One in five Swiss residents can’t pay an unexpected bill

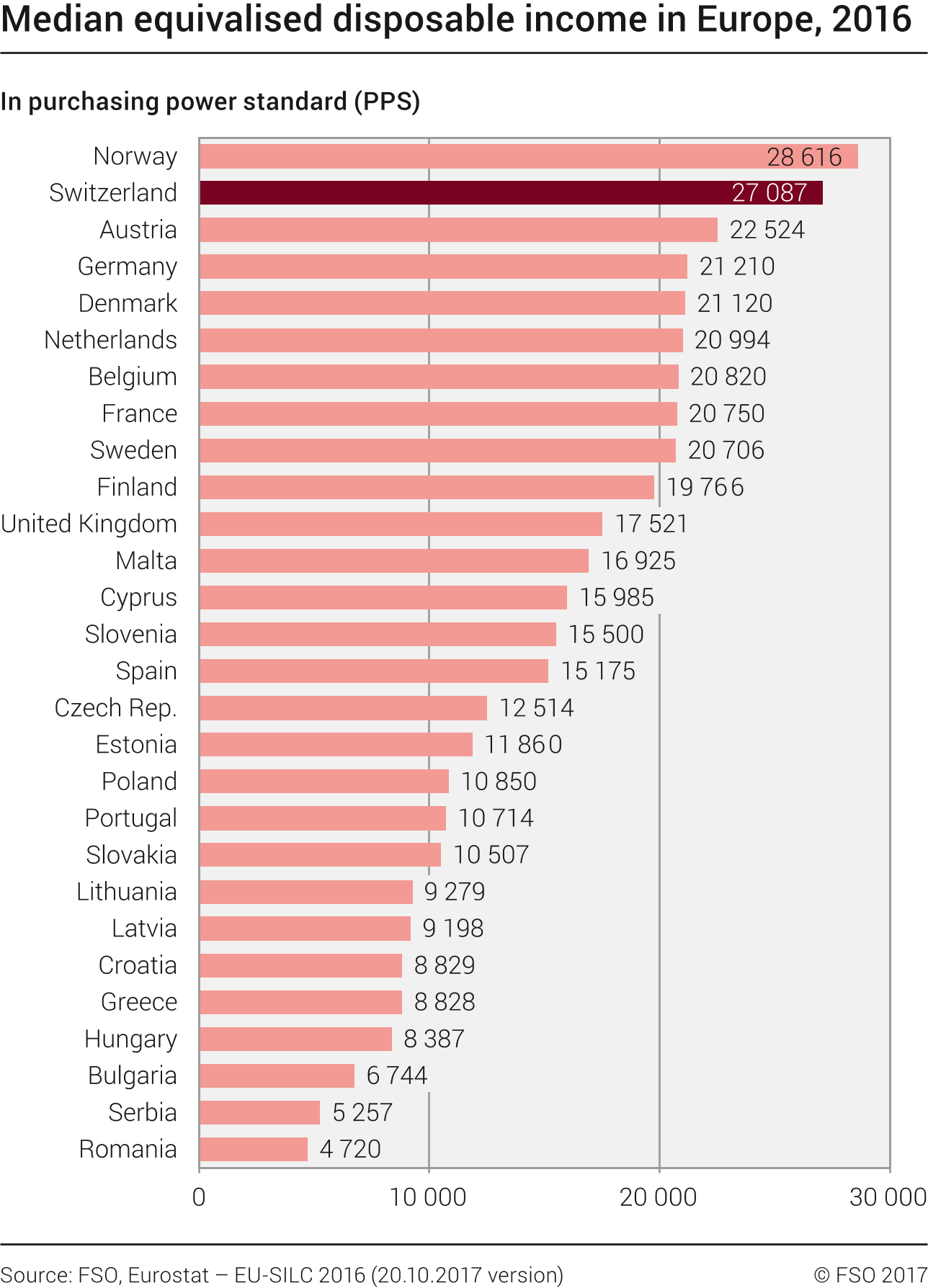

Despite its high standard of living, Switzerland is home to many who would struggle to finance a week’s getaway or a large bill.

Last year, 21.5% of Swiss residents lived in a household that would have been unable to pay a bill for CHF2,500 ($2,518) within a month, reports the Swiss Federal Statistical OfficeExternal link in its Survey on Income and Living ConditionsExternal link.

This was especially true for single parents, unemployed people and foreigners from outside Europe. Such an unexpected expense could also turn up in the form of a medical bill, as CHF2,500 is the maximum deductible amount offered by Swiss health insurers.

Meanwhile, 8.9% of the population was unable to afford a week’s holiday away from home in 2016. However, people in Switzerland can better afford to travel than their neighbours. Some 45% of Italians, 23% of French, 18% of Germans and 15% of Austrians spend their vacation time at home.

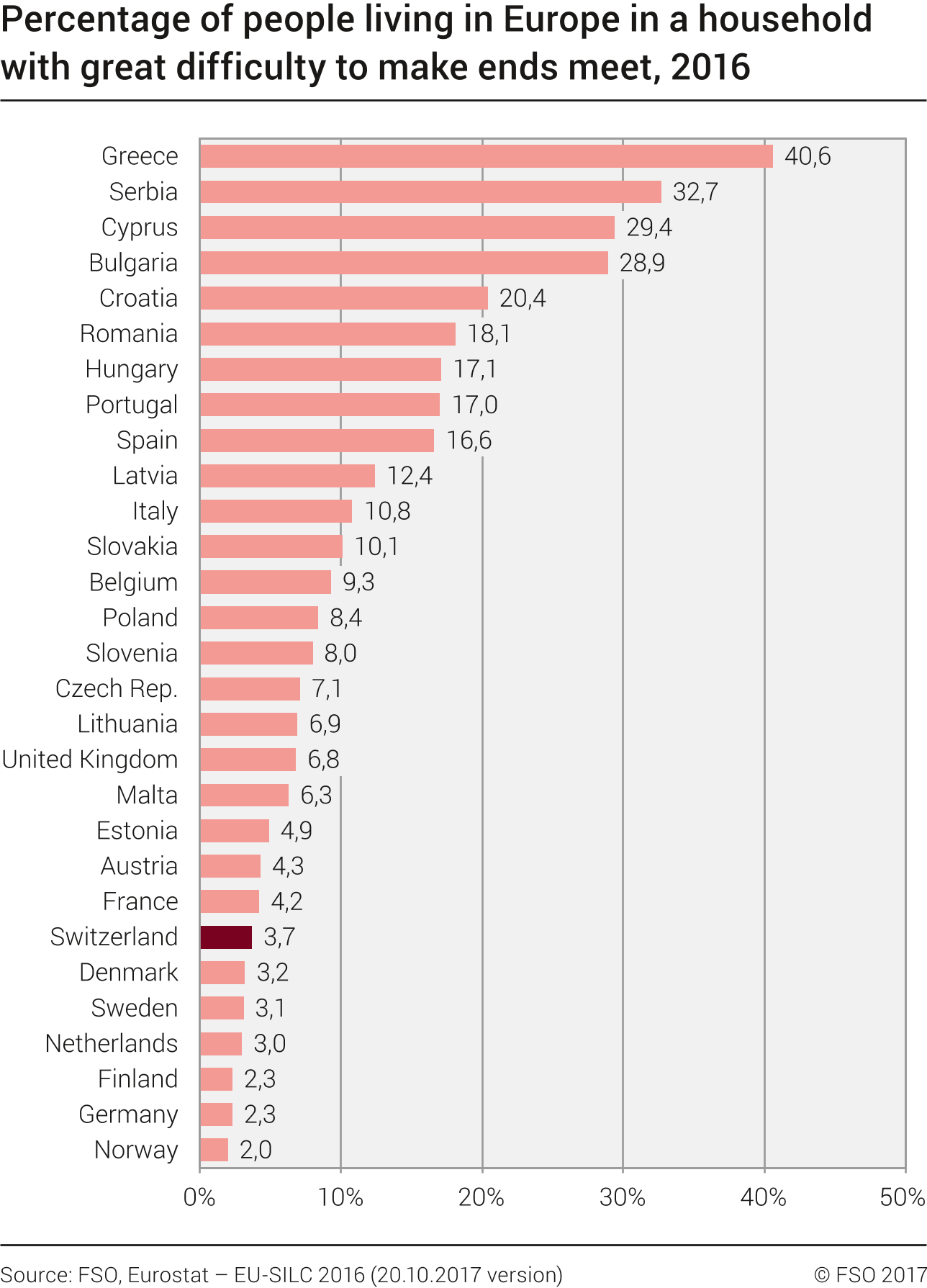

The persistent risk of poverty is a reality for 6.9% of the Swiss population, but that’s low compared to other countries, such as France and Austria (8%) Germany (10.5%) and Spain (nearly 15%).

Earlier this week, the 2017 Credit Suisse Global Wealth Report stated that the average fortune of a Swiss adult was $537,600 (CHF528,000).

Switzerland continues to top the Credit Suisse global list for wealth per adult, followed by Australia ($402,600), the United States ($388,600) and New Zealand ($337,400).

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.