Federal votes on March 3, 2024

Pensions were once again at the heart of Swiss politics on March 3, 2024, as voters decided on two people’s initiatives from opposing camps. In the end, unions managed to convince a majority to boost pension payments, while a separate proposal to raise the retirement age to 66 was resoundingly defeated.

With a majority of 58%, voters accepted the proposal put forward by unions and left-wing parties to introduce a new 13th monthly pension payment each year. The aim: to shore up pensioners’ purchasing power at a time of inflation and rising cost of living.

As a result, the maximum annual old-age pension will rise by CHF2,450 ($2,825) to CHF31,850 for single people, and by up to CHF3,675 to CHF47,775 for couples.

More

Pensions: how the Swiss voted on March 3

Right-wing and centrist parties, as well as the country’s main economic organisations, opposed the reform, which will cost almost CHF4 billion a year, according to government estimates. Opponents claimed the additional pension would be financed at the expense of workers, either through higher wage contributions or taxes.

The second initiative on March 3 was the brainchild of the youth section of the right-wing Radical-Liberal Party. Their proposal was to raise the retirement age from 65 to 66 in order to guarantee the medium-term financing of the pension system. The increase would have been phased in gradually until 2033, at which point the retirement age would have become tied to average life expectancy.

The proposal was never likely to appeal to a majority of voters, especially as the government and a large majority of parliament were opposed to it. The government argued that the demographic problem facing the pension system can’t be resolved solely by raising the retirement age.

More

Explainer: the three Swiss pension pillars

This is by no means the first time voters have been asked to decide on the future of pensions. The retirement age and the financing of old-age pensions are recurring themes which have been the subject of regular referendums since the inception of the state pension system in 1948.

Debates on the issue are often heated and raise fundamental issues such as solidarity, gender equality, insecurity, and the financing of social insurance. Numerous government ministers have come a cropper on pension reforms.

There was one notable exception in recent years: after decades of hard-fought battles, voters finally agreed in September 2022 to raise the retirement age for women from 64 to 65, on a par with men. However, the “yes” vote was just 50.5%, and the ballot revealed two major divisions within the country: between men and women, and between German-speaking cantons and the others.

More

Switzerland mulls raising the retirement age for women

Most industrialised nations have reached reforms in recent years. New pensioners in Norway and Iceland are the oldest in developed economies – residents have to work until 67 to get a full pension in the two Nordic countries. Under their legislation, introduced in the second half of the 2000s, men and women retire at the same age.

The Swiss system is based on three pillars: the first is the old-age and survivors’ insurance (OASI), the second is the occupational pension provision, and the third is a personal pension provision.

The OASI is intended to guarantee a minimum standard of living and is compulsory for all; the occupational pension provision is intended to guarantee a previous standard of living and is compulsory for all employees; the third pillar is an optional, tax-advantaged private savings scheme.

More

Thousands of retired Swiss seniors falling into poverty

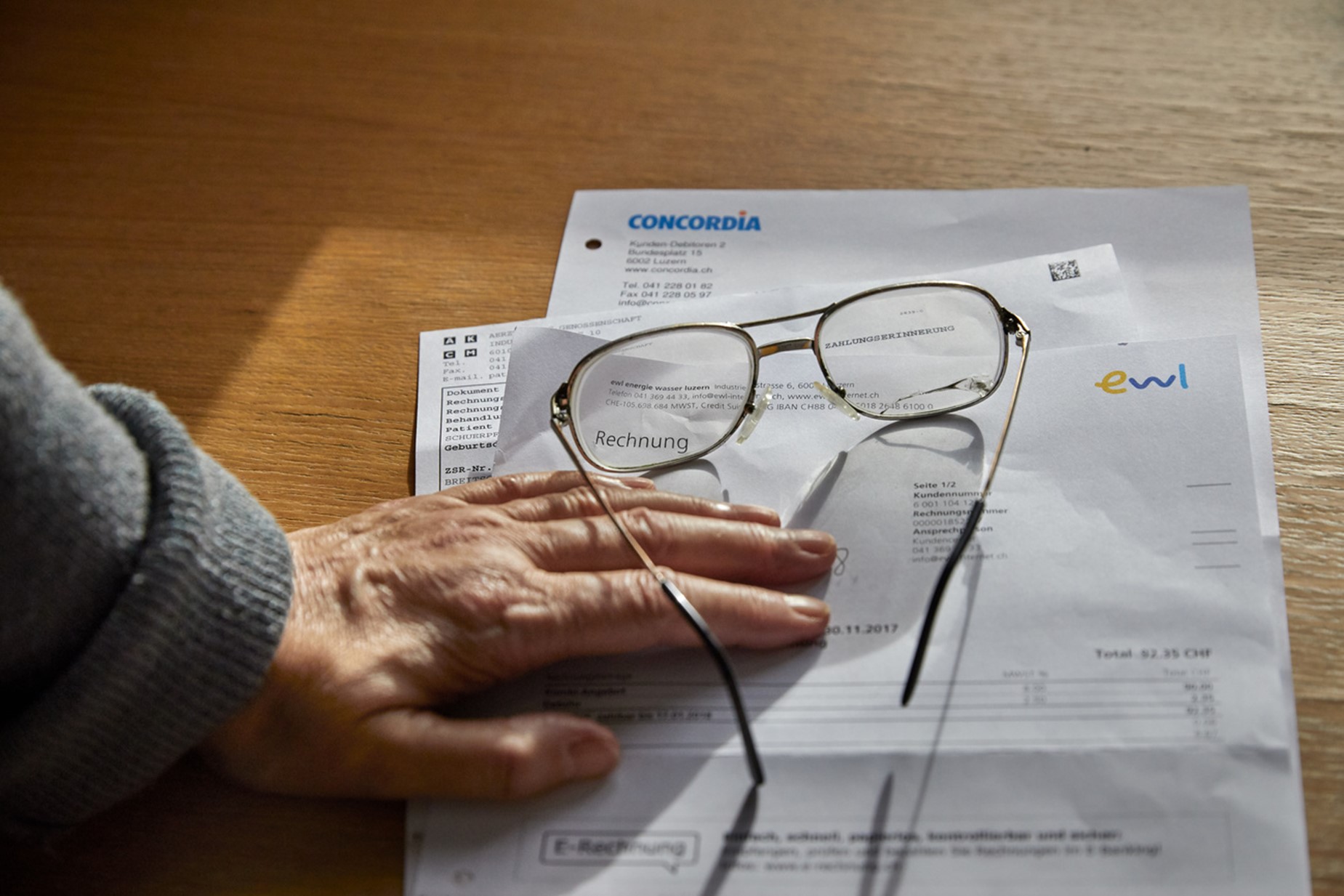

But there are gaps in the system: one in five elderly people in Switzerland lives below, or close to, the poverty line. This is the case for Bernard and Pierrette Apothéloz. In recent years, the retired couple from Neuchâtel have watched anxiously as the cost of healthcare and most basic necessities has risen. “It’s a constant struggle not to go under,” Bernard Apothéloz told SWI swissinfo.ch.

As a result of this, each year more and more Swiss retires move abroad to escape financial hardship and the high cost of living. In 2022, more than 150,000 OASI pensions were paid to Swiss nationals living abroad.

Edited by Balz Rigendinger. Adapted from French by Thomas Stephens/dos

More

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative