Picture of the week

Four Swiss politicians from various parties in their traditional costumes at the summer session of parliament on Thursday. (Keystone/Alessandro della Valle)

The Week in Switzerland

Dear Swiss Abroad,

Welcome to our selection of some of the biggest – and most colourful – stories in Switzerland over the past seven days.

If only everything was as harmonious as the “peace raclette” held between a Swiss village and a French village on Sunday. Instead, this week saw arguments on how – and whether – to rebuild the landslide-hit village of Blatten, heavy criticism of the Swiss foreign minister for his silence on Gaza, allegations that a government cybersecurity team leaked information to Russia, and a motion to ban government ministers from speaking English at international organisations.

The dust had barely settled on the Swiss village of Blatten, buried by a landslide on May 28, when questions started being asked about the cost of subsidising mountain communities. How much should be spent on protecting mountain regions? How much are the Alps worth to society?

“The rockfall in Blatten once again demonstrates the vulnerability of the Alpine region,” the NZZ am Sonntag wrote in an editorial. “Financial and burden-sharing for the mountain regions will reach their limits. The question of the proportionality of investments can’t be ignored for much longer.”

As the Alps crumble in the face of climate change, disasters such as Blatten – in which, miraculously, only one person is thought to have died – are going to raise more fundamental questions for Switzerland than the logistical removal of debris.

A few days before the Blatten landslide, the Tages-Anzeiger reported on a new protective wall for the village of Bondo in southeastern Switzerland, hit by a landslide in 2017 in which eight people died. The paper wondered whether the CHF53 million ($65 million) wall could be justified for a village of 200 people.

Should Blatten even be rebuilt? On Wednesday the Tages-Anzeiger asked one journalist to argue yes (“a Switzerland that abandons its mountain villages is abandoning itself”) and one to argue no. “A strategic withdrawal from high-risk areas is responsible,” the latter wrote. “We have to give some places back to nature. This is not a surrender. It is an act of respect towards forces that we cannot control.” Reader responses were predictably polarised.

National identity, solidarity, cohesion: the consequences of the landslide on May 28 will be felt far beyond Blatten.

Foreign Minister Ignazio Cassis has probably had easier weeks. In response to growing criticism of Swiss silence on the Israeli-Palestinian conflict – including from within the foreign ministry – Cassis on Tuesday admitted that Israel is failing in its obligations by hindering humanitarian aid to Gaza.

But in interviews with Swiss public broadcasters RTS and RSI he refused to join international criticism of the Israeli government, saying the Palestinian militant group Hamas was also responsible for the current situation.

His comments did little to calm his critics. “Ignazio Cassis finally speaks, and it’s worse than silence” was the headline of an editorial in Le Temps. “His words were at odds with those of most of the other foreign ministers: no clear denunciation of the Israeli army’s actions, no empathy for all the Palestinian victims.”

Cassis, the paper said, was “completely blinded by his dogmatism” and that “by sticking to his own vision of neutrality”, he was forgetting Switzerland’s humanitarian tradition. Le Temps concluded it was now up to the government and Swiss President Karin Keller-Sutter “to regain the upper hand, to reiterate Switzerland’s values and firmly denounce the horrors suffered by the people of Gaza. Lives are at stake, and so is Switzerland’s image in the world”.

Employees of the Federal Intelligence Service (FIS) have been cooperating with Russian contacts for years, according to research by SRF Investigativ published on Wednesday.

Highly sensitive data allegedly ended up in the hands of the Russian intelligence services via the Russian cybersecurity firm Kaspersky. The FIS told SRF Investigativ that it “does not comment on secret reports to the media” but it had “filed a criminal complaint against persons unknown with the Office of the Attorney General of Switzerland (OAG) on suspicion of violating official secrecy”.

On Thursday Swiss public broadcaster SRF reported that the independent supervisory authority for intelligence activities, AB-ND, had also filed a criminal complaint with the OAG “several months ago”. Neither the AB-ND nor the OAG is making any comment.

The justice ministry is reportedly now dealing with the criminal complaint and must decide whether the OAG is authorised to initiate criminal proceedings. In order to protect the interests of the country, the justice ministry can also prohibit criminal prosecution.

It’s a dilemma, SRF said. “On the one hand, investigations into the intelligence service could further damage the already tarnished reputation of the FIS, especially with important foreign partner services. On the other hand, there is a fundamental public interest in criminal prosecution.”

Swiss government ministers have been told to not speak English when representing Switzerland in international organisations. “Absurd,” reckons the current Swiss president.

The president should use one of Switzerland’s four national languages (French, German, Italian and Romansh) when communicating with international organisations that have one of these languages among their official working languages, according to a motion passed by the House of Representatives on Wednesday. The Senate had already backed it.

With such a motion “I will no longer have the right to speak in English with leaders of other countries and organisations”, declared Finance Minister Karin Keller-Sutter, who holds the rotating Swiss presidency this year. Keller-Sutter, who speaks good EnglishExternal link, said the motion was “absurd”. Parliamentarian Nicolò Paganini argued that Switzerland “may find itself having to take an interpreter to the table when all the other participants speak English”.

The result, it was argued, would be unnecessary costs and an attack on Switzerland’s top priority, which is to put its interests first. A minority of parliamentarians agreed.

The week ahead

As part of a European tour, Australian musician Nick Cave will be playing two solo shows in Zurich on Tuesday and Wednesday.

Friday is UN International Albinism Awareness Day, which highlights the need to prevent skin cancer in people with albinism. About 500 such people live in Switzerland.

Saturday is June 14 and therefore women’s strikes will take place in several Swiss cities.

Edited by Samuel Jaberg/ac

More

Fifty years of hurt: Taiwan struggles for Geneva role

More

Echoes from the Indian Ocean: Swiss stories of the 2004 tsunami

More

The difficult search for real Swiss cows

More

Around the world with a young Swiss explorer in 1900

More

Feline felons: The issue with Switzerland’s free-roaming cats

More

Tax information when emigrating from Switzerland: what you need to know

More

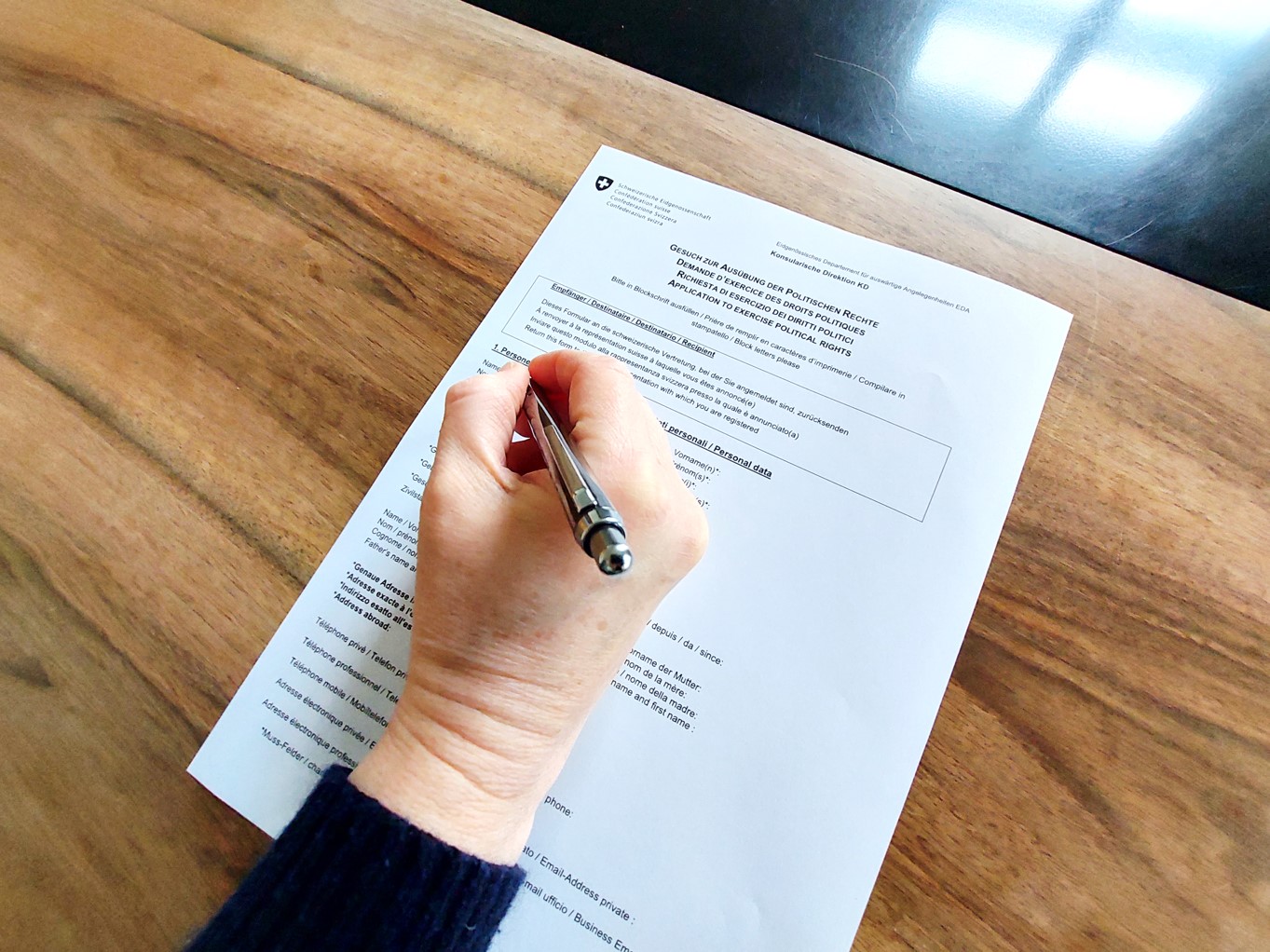

Voting from abroad: How to register for Swiss elections

More

What you need to know to get a job abroad

Switzerland in pictures

More

Picture of the week

More

Picture of the day

More

Picture of the day

More

Picture of the day

More

Picture of the day

Let’s talk

News from Switzerland

Logitech CEO: ‘We are well positioned to face US tariffs’

Logitech is well-positioned against the threat of US tariffs, said Hanneke Faber, CEO of the Swiss-American tech giant.

+Get the most important news from Switzerland in your inbox

“Today we manufacture our products in a total of six countries,” explained the 56-year-old in a speech at the Swiss Economic Forum (SEF), an event that brought together 1,700 personalities from business, science, politics and the media in Interlaken, in canton Bern from June 5-6.

More

Switzerland remains headquarters, says Logitech CEO

Logitech’s production in Asia and Mexico is more geographically diversified than in previous years and also than that of its competitors, the CEO emphasised. The group is also significantly reducing its production in China: by the end of the year, only 10% of Logitech products sold in the US will be manufactured in China, compared to 40% currently. However, the US is clearly the most important sales market for the company.

In the current period of uncertainty, the company intends to continue to invest heavily in innovation and product development, continued the Dutch executive in charge from December 2023. “Innovation is and remains our lifeblood and our product pipeline is well nourished,” she assured.

Translated from Italian by DeepL/jdp

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch

Many Swiss valleys face considerable landslide risk

In addition to the “best-monitored slope in Europe” above the landslide village of Brienz, there is a considerable risk of landslides in many other Swiss valleys, particularly in the eastern canton Graubünden. Every tenth building in the canton is located in a general natural hazard zone.

+Get the most important news from Switzerland in your inbox

Probably the best-known case of high landslide risk is currently in Brienz in canton Bern. Around 80 residents of the village in the Albula Valley have been evacuated since November due to the threat of a rock avalanche. But that’s not all. The entire mountain above the village has been intensively monitored for years and, according to the responsible municipality of Albula, is the “best-monitored slope in Europe”.

Back in spring 2023, around 1.2 million cubic metres of debris came loose and stopped just short of the village. All residents were evacuated early back then too.

More

Thirty residents return home following Swiss landslide

The example of the landslide in Bondo in Bregaglia shows that this is not always successful. The accident on Piz Cengalo claimed eight lives in 2017, when three million cubic metres of rock fell from its northern flank. Just a few weeks ago, three million cubic metres of rock and mud buried the village of Blatten in canton Valais.

Other areas with a significant risk of rockfall and landslides can be found between Thusis and Andeer, in the Rhine forest near Sufers and Splügen, near Savognin and Mulegns on the Julier Pass and in the Engadin near Pontresina and Samedan as well as in Susch, Lavin and Zernez. Rockfalls can also be expected in Poschiavo, Bregaglia and Misox, in canton Graubünden highlands, in Domleschg and near Chur in Felsberg. A look at the interactive hazard map of the canton of Graubünden shows this.

Over 5,000 homes at risk

Of a total of 170,000 buildings in the canton, 10% are located within general natural hazard zones, as can be seen from the cantonal guide to hazard maps. Of these buildings, one third are inhabited – that makes 5,100 residential buildings, another third of these 10% are used for agriculture, one fifth are industrial and commercial and the rest are used for other purposes.

In addition to rockfalls and landslides, Graubünden is also at risk from avalanches, debris flows, flooding, landslides, collapses and earthquakes. The latter harbours the greatest risk, said cantonal natural hazards specialist Urban Maissen to Südostschweiz newspaper at the end of May. An earthquake with a magnitude of 5.6 in the Chur area could claim countless lives and cause billions in damage, Maissen told the daily newspaper.

Translated from German by DeepL/jdp

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch

The difficult search for real Swiss cows

For tourists and locals alike, cows are inextricably linked with the image of Switzerland. But in most cases, this Swiss national symbol has non-Swiss origins. The search for an authentically Swiss cow is hard.

In Switzerland, cows are everywhere: in souvenir shops in the form of wooden figurines, on the packaging of many dairy products, and in art and folklore.

And, of course, in the fields and stalls. According to the animal statistics website IdentitasExternal link, at the end of April 2025 there were 1,505,003 registered cattle in Switzerland, including 664,032 cows. Cattle are the most common domesticated animal family in Switzerland – at least if we limit ourselves to declared and registered animals.

Cattle have been present in Switzerland for a very long time. The first traces of domestication date back to the Neolithic period, according to the Historical Dictionary of SwitzerlandExternal link. Over the centuries, cattle rearing grew considerably, with cheese even becoming one of Switzerland’s main exports at the end of the 18th century.

So you would expect Switzerland to have many different breeds of cow. But that’s not the case – or rather, it’s no longer the case.

“Of the 35 breeds once documented in Switzerland, only five remain: the original Brown Swiss, the Hérens breed, the original Simmental spotted breed, the Évolène breed and the Rätisches Grauvieh (Rhaetian grey cattle),” laments Pro Specie RaraExternal link, a foundation whose aim is to preserve Switzerland’s plant and animal heritage.

This impoverishment of varieties can be explained by the quest for greater productivity. “These days, cattle breeding is not spared by the law of specialisation. Old breeds are being supplanted by new breeding lines that either are highly productive in terms of milk or produce a lot of meat very quickly,” the foundation says.

More

How are you, Switzerland? Let us know in our 2025 survey

Given this trend, it has become difficult to find pure Swiss cows in fields. Most have all or part of their genetic heritage from abroad.

Swiss cows conquer the world

Some people may regret this development. However, they may take comfort from the fact that millions of cows around the world have Swiss genes. Swiss cows have also had their moment of glory on international markets.

The most striking example is the Simmental. Originating in the Simme valley in the Bernese Alps, this sturdy, good-milking, fast-growing cow was exported to Italy as early as the 15th century, according to certain texts. Exports exploded in the 19th and 20th centuries, reaching as far afield as South America and Russia.

It is estimated that there are between 40 million and 60 million Simmental descendants in more than 30 countries on every continent. They are used mainly for meat production.

Originally from canton Schwyz, the brown breed has also enjoyed a successful international career, particularly in the United States, where it has become known as the Brown Swiss. Considered to be one of the oldest dairy breeds in the world, it produces milk that is highly suitable for cheese production.

“The fat to protein ratio in Brown Swiss milk is ideal for cheese, thus making them one of the most popular breeds around the world for cheese making,” says the Michigan State University websiteExternal link.

The cow is well established in the United States, particularly in the states of Wisconsin, Ohio and Iowa, notes the Brown Swiss AssociationExternal link. From the US, the Brown Swiss has conquered the world. It is estimated that there are more than six million animals in more than 80 countries.

In search of the lost cow

However, this globalisation of cattle has had a detrimental effect on local breeds. Of the five breeds that can still be described as authentically Swiss, three are threatened with extinction, according to Pro Specie Rara: the original Simmental, the Évolène and the Rätisches Grauvieh.

But international trade is sometimes also a solution when it is necessary to go beyond national borders to save a breed. This is what happened with the Rhaetian grey cow. Once widespread in the Graubünden Alps, this hardy animal, well adapted to its environment, was gradually supplanted by the brown cow, until it disappeared from the Swiss landscape in the 1920s. Pro Specie Rara succeeded in reintroducing the species to Switzerland in the 1980s from a few remaining numbers in the Tyrol.

However, the search for the lost cow is not always successful, as the case of the Fribourgeoise shows. The Fribourgeoise was a white cow with black spots that was very common in canton Fribourg. But this local breed was mixed so much with the Canadian Holstein cow, which was also black and white but a much better milk producer, that it ended up disappearing in the 1970s.

A real identity tragedy for Fribourg – the canton with the most cows, the birthplace of Gruyère and double cream, and whose flag is black and white! But there was still hope: some Fribourgeoises were found in Chile, where many people from Fribourg had emigrated and where they had imported cows in the 1930s.

Specialists from Pro Specie Rara went to South America to investigate. The verdict in 2009 dashed Fribourg’s hopes: the Chilean cows were not sufficiently different from the local varieties and the Holstein cow to qualify as descendants of the Fribourg breed.

Fribourg has lost its emblematic cow but has kept the ‘Ranz des vaches’, a simple melody traditionally played on the horn by Swiss Alpine herdsmen as they drove their cattle to or from the pasture. Bernard Romanens’ rendition from the 1977 Fête des vignerons is considered to be the best version ever recorded:

If not the breed, at least appearances could be saved. You can still see black and white cows grazing in the green valleys of the Gruyère region. But they are … Canadian.

Edited by Samuel Jaberg. Adapted from French by Thomas Stephens

More

Whitsun holiday traffic blocked for 17 kilometres at Gotthard tunnel

On Saturday morning, road traffic was blocked for 17 kilometres in front of the Gotthard north portal between Erstfeld and Göschenen in canton Uri, resulting in a loss of time of up to two hours and 50 minutes, according to the Touring Club Suisse on its website.

+Get the most important news from Switzerland in your inbox

As an alternative route south, the Touring Club Suisse (TCS) has recommended the A13 motorway via the San Bernardino tunnel.

Already on Friday, Whitsun traffic was heavy on the A2 motorway. The Viasuisse traffic service was forecasting long traffic jams in front of the north portal of the Gotthard road tunnel between Friday and Saturday afternoon. Traffic overloads are also expected on Monday, on the return journey northwards.

Translated from French by DeepL/jdp

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch

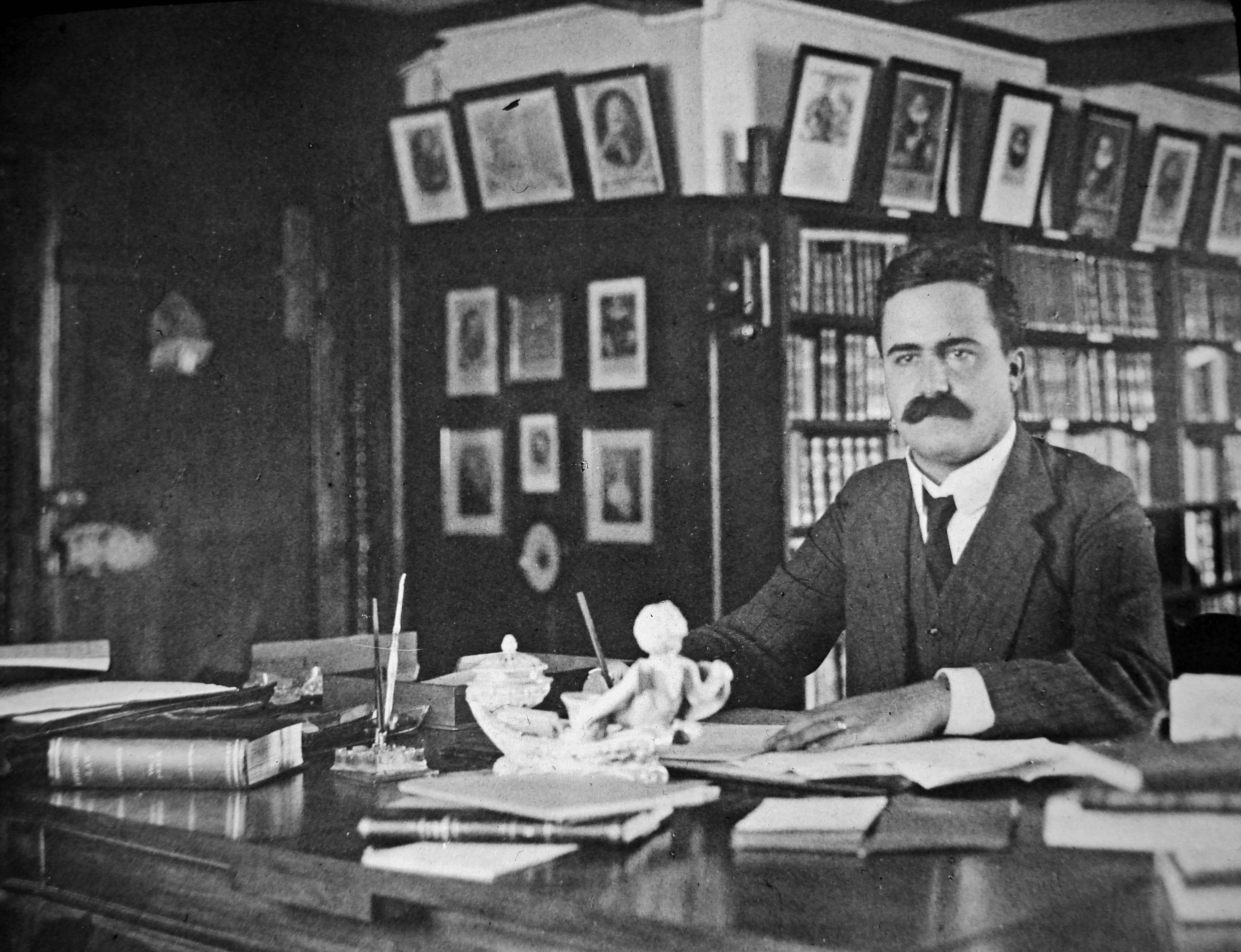

Around the world with a young Swiss explorer in 1900

Long before he became president of the ICRC, Zurich-born Max Huber travelled the world for two years. The young lawyer documented every step of his adventure. Now, over a century later, his grandson has brought the records and photographs to light.

Today, only a few Swiss will recognise the name Max Huber. But in Ossingen, a small village of 1,700 people in canton Zurich, he is a local legend. The striking 13th century Wyden castle used to be his home, and since his death on January 1, 1960, it has remained almost untouched. His grandson Ulrich Huber, born in 1939, recently showed me around the castle which has now become a small family museum.

Max Huber was born in 1874. He quickly climbed up the career ladder as a lawyer and diplomat. From 1902, he worked as a professor of law and served as an adviser on foreign policy for the Swiss government which required him to represent Switzerland at various international conferences. From 1920 to 1932, he was a member of the International Court of Justice in The Hague, and from 1928 to 1944 he served as the president of the International Committee of the Red Cross (ICRC). After his term, on December 10, 1945, he accepted the Nobel Peace Prize on behalf of the ICRC as honorary president.

The catalyst to his amazing career was Huber’s trip around the world from May 1900 to December 1901.

“I think my grandfather got key inspirations for his work as a diplomat during that trip,” says grandson Ulrich Huber.

Max Huber’s journey took him through Russia, Japan, Southeast Asia, Sri Lanka (then Ceylon), Australia and China before he finally ended up in the United States. He had hoped to embark on this journey as an official envoy of the Federal Political Department. The Swiss government did not grant him that mandate but gave him letters of recommendation that opened several doors for him.

Ulrich Huber takes me up to the very top of the castle’s tower where his grandfather’s library is located. One floor down, he surprises me by rolling a carpet aside. Through a trapdoor we descend into a dark room where part of the family archive is stored. Throughout his journey, Max Huber regularly wrote to his family. He sent his diary home in instalments (or portions) and later published an abridged version as a book in 1906.

The book includes three analytical chapters which talk about Siberia’s commercial landscape, the prospects for Swiss exports to China, Japan’s transition to a constitutional monarchy and democracy in Britain’s colonies in Australia. These chapters reveal that Huber processed many of his impressions only after his trip and turned them into carefully crafted prose.

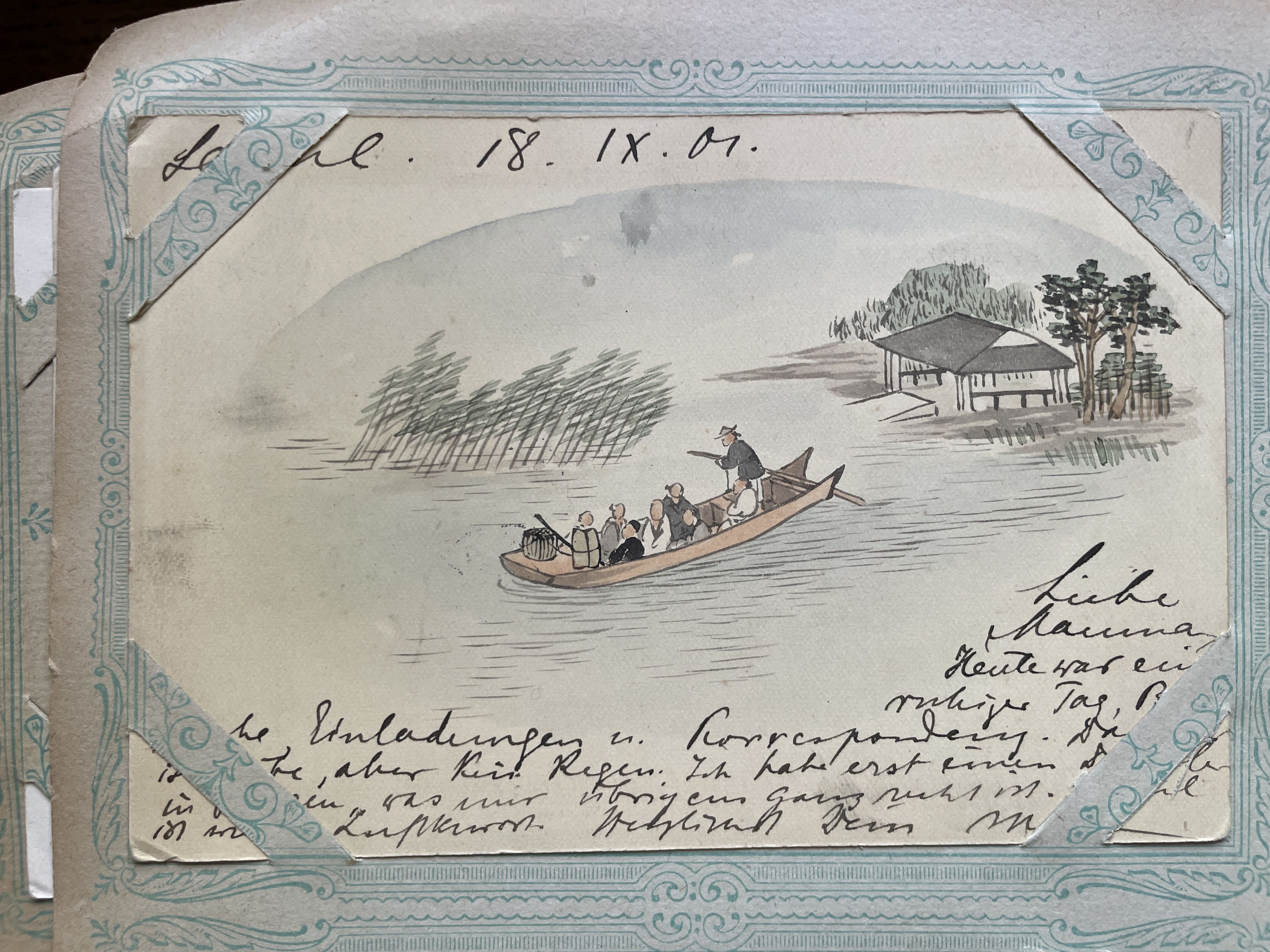

Max Huber sent home more than just words. He kept a precise log of every single document and item he sent home, while back in Ossingen, his relatives meticulously recorded everything that arrived.

In November 1900 alone, he sent six packages with photographs from Yokohama: a delicate letter written on Japanese wooden paper, four illustrated postcards, several pages from his diary and 12 postcards of temples, teahouses and parks. But that was just the beginning. In Japan, which the young globetrotter was particularly enamoured with, he bought sculptures and cast-iron temple lanterns nearly two metres tall.

Most impressive are the postcards to his mother. “Today I arrived in Saigon. The vegetation is tropical, and the botanical garden is amazing. A truly grand promenade. However, the hotel is rather modest. I received a very warm welcome from the Eberhard family as well as from many other Swiss here. The heat is horrendous and feels like being in an oven,” reads one postcard dated January 4, 1901. Huber often spread his messages across several postcards which he occasionally embellished with his own illustrations.

Max Huber travelled with a Kodak camera using glass plates as a medium. Lighter roll-film cameras were already available at the time, but their image quality left much to be desired. He also purchased photographs along the way and regularly sent them home.

Thanks to the wealth of material, it is possible today to retrace Huber’s steps in remarkable detail. His grandson has sifted through more than 3,000 photographs and thousands of postcards to compile a comprehensive documentary.

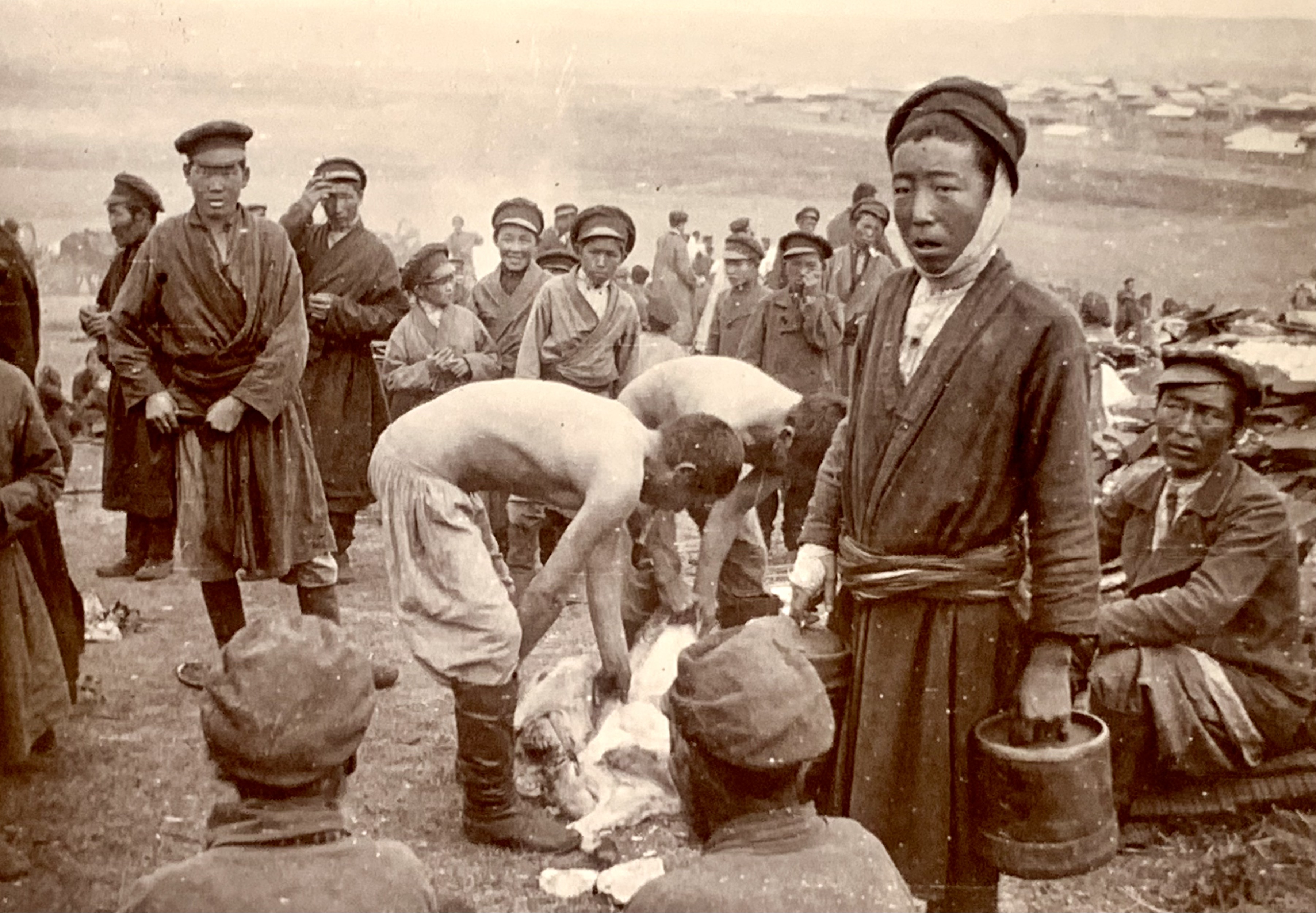

He mainly travelled by ship or train and sometimes by horse-drawn carriages. Thanks to his connections he often found himself in interesting situations. In Russian Irkutsk the director of the ethnographic museum took him to a traditional offering of the Buryats, the biggest ethnic minority in Siberia. Huber even managed to capture key moments of the ceremony with his camera. How he personally experienced this ritual is not known.

Huber often struggled with local traditions as reflected in his impressions of Canton (today’s Guangzhou).

“The houses were clean, but the canals, which were crossed by steep bridges, were little more than open sewers. On top of that there were countless open kitchens where chickens, suckling pigs, meatballs and fish were fried in disgustingly smelling grease. In rather uninviting taverns, oddly coloured drinks were served.”

In China, Huber experienced a tricky situation. Just before his arrival, the so-called Boxer Rebellion – a violent conflict involving Western superpowers – had come to an end. Reporting from northern China in September 1901, he wrote critically: “Some of the European and US troops lived like vandals.”

Although Max Huber could enjoy all comforts money could buy at the time, travelling was cumbersome. He struggled with the heat which led him to skip India and limit his stay to a visit of a tea plantation in the highlands of what was then Ceylon.

His father had urged him to visit Ceylon, apparently because he owned shares from a deceased friend there. The rewards for his efforts were the breathtaking train ride to the highlands and the pleasant climate.

Max Huber was part of a growing trend that had spread across Switzerland since 1860. Travelling the world had become an educational and leisure pursuit for the rich. Huber joined the ranks of fellow adventures like chocolate magnate Suchard, who set off in 1973, naturalist Johann Rudolf Geigy in 1886 and Burgdorf photographer Heinrich Schiffmann in 1897.

Edited by Benjamin von Wyl

Adapted from German by Billi Bierling/ac

Zurich court sentences Brian Keller to long prison term

The Zurich District Court sentenced Brian Keller to three years and nine months’ imprisonment on Friday. The boxer and once Switzerland’s “most famous inmate” had knocked out an opponent.

+Get the most important news from Switzerland in your inbox

Video recordings showed that all six blows were to the victim’s head, the judge said at the sentencing hearing. The court convicted Keller of attempted grievous bodily harm and public incitement to commit a crime.

The public prosecutor had demanded a prison sentence of four years and four months, the defence lawyer called for a conditional prison sentence. The judgement is not yet final. It remains to be seen whether Keller will have to go back to prison.

More

Swiss repeat offender Brian Keller released from custody

The trial centred on an escalated feud with another Tiktoker. Mutual insults and provocations spilled over from the digital realm into the real world. A video showed Keller punching his opponent on May 2, 2024. The offence took place just a few months after his release from prison.

Translated from German by DeepL/jdp

We select the most relevant news for an international audience and use automatic translation tools to translate them into English. A journalist then reviews the translation for clarity and accuracy before publication.

Providing you with automatically translated news gives us the time to write more in-depth articles. The news stories we select have been written and carefully fact-checked by an external editorial team from news agencies such as Bloomberg or Keystone.

If you have any questions about how we work, write to us at english@swissinfo.ch

Stocks Hit Highest Since February on Jobs Surprise: Markets Wrap

(Bloomberg) — Stocks closed at their highest since February and bond yields rose as jobs data allayed concerns of an imminent economic slowdown. Equities also gained amid hopes US-China trade tensions are easing, with President Donald Trump saying negotiators will talk Monday.

A 1% advance in the S&P 500 drove the gauge to the 6,000 mark. All major industries climbed. Tesla Inc. jumped over 3.5% to lead megacaps higher. Treasuries dropped across the curve, with two-year yields topping 4%. Money markets trimmed bets that the Federal Reserve will cut interest rates this year. The dollar rose. Bitcoin also got a boost.

Subscribe to the Stock Movers Podcast on Apple, Spotify and other Podcast Platforms.

While US job growth moderated in May and the prior months were revised lower, Friday’s report narrowly exceeded forecasts, bolstering bulls who were primed for disappointment after data this week raised doubts about the buoyancy of American hiring.

“While it may not be firing on all cylinders, it’s far from showing signs of a major breakdown,” said Bret Kenwell at eToro. “Today’s solid labor report buys the Fed more time, but Chair Jerome Powell may have a hard time justifying a restrictive rate policy should inflation continue lower.”

Following Friday’s data, Trump urged the Fed to cut rates by a full percentage point, intensifying his pressure campaign against Powell.

“‘Too Late’ at the Fed is a disaster!” Trump posted Friday on social media, using a derisive nickname for Powell. “Europe has had 10 rate cuts, we have had none. Despite him, our Country is doing great. Go for a full point, Rocket Fuel!”

Read: US Jobs Report Points to Gradual Moderation in Labor Market

Nonfarm payrolls increased 139,000 last month after a combined 95,000 in downward revisions to the prior two months. The unemployment rate held at 4.2%, while wage growth accelerated.

The payrolls figure helped alleviate concerns of a rapid deterioration in labor demand as companies contend with higher costs related to tariffs and prospects of slower economic activity.

“A solid jobs report reinforces the ‘slowly slowing’ economic narrative,” said Adam Hetts at Janus Henderson Investors. “Today’s news is positive, but ongoing tariff uncertainty means the subsequent hard data releases over the summer will be extremely important for clarity.”

In fact, Fed officials have signaled a wait-and-see approach on rates as they await further insights on the impacts of Trump’s policies on the economy.

“For the Fed, there is little urgency to cut rates,” said Seema Shah at Principal Asset Management. “Holding on until the trade mist clears will reduce the risk of a policy misstep. We expect the first rate cut to come in late-2025.”

Read: Traders Reel In Fed Cut Bets as Strong Job Data Drags on Bonds

Interest-rate swaps showed traders now see a roughly 70% chance of a quarter-point rate cut by September, compared with a probability of about 90% on Thursday. The amount of easing priced in for the year declined to about 43 basis points, fewer than two quarter-point cuts.

“The Fed should be reluctant to cut rates because the full effects of tariffs haven’t impacted inflation numbers yet and the job market isn’t deteriorating enough to force their hand,” said Chris Zaccarelli at Northlight Asset Management.

Under this backdrop, Zaccarelli thinks caution is still warranted because valuations are high, much of the tariff risks haven’t been removed and the economy appears to be slowing.

“While there is still uncertainty over tariffs, the stock market is forward looking and has been pricing in an eventual thawing of trade fears,” said Glen Smith at GDS Wealth Management. “We would not be surprised to see stocks breach and even move above their February peak at some point this summer, albeit with some continued volatility.”

US equities will put the worst of this year’s trade-war turmoil behind them and rally to fresh highs in 2025, according to a survey of Bloomberg subscribers who attended a panel discussion on macro trends.

The S&P 500 will climb to 6,500 by year-end, according to 44% of the 27 responses in a Markets Live Pulse survey. The index was seen reaching that level by the first half of next year by 26% of participants, with 11% saying it would happen in the second half and the remainder estimating 2027 or later.

Investors are enjoying a much-needed breather following a tumultuous two-month period, with the S&P 500 gaining for the fifth week in seven, noted Mark Hackett at Nationwide.

“Earnings revisions have stabilized, forward earnings have marginally improved, and corporate resilience is evident in forward guidance, suggesting the path of least resistance is to new highs,” Hackett said.

Corporate Highlights:

- China has approved temporary export licenses to rare-earth suppliers of the top US automakers, Reuters reported on Friday, citing unidentified people familiar with the matter.

- Boeing Co. has begun shipping commercial jets to China for the first time since early April, indicating a reopening of trade flows amid the long-simmering tariff war between the US and Asia’s biggest economy.

- Broadcom Inc., a chip supplier to companies like Alphabet Inc. and Apple Inc., fell after the company gave a lackluster revenue forecast for the current quarter, suggesting that the AI spending frenzy isn’t as strong as some investors anticipated.

- Lululemon Athletica Inc. sank after a second straight disappointing quarter fueled concerns that rising competition, new tariffs and a shift away from yoga pants are derailing its ambitious growth plans.

- Robinhood Markets Inc. rose for a sixth straight day as investors speculate that the online brokerage could become the latest firm to earn a coveted spot in the S&P 500 Index.

- UBS Group AG said it would examine steps to mitigate the effects of the Swiss government’s proposal for as much as $26 billion in fresh capital requirements, calling the demand “extreme” and vowing to continue its push to dilute the regulations.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1% as of 4 p.m. New York time

- The Nasdaq 100 rose 1%

- The Dow Jones Industrial Average rose 1%

- The MSCI World Index rose 0.7%

- The Russell 2000 Index rose 1.7%

- Bloomberg Magnificent 7 Total Return Index rose 2%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro fell 0.4% to $1.1397

- The British pound fell 0.3% to $1.3532

- The Japanese yen fell 0.9% to 144.79 per dollar

Cryptocurrencies

- Bitcoin rose 3.8% to $104,315.12

- Ether rose 3.6% to $2,487.06

Bonds

- The yield on 10-year Treasuries advanced 11 basis points to 4.50%

- Germany’s 10-year yield was little changed at 2.58%

- Britain’s 10-year yield advanced three basis points to 4.64%

Commodities

- West Texas Intermediate crude rose 2% to $64.63 a barrel

- Spot gold fell 1.2% to $3,312.90 an ounce

©2025 Bloomberg L.P.

UBS Slams ‘Extreme’ $26 Billion Capital Demand in Swiss Proposal

(Bloomberg) — UBS Group AG said it would examine steps to mitigate the effects of the Swiss government’s proposal for as much as $26 billion in fresh capital requirements, calling the demand “extreme” and vowing to continue its push to dilute the regulations.

After months of uncertainty that’s weighed on the Zurich-based bank’s share price, the Swiss Federal Council said Friday that it would require UBS to back the capital in its foreign subsidiaries fully at the parent bank. The government estimates that this will force UBS to add as much as $23 billion in capital to its Swiss-based main unit, with the remainder coming from other measures.

The bank has argued that the capital measures are an overreaction to the collapse of Credit Suisse in 2023 which puts them at a disadvantage to global peers and warned it could hurt their plans for investor payouts.

“UBS will also evaluate appropriate measures, if and where possible, to address the negative effects that extreme regulations would have on its shareholders,” UBS said in a statement late Friday. The bank confirmed previously-announced buyback plans for 2025 and added that it will decide early next year on how much it will return in 2026.

While a year-long lobbying effort by Chairman Colm Kelleher and Chief Executive Officer Sergio Ermotti essentially fell flat, there were some crumbs of comfort for investors. Following parliamentary debate, a lengthy phase-in period could see the bank given until 2035 to fully comply, while the government suggested that the measures could reduce the lender’s reliance on relatively expensive convertible debt, or AT1s, as capital.

UBS shares closed up 3.8%, having jumped as much as 7% after the government announcement.

“The shares have massively underperformed its peers and it seems that today’s proposals were priced in,” said Andreas Venditti, an analyst at Bank Vontobel AG in Zurich. Bloomberg reported the decision on foreign units in May.

UBS can now consider steps to meet the extra requirements including repatriating capital from abroad or selling assets. Yet the bank has already mooted the much more extreme reaction of moving its headquarters abroad if the proposals ultimately materialize.

The government justified its stance on the basis that UBS would be more resilient in a crisis, and in any case the bank has many ways to mitigate the impact of the changes. It also said that the measures could entail a reduction of about $8 billion in the use of convertible debt, or AT1s, as capital. That would leave a need for an extra $18 billion in so-called “going concern” capital, it said.

“How high the additional capital requirement is in the end depends on many factors and to a large extent also on how UBS reacts to these measures,” Swiss Finance Minister Karin Keller-Sutter said at a press conference in Bern.

The proposal on foreign units means that in an emergency, UBS “should be able to dispose of foreign subsidiaries either in part or in their entirety, without this negatively impacting the capitalization of the parent bank,” the government said in a statement. “The required build-up of capital can ideally be achieved without raising capital, without excessively restricting organic growth and without excessive reduction in distributions.”

The government also unveiled a list of other measures to be drafted into ordinances and legislation, including substantial new powers for the financial regulator Finma, including the ability to fine banks.

Officials first touted the plans in April last year, a factor that has weighed on the share price. The stock has been essentially unchanged since then, while the Stoxx Europe 600 Banks index — which tracks the biggest banks in the euro area — has climbed about by more than 40%.

Details of the phase-in including its exact length and whether it will be front-loaded or linear will likely be announced in the fall when the government publishes the finalized draft of the adjusted law. It’s as of now unclear whether the decision on these details will rest with the government alone or require parliament’s approval, according to an official.

Switzerland’s leadership also presented new rules for capital quality. These will update how banks have to quantify intangible items such as deferred tax assets, in-house software and other hard-to-value items they have on their books, adding up to a potential increase of $3 billion.

These changes are planned to be implemented via an ordinance which doesn’t require lawmakers’ sign-off. Therefore they may enter force as early as the middle of next year.

The government will now finalize the draft and propose the changes to parliament, which is expected to debate them in 2027. The new law likely won’t take effect before 2029. As UBS can lobby lawmakers, there’s a chance that the draft will be watered down. In any case, the government has proposed a phase-in period of between 6 and 8 years once the changes are agreed.

“The phase in period is even longer than what the market expected and the AT1 offset softens the blow somewhat,” said Johann Scholtz, an analyst at Morningstar. “This is as bad as it will get for UBS from a capital perspective. From here they can lobby for concessions and look to take mitigating actions themselves, for instance upstreaming capital from over-capitalized subsidiaries.”

–With assistance from Levin Stamm, Paula Doenecke, Allegra Catelli and Jan-Henrik Förster.

(Adds shares in sixth paragraph)

©2025 Bloomberg L.P.