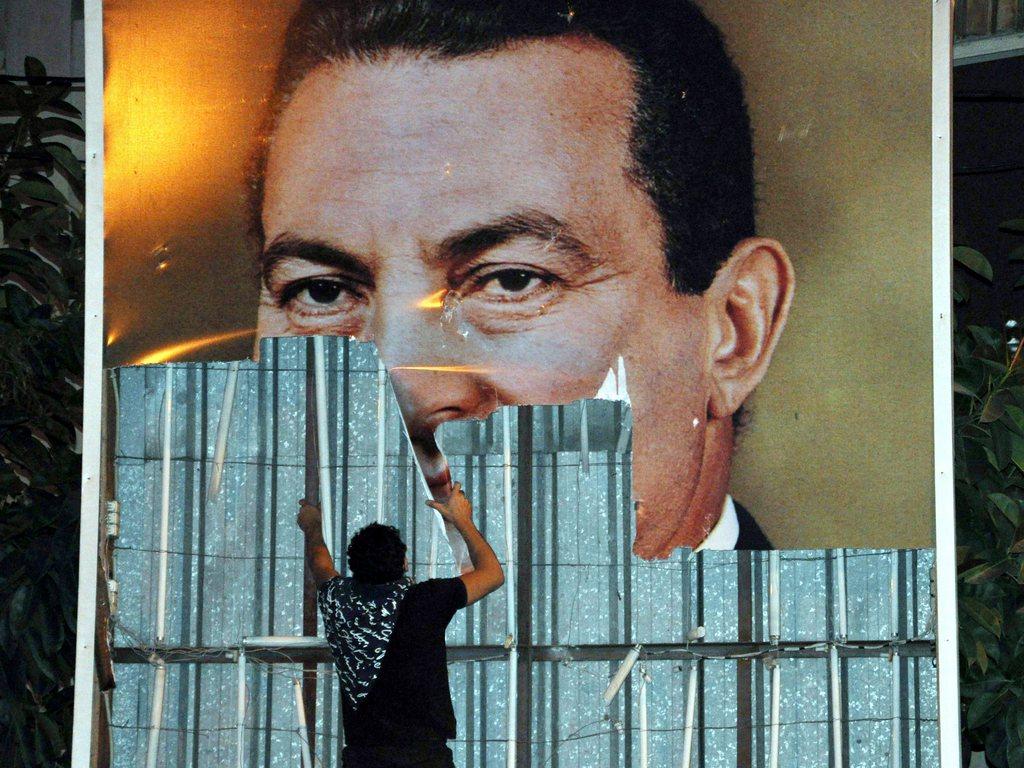

Switzerland repatriates chunk of frozen Mubarak funds

Switzerland has returned the first batch of remaining frozen funds to Egypt that related to the deposed President Hosni Mubarak. A payment of CHF32 million ($34 million) was made in December, according to a report in the NZZ am Sonntag newspaper.

The Swiss Attorney General’s Office confirmed to the newspaper that the money, which originally belonged to businessman Ahmed Ezz, had been handed over following a deal between Ezz and the Egyptian authorities.

Switzerland has been holding on to more than CHF400 million of funds linked to Mubarak’s regime since the dictator was deposed in 2011. The value of the assets has declined from an original total of CHF700 million but efforts to unblock the remaining funds, which were held in Swiss bank accounts, have been convoluted.

The Swiss authorities have stressed that the return of the Ezz funds will not have any impact on any ongoing legal proceedings. Switzerland is still conducting investigations against six people connected to Mubarak, including two of his sons.

In 2016 Switzerland introduced a new law to help seize and repatriate illicit wealth held in its banks by foreign dictators in cases which do not follow classic asset freezing-restitution procedures.

The law lets Swiss authorities seize and return funds that foreign leaders looted, even in cases that cannot be resolved through standard international requests for mutual legal assistance.

Ever since the Marcos (Philippines) affair in 1986, the list of illicit potentate funds that have been seized in Swiss banks and later returned to the country has steadily grown to include Montesinos (Peru), Mobutu (former Zaire), Dos Santos (Angola), Abacha (Nigeria), Kazakhstan, Salinas (Mexico), Duvalier (Haiti), Ben Ali (Tunisia), and Mubarak (Egypt).

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.