Stocks Extend September Rally as Gold Tops $3,800: Markets Wrap

(Bloomberg) — Stocks rose at the start of a week that will be dominated by a series of labor market reports, with traders betting the data will reinforce expectations for US interest rate cuts. Gold set a fresh record.

Futures for the S&P 500 climbed 0.5%, keeping the US benchmark on track for its best September since at least 2013. Europe’s Stoxx 600 rose 0.3%. A gauge for Asian stocks advanced following gains of 1.9% in Hong Kong.

Listen to the Stock Movers podcast on Apple, Spotify or anywhere you listen.

A Bloomberg gauge of the dollar headed for a second day of declines. Treasuries rose across the curve, with the 10-year yield falling three basis points to 4.14%. Gold surged past $3,800 an ounce. Oil fell as expectations that OPEC+ will hike production again in November exacerbated concerns about a glut.

A busy week of data releases will culminate in Friday’s nonfarm payrolls report, arriving as the Federal Reserve leans toward supporting the jobs market. In the mix is the risk of a US government shutdown amid an impasse in Congress that could delay some releases.

The momentum in markets is “driven by a Goldilocks environment of optimistic growth prospects alongside expectations of a more dovish Fed,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “There might be some adverse effects if the shutdown were to prevail for a longer period, which is not our base case.”

Friday’s payrolls report is expected to show that the US economy added 50,000 jobs in September, in line with the average from the past three months. The jobless rate is projected to hold steady at 4.3%.

Before then, Tuesday’s JOLTS report is expected to show a decline in job openings, while Wednesday’s data on company hiring is likely to confirm a further slowdown. Fed policymakers including Christopher Waller, Alberto Musalem and Raphael Bostic are due to speak Monday.

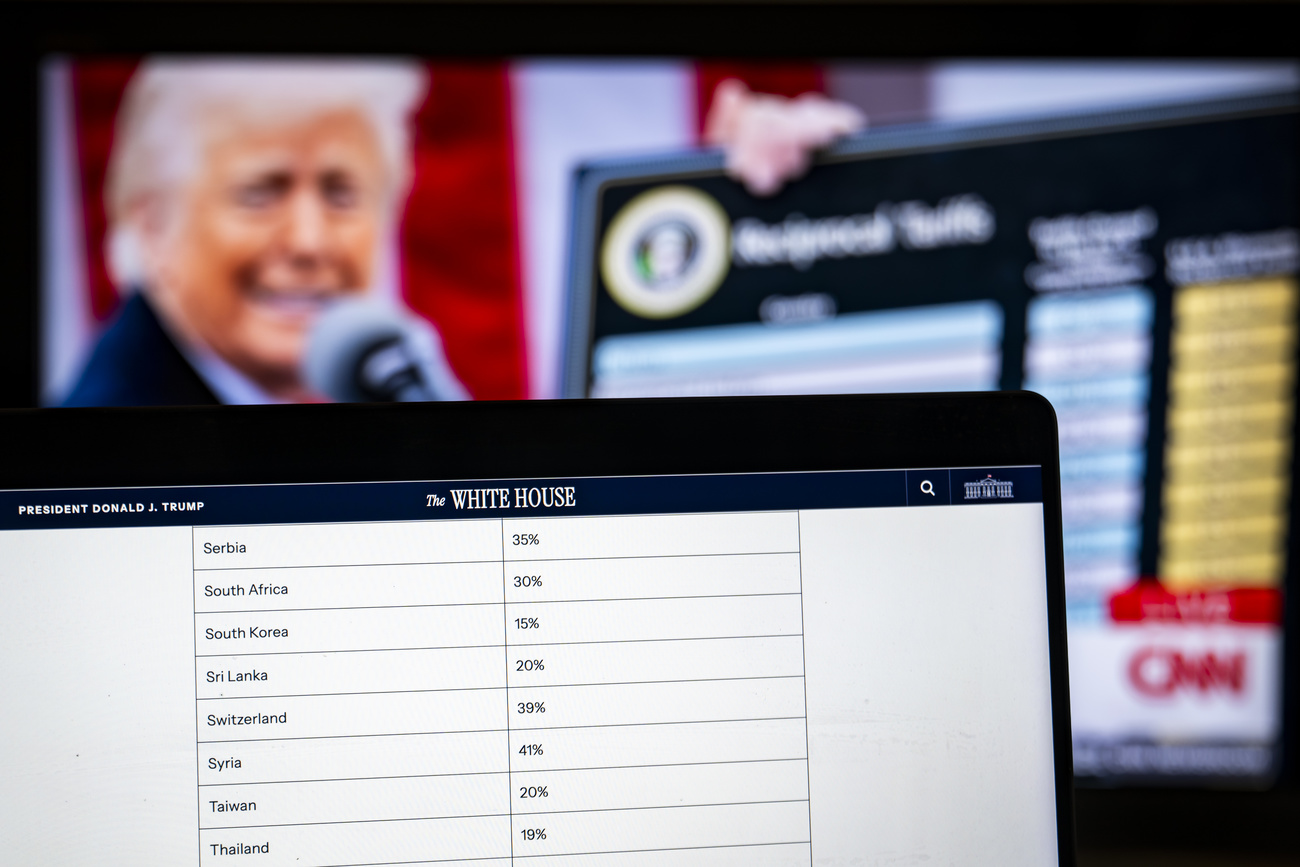

Top congressional leaders will meet with President Donald Trump at the White House a day before federal funding would expire if the two parties can’t agree on a short-term spending bill. The bill would only fund the government until mid-November and must pass before Oct. 1.

Strategists say the recent negative revisions and downtrend in jobs numbers will raise the stakes for Friday’s release.

“We could be set for some notable volatility around these prints going forward as the breakeven payroll rate now seems to be around or under 50,000 a month,” wrote Jim Reid, global head of macro research and thematic strategy at Deutsche Bank AG. “We are not really conditioned to negative prints being within that margin of error, so reactions to such prints may be not rational.”

Corporate News:

Alarm company Verisure Plc is targeting a market capitalization of as much as €13.9 billion ($16.3 billion) in an initial public offering in Stockholm that is set to be Europe’s biggest in three years. AstraZeneca Plc plans to list shares on the New York Stock Exchange to attract more investors but keep its London trading and UK headquarters. Nidec Corp. shares slid after the company discovered more suspected cases of improper bookkeeping, heightening fears the world’s biggest maker of mini motors may come under regulatory scrutiny for a potential delisting. Chinese precious metals and rare earth stocks gained after the government announced plans to push for breakthroughs in the materials industry in order to boost supply and support new technology and electric vehicle chains. Jaguar Land Rover has sought £2 billion ($2.7 billion) in emergency funding from global banks as the carmaker tries to ease the financial strain of a cyberattack that forced it to halt production, the Economic Times reported. Shares of Alibaba Group Holding Ltd. rallied as analysts touted improving growth prospects for the company’s cloud and artificial intelligence businesses. Auto-parts supplier First Brands Group Holdings filed for Chapter 11 in Texas, listing liabilities of between $10 billion and $50 billion, according to a court document. Denmark’s Genmab A/S agreed to acquire Merus NV, a Dutch drugmaker that’s developing a treatment for cancer of the head and neck, for about $8 billion. Sony Financial Group Inc. surged in its Tokyo debut on Monday after a rare spinoff-listing by Sony Group Corp., which is sharpening its focus on its entertainment and image sensor businesses. Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.3% as of 9:31 a.m. London time S&P 500 futures rose 0.5% Nasdaq 100 futures rose 0.6% Futures on the Dow Jones Industrial Average rose 0.3% The MSCI Asia Pacific Index rose 0.5% The MSCI Emerging Markets Index rose 1.1% Currencies

The Bloomberg Dollar Spot Index fell 0.2% The euro rose 0.1% to $1.1716 The Japanese yen rose 0.6% to 148.57 per dollar The offshore yuan rose 0.3% to 7.1223 per dollar The British pound rose 0.3% to $1.3439 Cryptocurrencies

Bitcoin rose 1.2% to $112,184.59 Ether rose 1.7% to $4,121.23 Bonds

The yield on 10-year Treasuries declined three basis points to 4.14% Germany’s 10-year yield declined three basis points to 2.72% Britain’s 10-year yield declined three basis points to 4.71% Commodities

Brent crude fell 1.2% to $69.31 a barrel Spot gold rose 1.4% to $3,812.07 an ounce This story was produced with the assistance of Bloomberg Automation.

–With assistance from Anand Krishnamoorthy.

©2025 Bloomberg L.P.