Asian Shares Advance as China Reopens, Oil Dips: Markets Wrap

(Bloomberg) — Asian shares rose for the first time in three days as a renewed wave of buying in companies linked to artificial intelligence lifted equities in Japan. Gold and oil edged lower after a peace deal in the Middle East.

MSCI’s regional stock gauge rose 0.3% with tech firms such as SoftBank Group Corp. among the winners. The Nikkei index extended its recent run of gains while Hong Kong fluctuated, with HSBC Holdings Plc falling after plans to take Hang Seng Bank Ltd. private. Shares in mainland China jumped 1.6% as markets reopened after the Golden Week break.

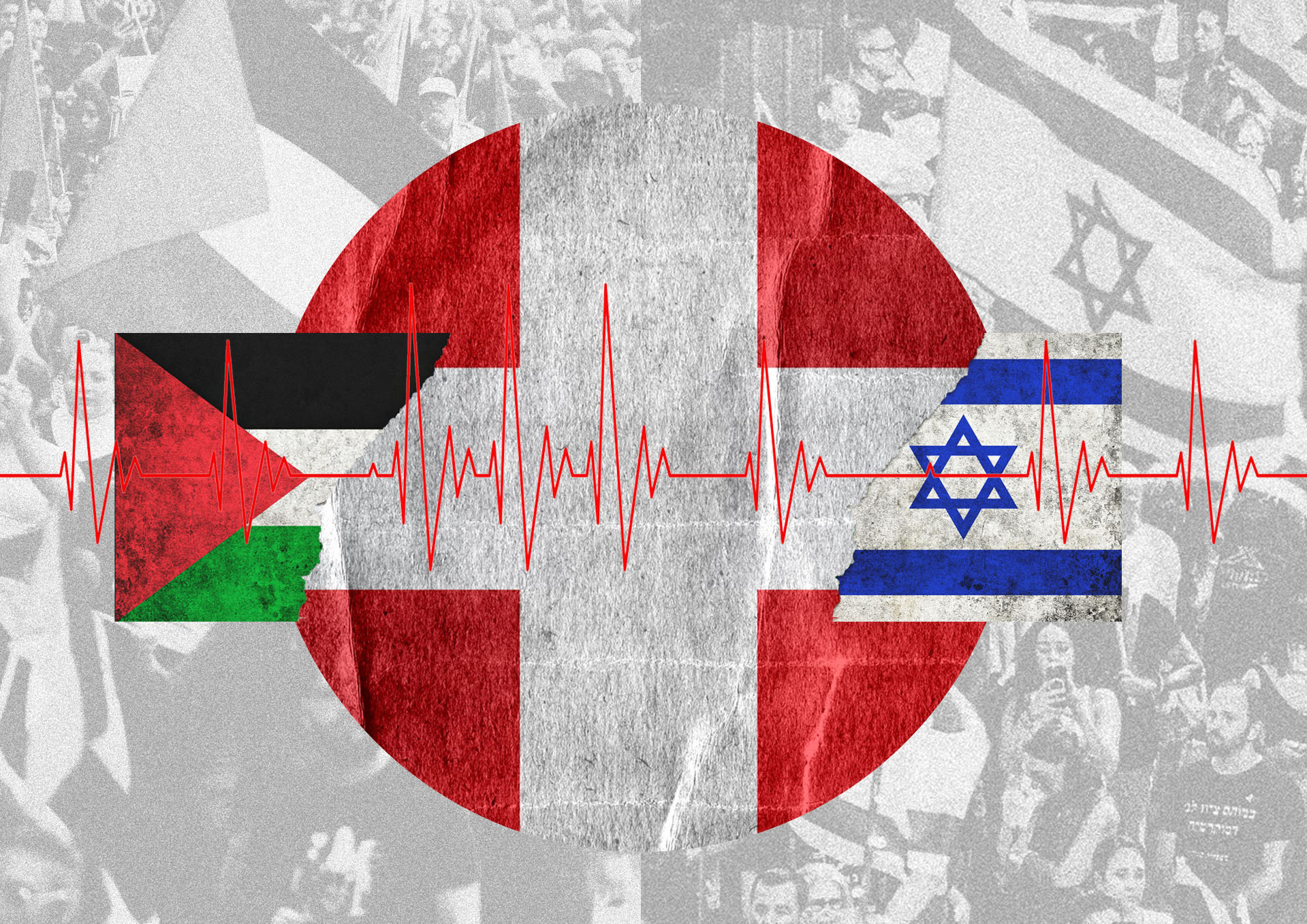

Gold fell, but still traded above $4,000, as traders took some profit after a scorching rally and on reduced demand for haven assets. Oil also retreated after President Donald Trump said Israel and Hamas have both signed off on the first phase of a peace plan.

Gains in Asia followed US benchmarks closing at yet another record as traders looked past worries of a potential bubble in high-profile tech names and instead focus on corporate resilience and the restart of Federal Reserve interest-rate cuts. The optimism that’s powered equities since their April slump now faces a key test as earnings season begins.

“Given how lopsided the expectations have become, given how lofty the valuations have become, I think investors are laser focused on earnings,” Aidan Yao, a strategist at Amundi Investment Institute, said in a Bloomberg TV interview. “They are trying to see if earnings are really catching up into the valuations.”

In other corners of the market, the yen edged up after touching its weakest level against the dollar since February, raising speculation about official intervention. A Bloomberg gauge of US currency slipped after three days of gains.

Attention in Asia is firmly on China’s markets as trading resumed after the Golden Week break. Investors are weighing whether renewed enthusiasm for artificial intelligence can outweigh signs of soft consumer spending.

“There’s been a bunch of news around OpenAI that’s positive on AI sentiment that happened during the China holiday that isn’t reflected in share prices,” said Xin-Yao Ng, a fund manager at Aberdeen Investments. “There’ll be some catching up to do.”

Holiday data showed households remained cautious. Spending was restrained, with cheaper road trips replacing flights and box office sales missing expectations.

The weakness in consumption comes alongside an artificial intelligence frenzy that sent global tech stocks to fresh highs while China was shut, fueled by firms touting OpenAI ties.

The CSI 300 Index climbed for five straight months through September, its longest winning streak since 2017, led by enthusiasm over chip stocks after DeepSeek’s unveiling of an updated AI model and Huawei Technologies Co.’s plan to double output of its top AI chips. The gauge is up 18% this year.

In geopolitical news, Trump said both Israel and Hamas had agreed to terms for the release of all hostages held by the Palestinian militant group in Gaza, a major breakthrough in the US-brokered negotiations to end their two-year war.

China will tighten curbs on rare earths to include items manufactured abroad, expanding restrictions that have been a source of tension between Beijing and Washington.

With a slim economic calendar amid the US government shutdown, investors on Wednesday scoured the minutes of the latest Fed meeting, with officials showing a willingness to lower rates further this year, but many expressing caution driven by concerns over inflation.

The Fed is clearly not on a preset path and data dependency is now more necessary than before, especially as officials attempt to calibrate between conflicting goals, said Luis Alvarado at Wells Fargo Investment Institute.

“We still expect two more quarter-point rate cuts by the end of this year, and two more next year,” he noted.

Corporate News:

HSBC Holdings Plc plans to take Hang Seng Bank Ltd. private in a deal that values the lender at $37 billion, ramping up its exposure to Hong Kong as the financial hub attempts to bounce back from years of economic turbulence. BlackRock Inc. has requested to pull some money it invested in a Jefferies Financial Group Inc. fund with large exposure to the trade debt of bankrupt auto-parts supplier First Brands Group Inc. Alibaba Group Holding Ltd. said it has established an in-house team for robotics, joining major global firms in a race to build AI-powered physical products. SoftBank Group Corp.’s stock surged as much as 13% to a fresh intraday high as its plan to buy ABB Ltd.’s robotics arm boosted expectations for profit growth from artificial intelligence.

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 11:50 a.m. Tokyo time Japan’s Topix rose 0.3% Australia’s S&P/ASX 200 rose 0.2% Hong Kong’s Hang Seng was little changed The Shanghai Composite rose 1.1% Euro Stoxx 50 futures fell 0.2% Currencies

The Bloomberg Dollar Spot Index fell 0.2% The euro rose 0.2% to $1.1647 The Japanese yen rose 0.2% to 152.46 per dollar The offshore yuan rose 0.3% to 7.1312 per dollar Cryptocurrencies

Bitcoin fell 0.9% to $121,741.48 Ether fell 1.7% to $4,430.3 Bonds

The yield on 10-year Treasuries was little changed at 4.11% Japan’s 10-year yield declined one basis point to 1.685% Australia’s 10-year yield declined five basis points to 4.31% Commodities

West Texas Intermediate crude fell 0.7% to $62.09 a barrel Spot gold fell 0.6% to $4,018.12 an ounce This story was produced with the assistance of Bloomberg Automation.

–With assistance from Abhishek Vishnoi, Sangmi Cha and Joanne Wong.

©2025 Bloomberg L.P.