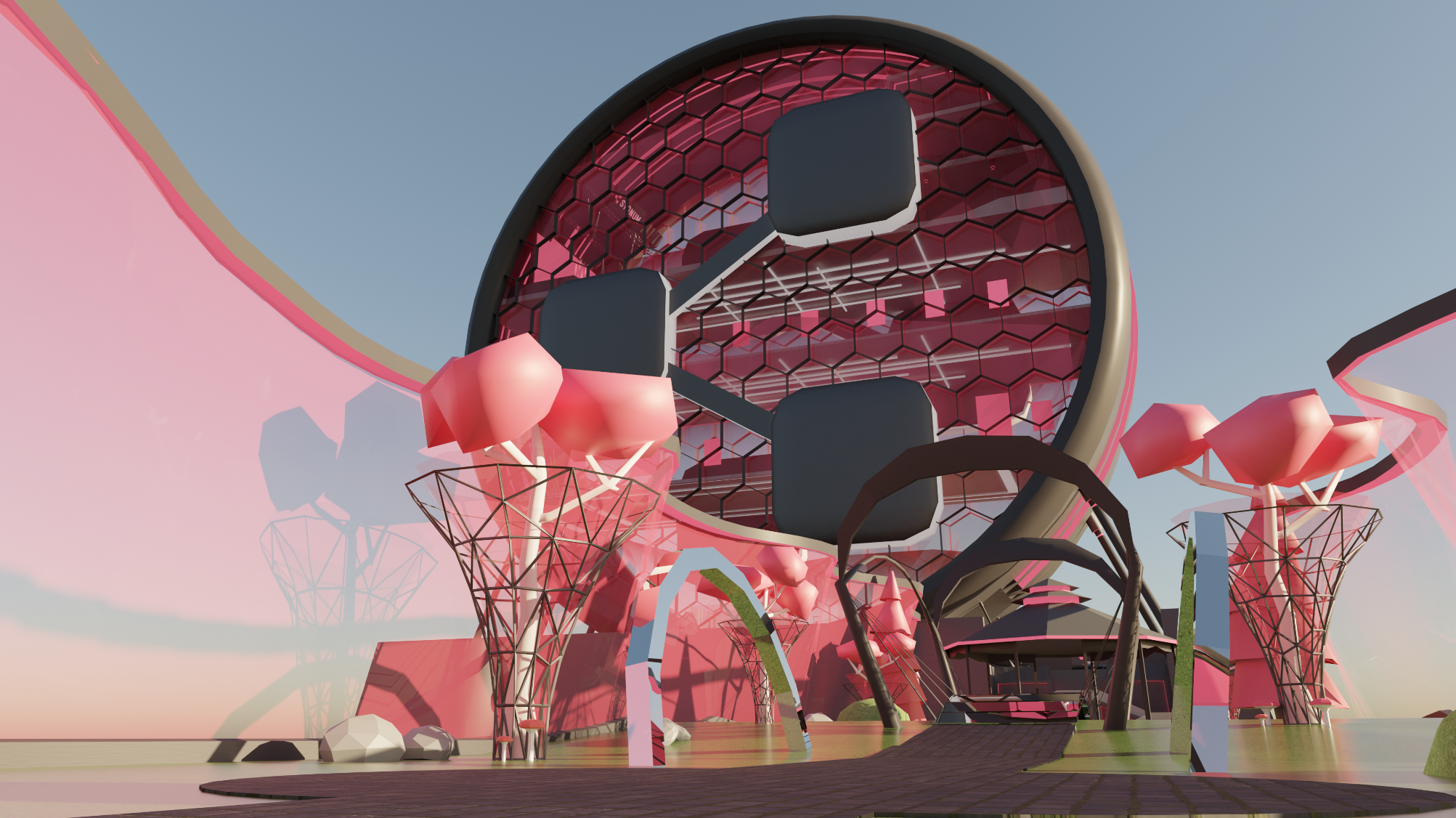

Sygnum will later this month open a metaverse hub in Decentraland’s virtual version of New York’s Times Square. The hub will feature a receptionist based on a CryptoPunk digital artwork and a gallery of non-fungible tokens (NFTs) which link digital art to the blockchain.

“Metaverse investment is ramping up, powered by crypto-enabled retail transactions and a new generation of users completely at home with socialising, shopping and working in virtual spaces,” said Sygnum Chief Clients Officer Martin Burgherr.

A $5 trillion business

Consultancy group McKinsey believes the metaverse will generate $5 trillion (CHF4.9 trillion) in new business opportunities by 2030.

The main drivers are tipped to be retailers opening virtual stores, the staging of educational or live cultural events, e-commerce and financial services and new computer gaming applications.

While the mainstream Swiss financial sector has so far shown little appetite for dabbling in the metaverse, a new fintech company called Fiat24 is also building a Web3 banking operation along with its own metaverse functionality.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.