Blockchain trading venue challenges stock exchange dominance

Digital assets bank Sygnum says it will open up new sources of funding for small companies by creating and trading shares on the blockchain. Its new trading facility will also target venture capital, real estate and the arts and collectibles market.

The goal is to translate traditional assets into blockchain-compatible digital ‘tokens’ that can speed up trading and make it more affordable to participate in the financial markets. Such trading venues offer an alternative to established stock exchanges.

On Thursday, Sygnum unveiled its ‘Desygnate’ token issuance service and the ‘SygnEx’ trading exchange. Sygnum’s virtual DCHF currency, backed by the Swiss franc, will be employed for instant payments on trades.

The bank has attracted sizeable Italian asset management company Azimut Group and Japanese venture capital group SBI Ven Capital as initial clients. Switzerland’s Fine Wine Capital, which invests in collectible wines, and property investor ImmoZins are among the other clients that plan to issue and trade tokens on the platform.

Swiss electric car manufacturer BAK Motors will also use the platform to raise money to fund projects.

Azimut aims to leverage blockchain to help small and medium sized enterprises raise funds for growth. Sygnum believes tokenisation will solve “many of the challenges start-ups and SMEs face when raising capital in traditional capital markets: high costs, extensive listing requirements, and resource-intensive processes.”

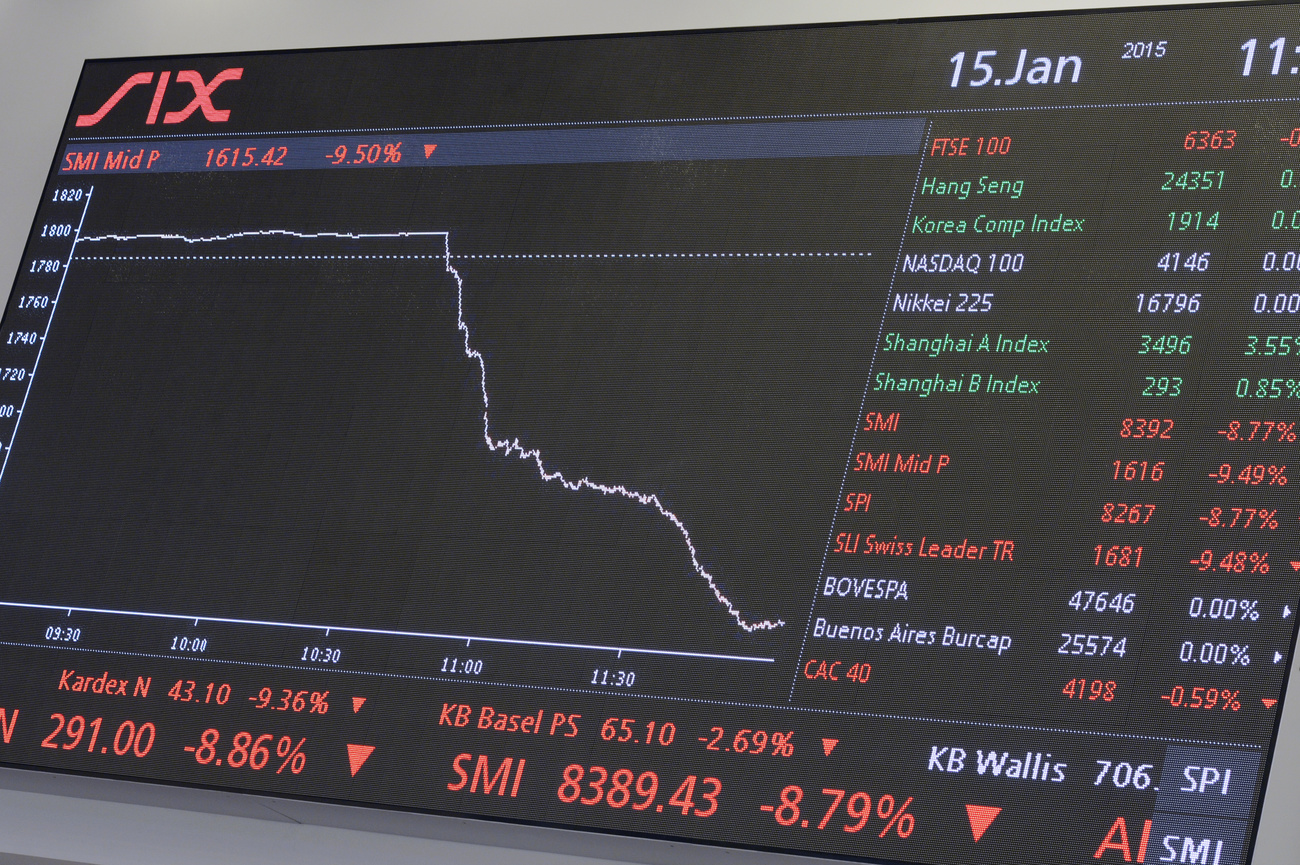

In a 2019 reportExternal link, the Swiss stock exchange operator SIX Group calculated that under traditional processes, financial intermediaries could charge up to CHF500,000 ($551,120) for every CHF100 million of debt that companies issue in the financial markets.

The Swiss financial regulator granted Sygnum a license in September to run its blockchain trading facility. Other projects in Switzerland, including SIX Group’s proposed SDX digital exchange and blockchain financial services company Lykke, are queuing up for licenses to operate.

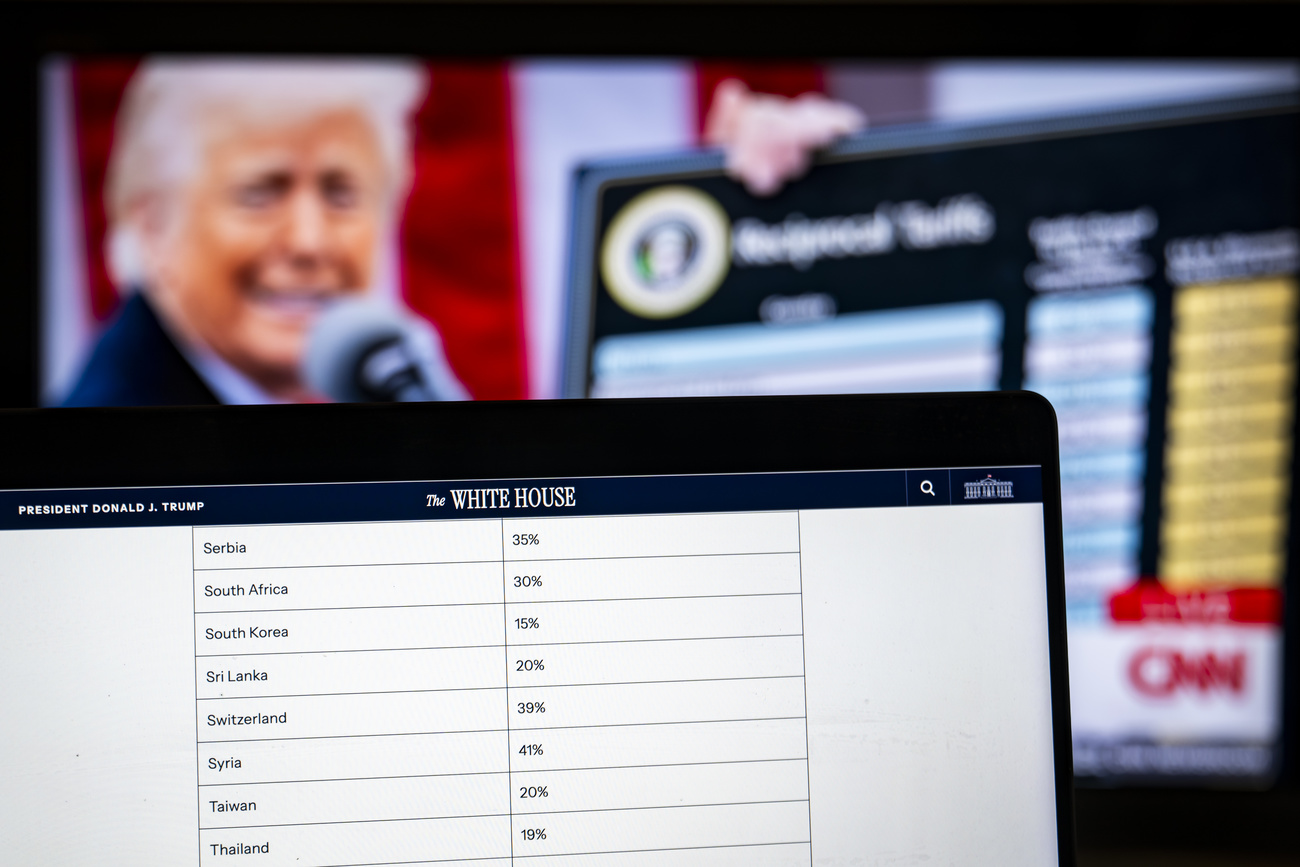

Swiss lawmakers recently passed a wide-ranging upgrade of the country’s financial and corporate laws to incorporate blockchain and a new breed of digital assets.

Other major stock exchanges around the world are exploring ways to integrate blockchain. And leaked documents recently hinted that Singapore’s DBS bank is also planning a digital assets trading platform.

It has been possible for some time to issue blockchain compatible assets. Examples include tokenised shares by Lykke and budding blockchain bank Mt Pelerin. Earlier this year, Brickmark converted a building on Zurich’s exclusive Bahnhofstrasse into a blockchain-powered investment.

But the financial innovation has been slowed by regulatory demands and hindered by a lack of reliable trading venues. Sygnum’s co-founder, Mathias Imbach, hopes the much-hyped merger of traditional and blockchain finance will finally become reality.

“After a lot of talk by the industry, all the pieces are finally coming together to truly unleash the true potential of tokenisation,” he told swissinfo.ch. “The key is to embed it into the regulated banking system, which takes care of the legal and operational processes for issuers and investors.”

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.