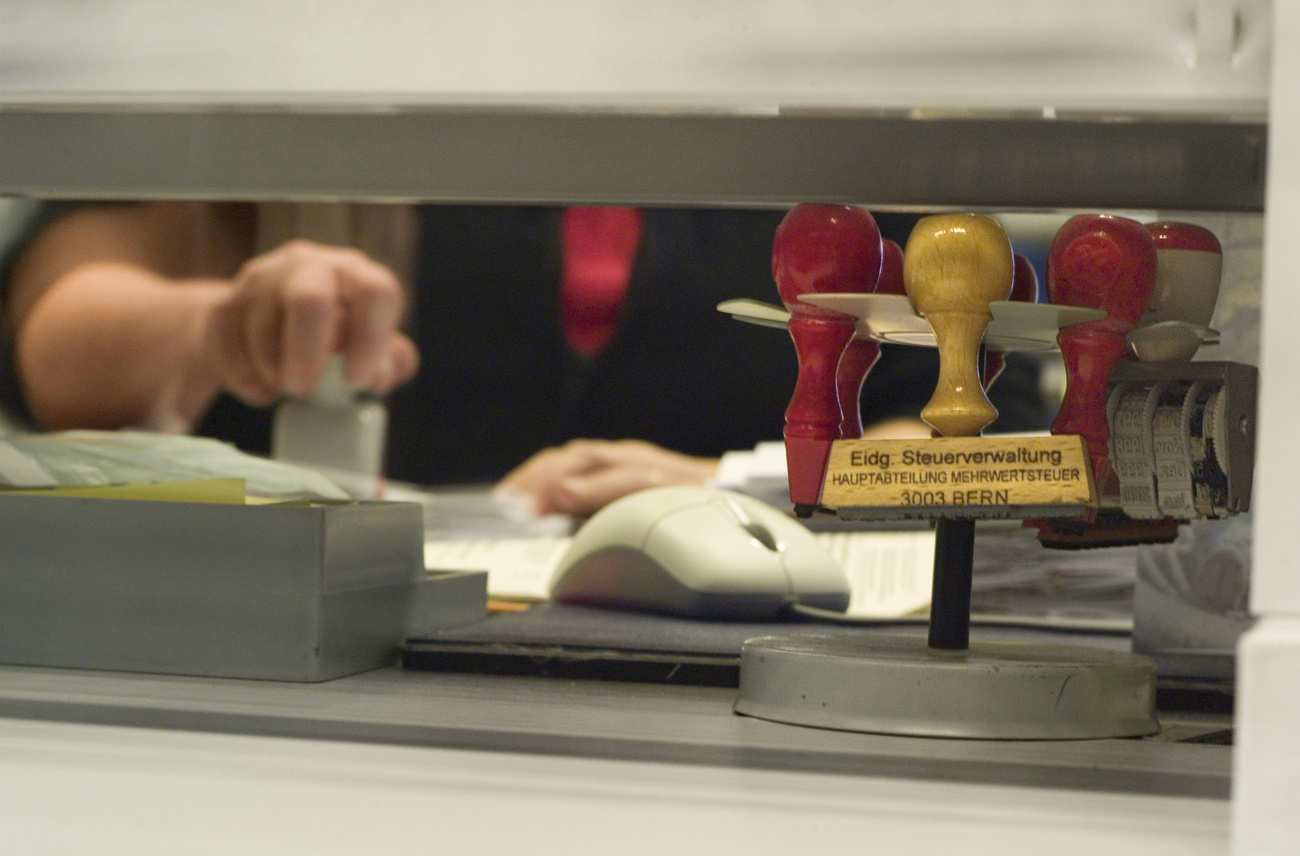

‘Unnecessary’ corporate tax breaks cost Switzerland billions

Controversial tax breaks used in the past to attract foreign firms to Switzerland cost the federal government some CHF12 billion ($12.7 billion) in lost revenue and were not always necessary, a report has concluded.

The Federal Audit Office analysed tax breaks granted to multinational firms moving to Switzerland over the past 20 years and found that, in the first ten years especially, such preferential measures were frequently used.

The report said 30-90 firms received special tax deals every year. It also concluded that not all the deals were “absolutely essential” to attract the companies.

“The results of the audit indicate that many of the projects that were examined would have been implemented without the tax relief,” Eveline Hügli of the Audit Office told Swiss public radio, SRF, on Tuesday. According to the report, around two-thirds of the new jobs would have been created in any case, with or without tax breaks.

Last year voters agreed to overhaul Switzerland’s corporate tax system to bring Switzerland in line with international tax rules. Tax breaks on foreign earnings of multinationals were ditched while baseline rates for all firms was lowered in a bid to prevent them fleeing to more attractive destinations.

Mixed assessment

The audit office thus had mixed views on the practice of offering tax relief for the first few years after a company relocates to Switzerland.

In general, the system was found to be “sustainable”, said Hügli, especially since 80% of newly created jobs continued to exist in the same location after the tax relief period expired.

Christoph Brutschin, a Basel City councillor and president of the Conference of Cantonal Economic Directors, added that such tax relief mechanisms are important instruments for attracting businesses to structurally weak areas of the country.

“This instrument can add value; I believe it should be kept in its current form,” he told SRF.

The report also showed that fewer tax breaks were granted over past ten years and that the focus had shifted towards more domestic development. Today, 80% of Swiss companies benefit from some kind of tax relief.

More

Switzerland votes ‘yes’ to overhaul corporate tax rules

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.