Stocks Extend Advance on Fed Rate-Cut Optimism: Markets Wrap

(Bloomberg) — Asian shares tracked Wall Street’s rally and gained the most in nearly two weeks as traders increased bets the Federal Reserve will lower interest rates next month following dovish comments by Chairman Jerome Powell.

A gauge of Asian equities rose 1.1%, with an index of technology stocks in Hong Kong jumping by 3.1%. Shanghai shares gained 0.9%, hovering around their highest level in 10 years, with property companies among the winners as the Chinese city eased home buying curbs.

Equity-index futures for US and Europe retreated as investors curbed some of Friday’s optimism ahead of this week’s risk events. Treasuries edged lower, paring some gains made after Powell’s speech, with yields on the two-year up one basis point to 3.71%. A gauge of the dollar strengthened 0.1% after posting its third weekly loss. Gold fell.

Traders see an 84% chance of a Fed rate cut next month after Powell signaled at Jackson Hole, Wyoming, the central bank may ease before inflation fully returns to target amid a softening hiring environment. That optimism faces key tests this week, including a US inflation reading, Nvidia Corp.’s results and the peak of Asian earnings season.

“Powell’s wish-to-reality signal is set to serve as glue on the cracks beneath Asia’s mildly shaking markets,” said Hebe Chen, analyst at Vantage Markets. “For investors, this fresh dose of optimism is likely to keep risk appetite buoyant” through to the next Fed board meeting.

Sentiment had been weak heading into Friday, with the S&P 500 falling for five straight sessions. Its longest losing streak since January came as Wall Street pulled back on bets that the Fed was about to reduce borrowing costs. Powell’s comments halted those concerns, sending the equity benchmark soaring to its best day since May.

What Bloomberg Strategists say:

Currency traders are curbing the enthusiasm that broke out among dollar bears after Jerome Powell’s Jackson Hole speech opened the door for the Fed to cut rates. That underscores the potential that this week’s inflation data and further economic prints before the mid-September FOMC mean it’s far from certain that policymakers will resume easing then.

—Garfield Reynolds, MLIV Team Leader.

However, Powell, in what was likely his final Jackson Hole speech at the helm of the Fed, detailed the cloudy signals coming from the economy.

While the effect of tariffs on prices is now visible, there are still questions about whether that will reignite inflation in a more persistent way, he said.

He called the labor market’s current status — with both falling demand for, and declining supply of workers — “curious.”

“It’s clear that Fed is prioritizing the job weakness concern over inflation and that’s their stance now,” said Jin Yuejue, Hong Kong-based multi-asset solutions investment specialist at JPMorgan Asset Management. Still, the signal from the speech is “quite clear” that the Fed is ready to pivot, she said.

Chinese stocks have been in focus with questions mounting over how much further the market can rally with concerns of trade tariffs and a deep-rooted property crisis weighing on the economy. While the market’s steady advance may suggest less risk of a sudden correction, some analysts are warning that a bubble is in the making.

“Markets might be expecting, either correctly or incorrectly, that macroeconomic fundamentals will improve,” said Homin Lee, senior macro strategist at Lombard Odier Ltd. in Singapore. “But a bull market will not be sustainable if inflation remains close to 0% and corporate pricing power faces severe headwinds from weak domestic demand.”

Then there’s Nvidia, which is set to report quarterly earnings on Wednesday after the market close. Traders are hoping it can soothe fears about AI spending and effectively confirm that the stock market’s latest rally isn’t just a technology bubble.

Nvidia’s size — it has the biggest weighting in the S&P 500 at almost 8% — and its position at the center of AI development have made it a bellwether of the broader market. The tech giant’s chips are everywhere, with 40% of its revenue coming from tech giants including Meta Platforms Inc., Microsoft Corp., Alphabet Inc. and Amazon.com Inc.

Meanwhile, several Asian borrowers are opening talks with investors this week on dollar bond deals, aiming to lock in some of the tightest credit spreads seen in decades amid growing expectations for further US interest rate cuts.

Corporate News:

Dongfeng Motor Group Co.’s Hong Kong-listed shares surged the most in six months after the Chinese automaker announced long-awaited restructuring plans. Buyout firm Thoma Bravo is nearing a deal to acquire call center software maker Verint Systems Inc. The deal would value Verint at about $2 billion, including debt. Keurig Dr Pepper Inc. is close to a deal to acquire European coffee company JDE Peet’s NV for about $18 billion. Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 1:15 p.m. Tokyo time Japan’s Topix rose 0.2% Australia’s S&P/ASX 200 rose 0.3% Hong Kong’s Hang Seng rose 2.1% The Shanghai Composite rose 0.9% Euro Stoxx 50 futures fell 0.3% Currencies

The Bloomberg Dollar Spot Index was little changed The euro fell 0.1% to $1.1705 The Japanese yen fell 0.3% to 147.32 per dollar The offshore yuan rose 0.2% to 7.1592 per dollar Cryptocurrencies

Bitcoin was little changed at $112,837.01 Ether fell 1.5% to $4,713.5 Bonds

The yield on 10-year Treasuries advanced two basis points to 4.27% Japan’s 10-year yield was unchanged at 1.615% Australia’s 10-year yield declined four basis points to 4.28% Commodities

West Texas Intermediate crude rose 0.2% to $63.80 a barrel Spot gold fell 0.2% to $3,365.59 an ounce This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu, Joanne Wong and Finbarr Flynn.

©2025 Bloomberg L.P.

Boats sail to Solothurn to celebrate 700 years of Le Landeron

The challenge of crossing Lake Biel from Le Landeron to Solothurn without a motor was taken up by 16 amateur crews on Saturday. The competition is part of Le Landeron’s 700th anniversary celebrations.

+ Get the most important news from Switzerland in your inbox

Nearly 1,500 people were on hand to admire the boats decorated with humour and inventiveness. First prize went to the “La Galère” crew.

Named “Chargé pour Soleure”, the competition pays tribute to the historic links between Le Landeron and Solothurn, the organisers said in a press release on Sunday. Relations between the two communes have been built up over the centuries through “commercial, religious and cultural” exchanges.

The Solothurn authorities have been invited to take part in the festivities.

Translated from French with DeepL/ds

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch

Swiss cantonal ministers keep low profile on social media

Swiss cantonal ministers have only modest social media followings and post largely neutral content, a new University of Lausanne study has found.

+ Get the most important news from Switzerland in your inbox

Facebook is the platform where Swiss cantonal ministers a\ttract the largest followings, according to researchers at the University of Lausanne’s Graduate Institute of Public Administration. Most count between 0 and 5,000 followers, with a few notable exceptions such as Zurich politician Natalie Rickli (27,499) and Valais politician Mathias Reynard (12,193).

On Instagram, ministers average fewer than 5,000 followers, while most do not maintain an account on X.

The researchers found that the vast majority of ministers’ posts are neutral in tone and contain little or no political content.

Transalated from French with DeepL/ds

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch

Swiss rents forecast to rise up to 5% annually, housing chief warns

Swiss tenants face years of rising housing costs, with rents expected to climb 3–5% annually, the Federal Housing Office warned Sunday.

+ Get the most important news from Switzerland in your inbox

Housing demand continues to outstrip supply. Without a fall in economic activity, we can expect rents to rise, says Mr Tschirren in an interview published by the NZZ am Sonntag. The tenants affected are those who are new to the housing market or who have to move house, he points out.

He explains this increase by the fact that the housing market is increasingly being used as an investment for capital. Added to this is the fact that building land has become scarce in Switzerland, he continues. “In the past, we could solve the problem of growing demand by putting land in building zones. Today, that’s no longer possible.

Fewer building permits

The Director of the OFL also notes that the number of building permits has fallen by almost a third since 2016 in Switzerland. “Construction activity has not yet fallen by the same proportion, but it will continue to fall”. He cites a study that points to objections and appeals as the main cause of obstacles to housing construction projects.

The study recommends limiting the right to object to those directly affected, says Tschirren. “In principle, the right to be consulted would be maintained”, but it would be more targeted in order to avoid projects being unnecessarily delayed or prevented for opportunistic reasons, he adds.

Introducing an obligation to pay costs or damages in the event of manifestly abusive objections could also be an effective means, he stresses.

As for a rent cap, as practised in Basel, Tschirren has mixed feelings: “Its impact appears ambiguous”.

From the point of view of the tenants’ association, he points out, the model has been a success, as unfair terminations have fallen, but at the same time, construction and renovation have suffered.

“The canton of Basel-Stadt has therefore had to adapt its regulations to make renovation more attractive,” he noted.

Translated from French with DeepL/ds

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch

Swiss Abroad say ‘yes’ to electronic identity

The Council of the Swiss Abroad, meeting today in Bern, passed a resolution in favour of the new Electronic Identity Act (Id-e), which will be put to the vote on September 28.

+ Get the most important news from Switzerland in your inbox

The body, which represents more than 826,000 Swiss citizens living outside Switzerland, emphasises that the Id-e is crucial for simplifying access to administrative services, which is often hampered by geographical distance, time zones and bureaucracy.

According to the Council, the creation of a state digital identity is a key step in developing e-government and paving the way for new forms of political participation, such as e-voting and online collection of signatures for initiatives and referendums. Such tools would allow expatriates to exercise their political rights in a simpler, safer and more modern way.

The first meeting of the new legislature was attended by more than one hundred delegates from all over the world, welcomed by National Council President Maja Riniker. Of the 120 Council members, 71 were newly appointed.

Translated from Italian by DeepL/ds

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch

Visiting the Rigi used to make people ill – why?

Around a century ago, many people complained of severe diarrhoea and vomiting following a visit to the Rigi mountain. For a long time, people blamed the Rigikrankheit (as the condition was known) on the mountain air, until a high profile defamation trial uncovered a major environmental scandal.

Around 1900, the Rigikrankheit barely merited a mention. It was just considered one of those things. Hoteliers, their families and employees often experienced repeated bouts of severe vomiting and diarrhoea during the tourist season. Sometimes it also affected up to 50% of guests. Hoteliers blamed it on the mountain air. It was also thought to be due to overindulging on food and drink, especially among children, eating too much fruit, and drinking cold water when overheated.

Swissinfo regularly publishes articles from the Swiss National Museum’s blog External linkdedicated to historical topics. The articles are always written in German, usually also in French and English.

In 1909, however, the Rigikrankheit became too much, or “virulent” as a subsequent investigative report stated. Entire classes who had visited the Rigi on a school trip fell ill, severely so in some cases. The Zurich city doctor documented 287 cases, which he had personally encountered. In one class, all the children were afflicted with severe vomiting and diarrhoea, and 21 of 26 pupils in another class fell ill, plus all the adults.

School trips banned

The authorities in Zurich and Winterthur forbade their teachers from taking any more classes to the Rigi. And the Zurich Department of Health demanded measures in writing from Schwyz Cantonal Council as to how such incidents could be avoided in future. “We will not tolerate a situation whereby hundreds of people are exposed to the risk of serious, possibly even fatal, illness following a visit to the Rigi.”

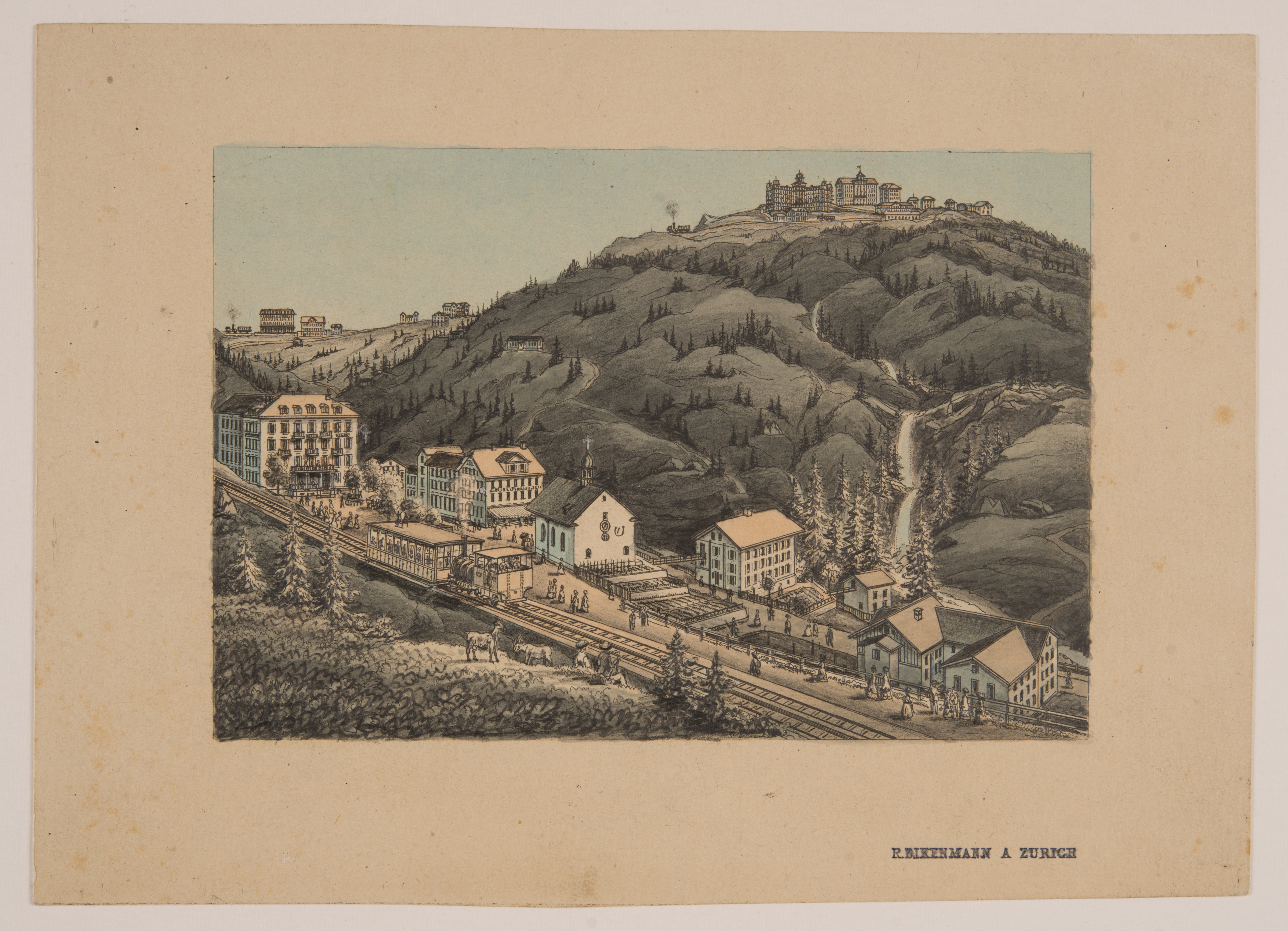

The Rigi was Europe’s ‘in’ mountain during the 19th century. By 1840, it had about 40,000 visitors every summer, rising to 70,000-80,000 following the construction of Europe’s first mountain railway in 1871. There were many grand hotels at Kulm, Staffel, Klösterli, Rigi-First, Scheidegg and Kaltbad where people could stay. The mountain had a total of about 2,000 hotel beds.

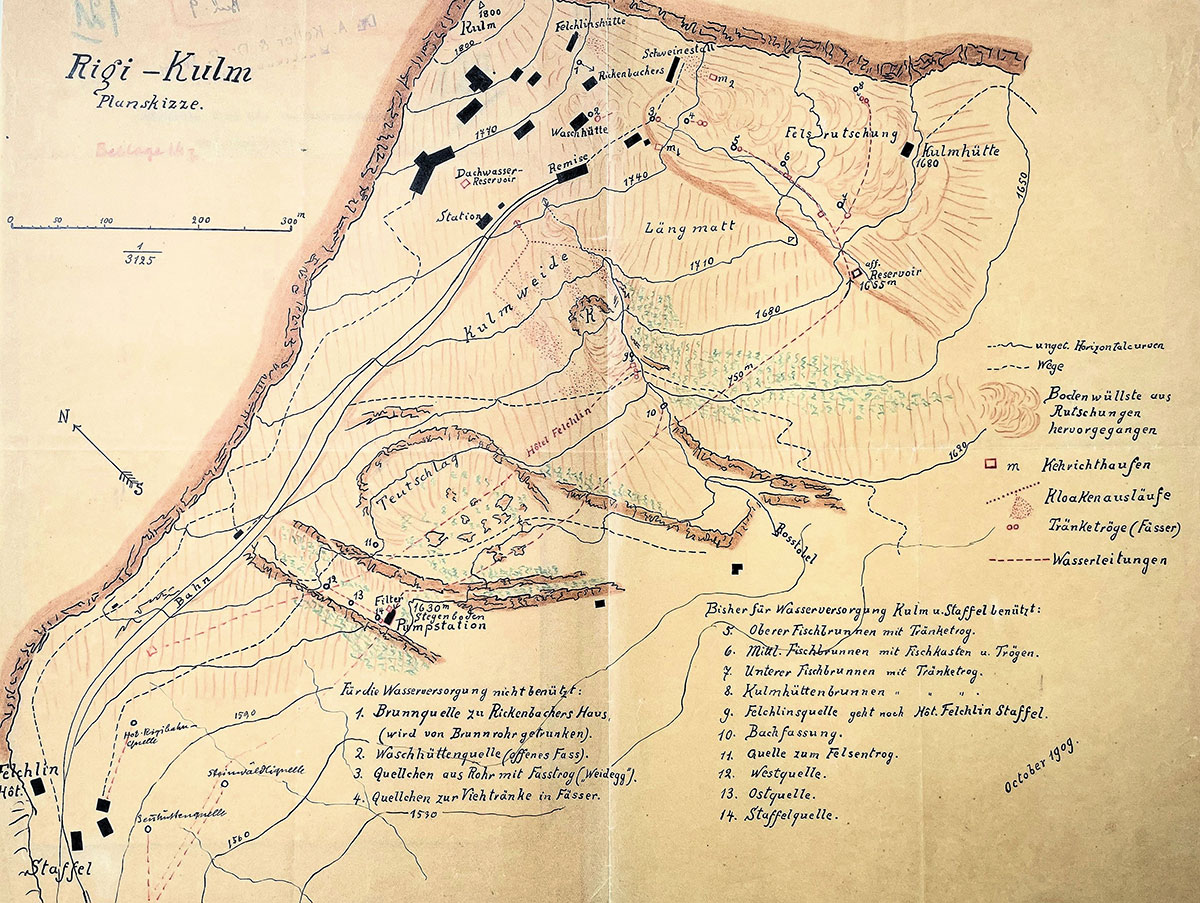

Hoteliers always referred to positive health impacts as a selling point. Fresh air and whey curesExternal link were supposed to benefit the healthy just as much as the sick and convalescing. This naturally made the Rigikrankheit even worse for business, especially from 1909 when it became too big to hide or water down. Schwyz Cantonal Council immediately commissioned district physician Carl Real to launch an investigation following the announcement by the Zurich authorities. The report came out at the end of 1909 and it unmistakeably showed that it was not the air but the, in some cases, scandalous state of the drinking water supply that was behind the Rigikrankheit. The cause was coli bacteria, traces of which were repeatedly found in the water both at that time and in subsequent years.

The large Kulm and Staffel hotels were the worst. They drew drinking water from different sources as well as from the rainwater on the roof. All the sources merged into a big reservoir – including the wastewater from the hotels located higher up, which was expelled into a field from where it flowed down almost unfiltered into a well further down the mountain. It was then pumped back up from the reservoir as drinking water to the hotels higher up.

At one location, the water was pumped out from the ground in a marshy area. Humans and bovine excrement contaminated that particular water hole, which the report referred to as a “source” in inverted commas. Another spring initially flowed into an open cattle trough; the overflow was then diverted into the drinking water reservoir.

In parallel with the investigations by Carl Real, Professor Oskar Wyss, Head of Zurich Hygiene Institute also got to work. The manager of the Kulm hotel had asked the professor, who was his friend, for an assessment. Wyss enlisted the services of Albert HeimExternal link, a prominent professor of geology, who immediately concurred and described the water supply as “highly dangerous, unsanitary”.

Typhoid in Klösterli

Various measures were undeniably well overdue. As if the Rigikrankheit were not bad enough, there were recurring typhoid epidemics in the Rigi hotels. In 1893, 17 people in the Hotel Sonne in Rigi-Klösterli fell ill, four of whom died, including the porter. The cause was recognised as contamination at source through slurry and wastewater from the First Hotel higher up the mountain. However, the measures demanded by Schwyz were only applied half-heartedly.

In 1909, the environmental scandal finally became public knowledge. The issues with the drinking water supply had already been covered by various newspapers. In 1910, Zurich City Council demanded that school trips only be authorised once the Zurich city or school doctor had investigated the state of the drinking water supply. Progress on the Rigi was slow. Some particularly poor drinking water sources were discarded and the wastewater from Kulm hotel was diverted eastwards over the cliff wall. In any case, even as late as 1912 most of the spring water was captured from old oil barrels buried in the ground.

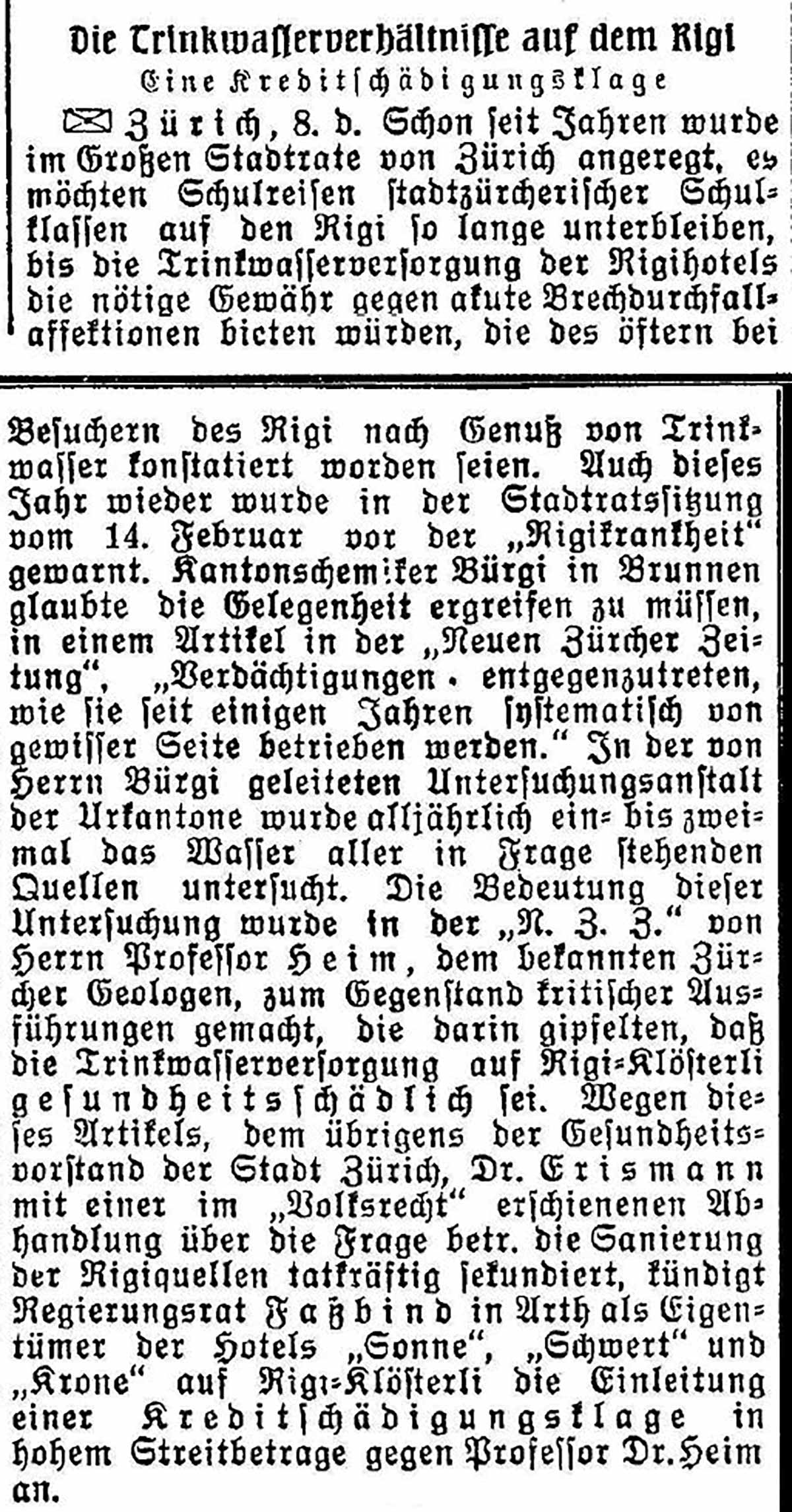

The story gained traction in 1914 and became something of a nationwide cause célèbre. It began with a session of Zurich City Parliament. Communal Councillor Friedrich Ehrismann complained that the canton of Schwyz had refused an investigation by the municipal health authorities. As a result, the ban on school trips remained in force. Then Jean Bürgi, the Schwyz cantonal chemist, weighed in with a lengthy article in the Neue Zürcher Zeitung (NZZ) newspaper. He wrote that the authorities in his canton had done everything they could. But they didn’t want other parties to intervene in their own affairs. The situation was, he argued, dealt with by the district doctor and cantonal chemist being made responsible for checking the sources at least once a year.

‘Don’t touch a drop’

This article elicited a response from Professor Albert Heim. He wrote a lengthy piece in the NZZ calling it “dangerously naïve”, to think one or two checks a year would be enough. A small source could remain perfectly viable in dry weather and then immediately become contaminated again in the rain. Although he agreed that the right measures had been implemented, he also said they were not nearly enough. In the name of the many thousands who had fallen seriously ill, he implored the people of Zurich: “If you go to the Rigi, don’t drink one drop of the water!”

Heim’s article caused a stir, and it was quoted in many Swiss newspapers. Readers wrote into the Schwyz newspaper to express their disagreement with Heim’s claims, the “Zurich water detector”, who denigrated the beautiful Rigi with his “lamentations”. Joseph Fassbind was the Rigi-Klösterli hotelier at the time and also a member of Schwyz Cantonal Council. He may even have prompted the cantonal chemist to write the article published in the NZZ, which surprisingly made no reference at all to his own hotel.

Albert Heim mentioned this in his article – and was promptly sued by Joseph Fassbind for reputational damage. Heim’s article was a bombshell and caused maximum damage according to the libel action. Bookings had fallen massively, claimed Fassbind. Heim contested the allegation that his article had been damaging. The fall in bookings in 1914 had instead been triggered by the outbreak of the First World War, he claimed.

The water on the Rigi was thus tested every year, increasingly so in 1914, “due to the controversial newspaper coverage”. Two hoteliers purchased filter systems, the one in the Kulm hotel was again out of order during the check in August, the hotel was closed in any case due to the war. It rained during the inspections and coli bacteria were found in various sources. It didn’t improve during the ensuing years either.

On 3 October 1917, Zurich District Court rejected Fassbind’s claim. It was proven that the water he used came from a highly questionable source. Fassbind appealed to the Cantonal Supreme Court and subsequently came to an agreement with Albert Heim. The case was dropped, and Heim provided an explanation, whereby the water supply in Klösterli had been sanitised “as far as humanly possible”.

The First World War brought all the Rigi hotels to the brink of ruin. The many tourists from abroad disappeared almost overnight. Most businesses did not survive, and the buildings were knocked down, with some burning to the ground. The last known case of typhoid was in 1932, on the Lucerne side of the Rigi, in Kaltbad. This led to a further improvement in the drinking water supply.

Adi Kälin is a historian and freelance journalist.

The original article on the Swiss National Museum’s websiteExternal link

One person consumes 4.8 megawatt hours of electricity

On average, the Swiss consume 4.8 megawatt hours of electricity per year. According to Velobiz.de, this is roughly equivalent to the amount generated by all 176 cyclists in the Tour de France during the entire race.

+ Get the most important news from Switzerland in your inbox

The estimate was calculated by the Energy Switzerland online platform. In an international comparison, this puts Switzerland in the middle of the field among other industrialised countries.

In the USA, for example, consumption is around 7.7 megawatt hours, as the “Our World in Data” platform shows. In Italy, on the other hand, it is only 2.9 megawatt hours.

Translated from German by DeepL/ds

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch

Outgoing ICRC chief in Ukraine defends neutrality amid war

Swiss national Jürg Eglin is ending his two-and-a-half-year term as head of the International Committee of the Red Cross (ICRC) in Ukraine. Looking back, he admitted that neutrality is hard to explain in wartime but said acceptance of the ICRC has grown.

“When I started here two and a half years ago, I came in the hope that this war would soon come to an end. Now, in August 2025, we are still in the middle of the fighting,” Eglin told Swiss public broadcaster SRF.

He said the ICRC’s work is now more effective. Relations with the public and Ukrainian authorities have also improved.

In the first years of Russia’s full-scale invasion, the ICRC was heavily criticised. “Our principles are hard to understand amid the chaos of war,” Eglin said in reference to the ICRC core tenets of neutrality and impartiality.

+ Get the most important news from Switzerland in your inbox

Over time, he argued, the benefits of those principles became clearer. The ICRC could deliver aid others could not, working under international humanitarian law and the Geneva Conventions. “As a large organisation, we are very visible,” he said. “We can do things that others cannot.”

“At the end of the day, it becomes clear that these principles do have value,” he added. “We have brought a lot of relief to families of fallen soldiers and to relatives of prisoners of war.”

Some complaints were justified, he conceded. “The criticism that not enough is being done is partly justified,” he said. But he stressed that many barriers were systemic and outside the ICRC’s control. On accusations of indifference, he said: “They know that we have empathy and show it. I reject the criticism of a lack of empathy.”

Eglin said the ICRC remains highly visible, but much of its work must be done discreetly. That discretion, he noted, is essential for access to authorities, security forces, and across front lines.

SRF-Swissinfo/ds

Green party leader criticises government’s neo-liberal policy

Switzerland’s Green Party meeting opened on Saturday morning in Vicques, canton Jura, with a speech by party president Lisa Mazzone. Mazzone took particular aim at the government’s policy towards the United States.

Mazzone criticised the neo-liberal policies of the Swiss government, supported by the “bourgeois majority”, who “systematically position themselves on the wrong side of history”, she said, referring to Switzerland’s policies towards China, the United States and Israel.

+ Get the most important news from Switzerland in your inbox

In her view, the 39% tariffs imposed on Switzerland by the United States were a direct consequence of the economic model promoted by the political right. She also attacked Donald Trump, “who is leading the world into a crisis of globalisation”.

“When a crisis breaks out, it’s an opportunity to transform our system to make us more resilient,” she added. According to Mazzone, Switzerland must invest in public services and care work, as well as in the energy transition, while developing global economic exchanges “that strengthen the countries of the South rather than plundering them”.

Better prevention of feminicide

The Geneva native also said she was “ashamed” of the Federal Council, “incapable until now of clearly condemning Israeli war crimes” in the Gaza Strip. “The threshold of horror was crossed a long time ago,” she said.

The politician also called on the authorities to take steps to combat feminicide. “Switzerland must finally make women’s safety a priority”, she declared.

She proposed, among other measures, that women who are victims of violence should be able to find help quickly, protective measures and a place to take refuge with their children. The police and judiciary must have specialised departments, while “firearms, military or otherwise, have no place in the home”, the President pleaded.

Translated from French by DeepL/ds

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch

Picture of the week

Tourists pose for a photo on a bridge over the River Limmat in Zurich’s old town on Tuesday. (Keystone/Michael Buholzer)