Q1 check-up: how is the Swiss economy doing?

A banking crisis, inflation and higher interest rates: the Swiss economy is confronted with numerous challenges at the start of 2023. Every three months SWI swissinfo.ch business journalists propose a sector-by-sector overview of key developments.

Growth forecast revised upwards

In mid-March the State Secretariat for Economic Affairs (SECO) raised its annual growth forecast to 1.1%, compared with 1% for the previous assessment in mid-December 2022. Next year government economists are expecting growth of 1.5%, compared with 1.6% previously expected.

This is partly due to China’s strong recovery and an easing of the energy situation in Europe over recent months, SECO said. At the same time, underlying inflation in major industrialised countries has been less favourable than expected, which should lead to more restrictive monetary policies and slow global demand.

As far as inflation is concerned, the forecast made at the end of March by the Swiss National Bank (SNB), which raised its key rate by 50 basis points to 1.5% on March 23, remains relatively high. Inflation is expected to hit 2.6% in 2023, and 2% in 2024 and 2025.

More

Looking ahead: Switzerland’s economic outlook for 2023

Banking sector in shock amid Credit Suisse turmoil

The first ever fusion of “too big to fail” banks is fraught with danger and will require deft handling to avoid more panic, which could spread to the global markets.

Switzerland’s reputation as a reliable, conservative financial centre has taken a battering. Shareholders and bondholders were shoved aside by the government to push the deal through.

The decision by the financial regulator to write off CHF16 billion ($17.45 billion) of so-called AT1 bonds has caused confusion and possible lawsuits.

Parliament has the task of finding out what went wrong and determining whether the authorities were asleep at the wheel before the crisis unfolded.

Various political parties want additional banking regulations or the Swiss operations of Credit Suisse to be spun off into a separate entity.

More

How the Swiss ‘trinity’ forced UBS to save Credit Suisse

Nestlé slumps, commodity traders soar

Inflation has hit companies in the food-and-beverage sector particularly hard. Nestlé saw net profits tumble by 45% in 2022 – also due to the sale of shares of the cosmetics brand L’Oréal – despite strong growth, especially in emerging markets. Chief Executive Mark Schneider said in February that the world’s largest food company planned to raise prices again this year to offset higher costs.

One group that is not complaining about high prices is Swiss commodity traders, including Zug-based Glencore, which saw its pre-tax profit jump 60% to more than $34 billion on the back of soaring oil and coal prices. Geneva-based Trafigura, meanwhile, saw net profit soar from $3.1 billion in 2021 to $7 billion in 2022. As commodity markets return to normal levels of volatility, profitability is expected to be lower in 2023.

The sector is, however, under more pressure from Swiss authorities who said in March that they want more transparency and oversight over the sector and its role in the trade of oil and raw materials from Russia.

More

Why Western companies still can’t quit Russia

Tourism sector gets off to a flying start

Switzerland Tourism, the national tourism body, has given a positive assessment of the 2022/2023 winter season. Final figures for overnight stays for the season are not yet available, but November, December and January saw numerous Swiss guests, with an increase of around 15% in overnight stays and a return to normal for foreign guests comparable to the same period in 2019.

The return of visitors from southeast Asia was particularly rapid in 2022, with a level close to 2019 (3.2% fewer). There were 5% fewer travellers from the Gulf states and 8.1% fewer from North America. Switzerland Tourism expects a boom in tourists from countries such as Indonesia, Malaysia, Singapore and Thailand in the coming years.

The next few months should also see the return of tourists from China, Japan, South Korea and India. “It’s likely that Chinese tourists will not return to Switzerland until this summer. Currently, bottlenecks in air transport capacity, Schengen visas, accommodation in Switzerland and high prices, especially for flights, are still holding back the flow of travellers,” said Switzerland Tourism spokesperson Véronique Kanel.

More

Fans of Netflix series disrupt peaceful Swiss village

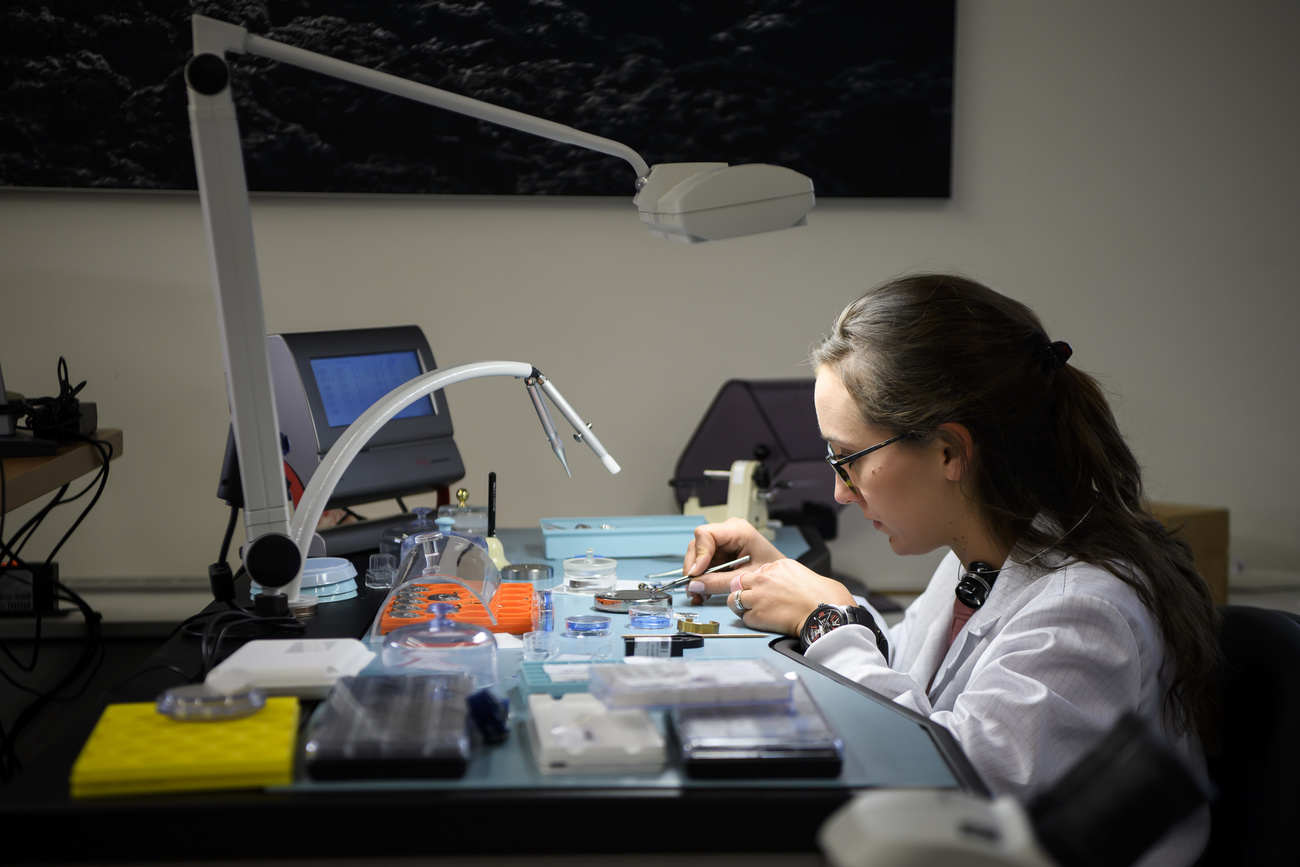

5) Watchmakers continue to ride wave of success

Business is booming for Swiss watchmakers. After a record-breaking 2022, watch exports continued to grow at the beginning of this year. They jumped by 12.8% to CHF3.8 billion in the first two months of 2023 compared with the same period last year, according to the latest figures from the Federation of the Swiss Watch Industry.

All the main markets saw increases. The United States (+20%) remains the leading market for the sale of Swiss timepieces. China, one of the last countries to have lifted Covid-19 health restrictions, recorded positive figures again in February and could once again become one of the main drivers of growth in the coming months.

Confirming last year’s trend, exports of entry-level timepieces – under CHF500 – rose again by over 10% at the start of the year. This phenomenon is partly due to the success of the Moonswatch, a Swatch series based on the design of the Omega Speedmaster. According to Nick Hayek, the head of the Swatch Group, more than a million units have already been sold since its launch in March 2022. Expensive high-end watches nonetheless remain the industry’s cash cow: over three-quarters of Swiss watch exports can be attributed to watches costing more than CHF7,500.

More

Surfing the American wave: Swiss watch exports reach new heights

Swiss pharma hunts for new blockbuster drugs

In February Novartis announced a 2% decline in net sales in 2022, mainly due to negative currency effects (+4% at constant exchange rates). Consequently, Novartis CEO Vas Narasimhan saw his pay slashed by 25% to CHF8.5 million. The Basel-based pharma giant is still planning to spin off its Sandoz generics business, which will result in the loss of 8,000 jobs globally, including 1,400 in Switzerland.

Roche’s new CEO Thomas Schinecker used his first day on the job in mid-March to announce big investments in digital technologies and research and development. He said that no job cuts were expected this year.

As the Covid-19 pandemic takes a backseat, the Swiss pharmaceutical industry is focused on new, so-called innovative medicines largely in cancer and rare diseases. With some major blockbuster drugs nearing patent expiry, both Novartis and Roche are pouring money into new drug launches and reinvigorating their research pipelines.

More

Why Switzerland is running out of pharmaceuticals

Edited by Virginie Mangin

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.