Swiss Offer Trump Sweetener on Gold to Get Better Tariff Deal

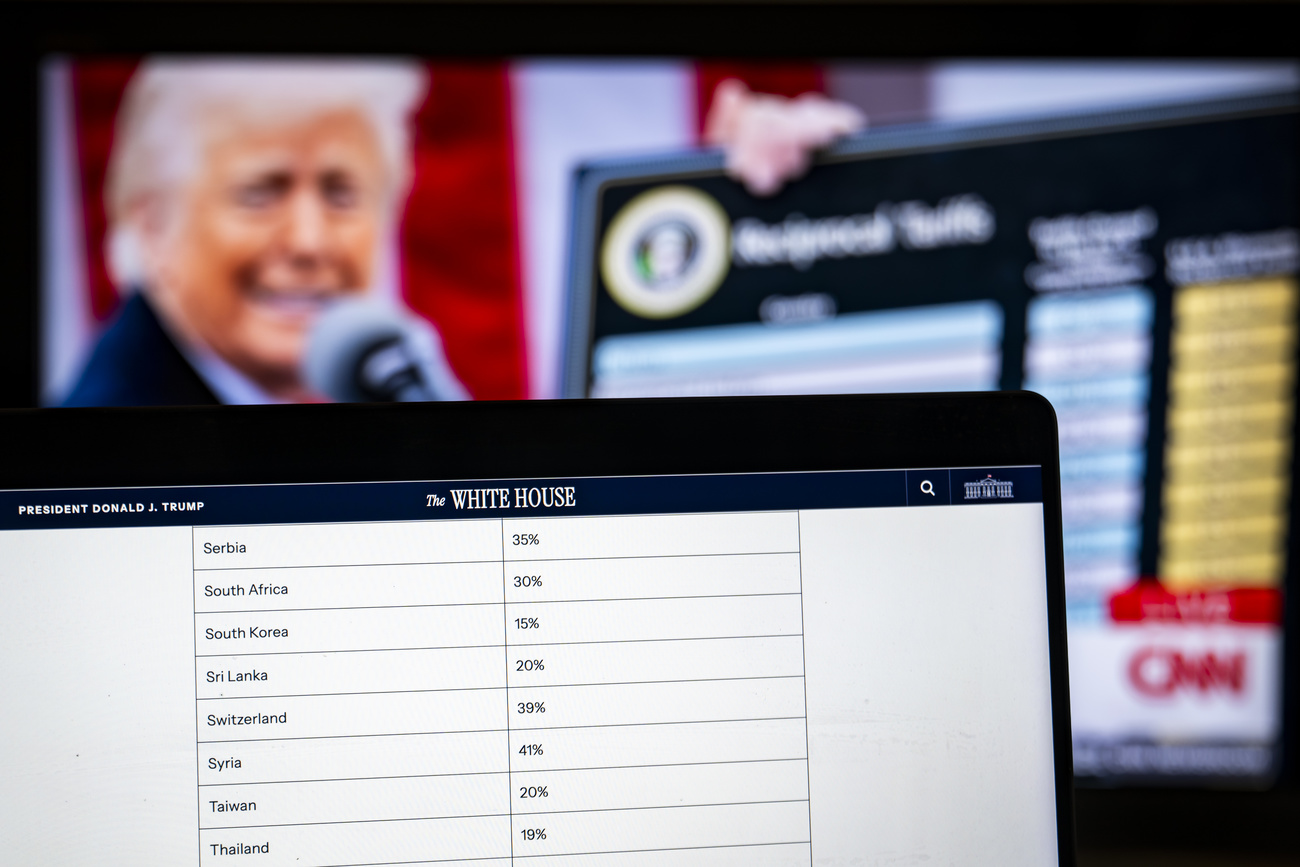

(Bloomberg) — Switzerland has offered to invest in the US gold-refining industry, as part of its efforts to persuade the Trump administration to lower the 39% import tariff imposed last month.

The levy — the highest of any developed nation — has already hit exports to America and curbed growth forecasts. Now Swiss officials are weighing concessions in sectors spanning energy to agriculture, after President Karin Keller-Sutter’s earlier attempt to stand up to Donald Trump backfired.

The proposal made to US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer would see Swiss refiners move their lowest-margin business to the US, according to people familiar with the talks. That includes melting down the gold bars traded in London and recasting them into the smaller bars favored in New York, the people said, asking not to be identified because the negotiations are private.

The US Treasury did not respond to a request for comment.

The Swiss government declined to comment on the gold industry, but said it has “optimized its offer to the US in order to reach a swift agreement.”

“Diplomatic and political exchanges will continue with a view to achieving a quick reduction in additional tariffs,” the Swiss government said in a statement.

The spotlight fell on the world’s largest gold refining hub in the canton of Ticino as Switzerland reeled from Trump’s tariffs. The bullion trade with the US is typically fairly balanced, but that changed when a massive surplus blew up in the first quarter as fears that Trump would levy tariffs on gold opened a lucrative arbitrage opportunity for traders.

That trade distortion — with bullion accounting for more than two-thirds of Switzerland’s first-quarter surplus with the US — prompted criticism of the gold industry. Diverse voices from Swatch Group AG Chief Executive Officer Nick Hayek to Swiss Green Party President Lisa Mazzone called for gold shipments to be taxed, while government officials rushed to come up with sweeteners to persuade the White House lower the tariffs.

To some extent, the major Swiss gold refiners are an easy target for politicians — and they only employ 1,500 people. However, painting the gold refiners as the villains of Switzerland’s 2024 trade surplus — which Trump seemed to blame for the 39% tariff — doesn’t bear scrutiny. The US had a surplus of roughly $3.6 billion in gold with the Swiss last year.

Christoph Wild, president of the Swiss Association of Precious Metals Producers and Traders, said the need to route gold through Switzerland when moving it from the UK to the US is a market inefficiency that could be addressed by increasing American refining. That might be best achieved by expanding existing sites, though having sufficient US demand is key to the viability of such projects, he said.

“All our refinery members have mid-term to long-term plans to further invest in the US,” Wild said. In terms of the low margin business of recasting bars, Wild said he doesn’t know “if it’s possible to run that business in an economical way without having some subsidies from the Swiss government or the US government.”

At least one refiner is considering plans to accelerate investment in the US, according to a person familiar with the matter.

As Swiss refiners consider US investments, the Green Party’s Mazzone is calling for a 5% levy on the industry, which she says carries the risk of “dirty gold.” That would generate revenue to cushion the blow from Trump’s tariffs on the Swiss economy, she said.

“The industry carries a reputational risk but doesn’t bring a large net benefit to the economy,” Mazzone said in an interview. “If this sector costs so much to Switzerland, particularly right now because of the tariff dispute, then it should contribute more.”

Mazzone’s concerns echo Switzerland’s controversial history with the precious metal, which started with Swiss banks taking delivery of looted Nazi gold during World War II.

The refining industry itself took off when three Swiss banks created the Zurich Gold Pool in 1968. That turned the city into a major trading hub for bullion, with the banks investing in refineries to manage the flow of gold, much of it from apartheid South Africa, according to Professor Mark Pieth, author of the 2019 book Gold Laundering – The Dirty Secrets of The Gold Trade and How to Clean Up.

The ownership of the refining industry has since evolved, but margins remain thin. While spot prices surged to a record above $3,800 an ounce on Monday, refiners still only pocket a couple of dollars of that when recasting a bar.

As Swiss politicians seek ways to appease Trump, Swatch’s Hayek, a powerful voice in the luxury-goods industry, last month suggested Bern should consider taxing gold bars exported from Switzerland to the US at 39%. That came after the US president clarified that US imports of gold bars will not be subject to tariffs.

The refining industry has pushed back, pointing out that the US could easily procure gold bars from elsewhere. And given the low margin-nature of the gold refining business, export levies would be all but certain to end the trade.

Nobody would pay a premium of even 1% for gold when you could buy it at the market price, making a tax a non-starter, said Wild, head of the Swiss refiners’ association.

For the largest Swiss refiner Valcambi SA, which has no presence in the US, there is no commercial argument for building a new American refinery, partly because of low margins but also because the market is saturated, said Chief Operating Officer Simone Knobloch. In an industry where profitability is related to scale, the company processes up to 2,000 tons of precious metals a year at its site in Balerna on the border with Italy.

“If I look at the business case, it doesn’t make sense,” said Knobloch.

Read More on the Swiss-US Trade Spat:

Switzerland Will Face Trade Fallout Next Year Despite Resilience

Swiss Exports to US Collapsed in First Month of 39% Tariff

From Hope to Despair: How Switzerland’s Tariff Drama Played Out

–With assistance from Jack Ryan and Daniel Flatley.

©2025 Bloomberg L.P.