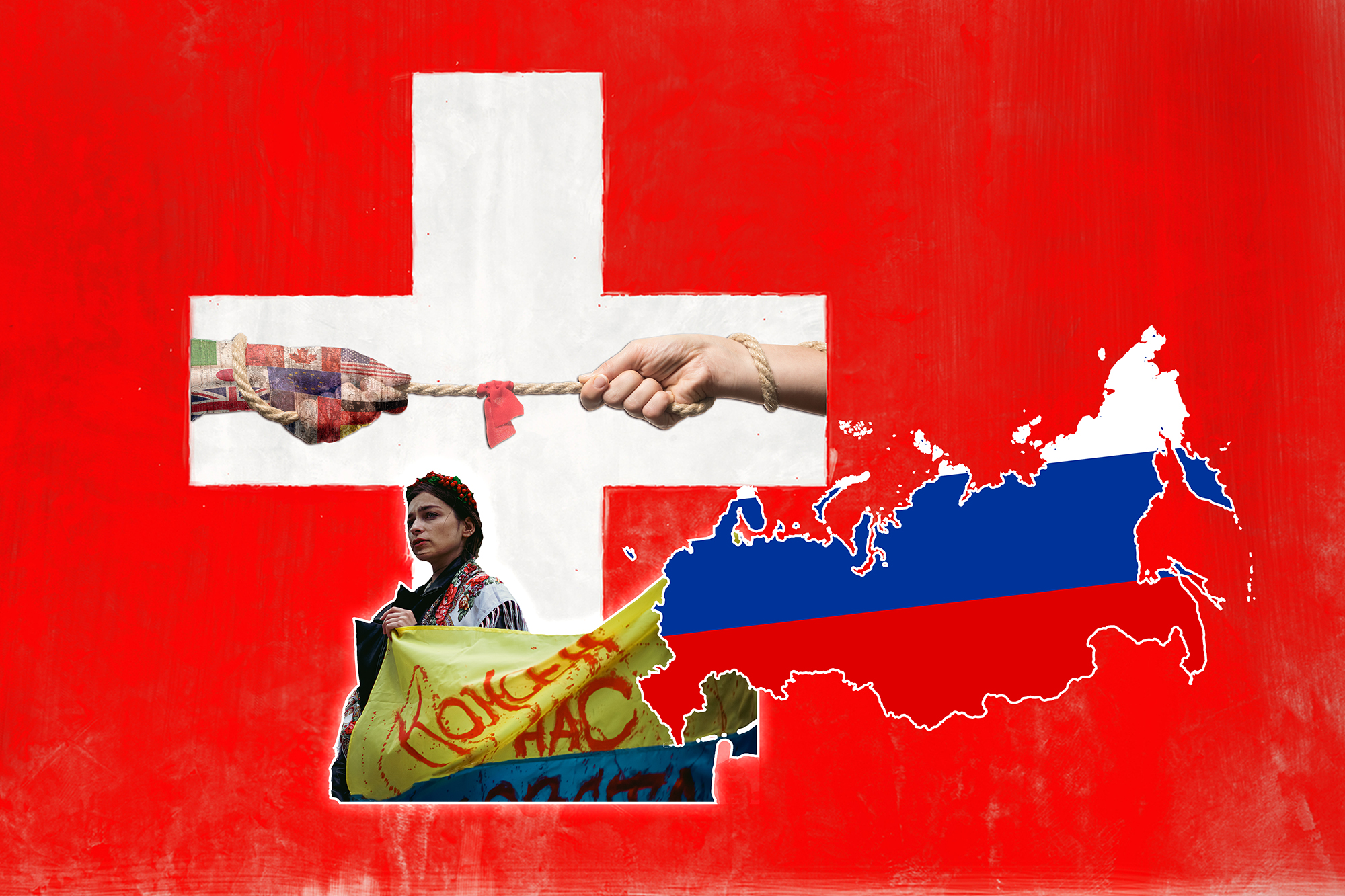

Switzerland questions oil trader over sidestep of Russian sanctions

Swiss authorities are probing a prominent Geneva-based oil trader’s legal arrangements to sidestep Russia sanctions, in a sign the country has begun actively policing its large commodity industry’s ties with Moscow.

The regulatory questions to Paramount, posed in April in a letter seen by the Financial Times, are one of the first known efforts by a European authority to investigate compliance with the western sanctions regime on Russian oil.

Switzerland, the world’s commodity trading capital, has mirrored EU sanctions against Moscow, placing a cap of $60 (CHF53) a barrel on all trade in Russian crude. But under Swiss rules, overseas subsidiaries of a local company are largely exempt if they are “legally independent”.

+ Swiss trading links to murky world of Russian oil

The provision was notably used by Geneva-based Paramount Energy & Commodities SA, founded by veteran commodities trader Niels Troost, which transferred its Russian oil trading activity to a company with a near-identical name in the United Arab Emirates last year.

West needs Russian oil

That company, Dubai-based Paramount Energy & Commodities DMCC, has continued to export a crude from eastern Russia called ESPO-blend. This has consistently traded above the $60-a-barrel cap introduced by the G7 in December, the Financial Times reported in March.

Following the FT report, Switzerland’s State Secretariat for Economic Affairs (Seco), the department responsible for sanctions enforcement, wrote to Paramount SA about its relationship with Paramount DMCC in the UAE, and Russian oil trading.

The sanctions were intended to allow Russian oil to continue to flow to markets outside Europe and the US, while limiting the revenue captured by the Kremlin. Washington has even encouraged western traders to keep moving Russian oil under the price cap to limit supply disruptions.

But one result has been a massive shift in oil trading activity out of former European centres like Geneva to jurisdictions such as Dubai, which has not enforced the west’s rules.

+ How the Ukraine war has impacted Swiss commodity trading

While some traders in the UAE have chosen to comply with the price cap in order to maintain access to western services, others appear to be trading oil above the cap by using non-European shipping and financial service providers to do it.

“Separate entities”

In the April letter, Seco asked Paramount SA, among other questions, to confirm whether and at what price it had sold Russian oil since December and whether any individual holds shares — directly or indirectly — in both Paramount SA and Paramount DMCC. It also asked whether there had been any financial flows between the two companies, such as loans or dividend payments, since March 2022.

More

Switzerland has to ‘go above and beyond’ to implement sanctions

Paramount SA told the FT it had responded to Seco’s questions in full, telling the agency that the Swiss entity had ceased all transactions involving Russian oil “long before any price cap was in place”.

It said Paramount DMCC is a subsidiary of Paramount SA but stressed the companies are “separate legal entities” and “do not share directors”.

However, separate legal structures and directors do not guarantee that Swiss courts will view a subsidiary as independent and therefore beyond the purview of Swiss law, Seco told the FT in response to questions.

“Swiss authorities assess on a case-by-case basis to what extent acts committed abroad fall under Swiss jurisdiction and thus under the sanctions provisions of Switzerland,” Fabian Maienfisch, a spokesperson for the department said. “Possible points of contact with Swiss jurisdiction exist, for example, if payments or instructions are made from Switzerland,” he added.

The agency declined to respond to specific questions about Paramount. “Seco does not comment on specific cases nor on ongoing investigations,” it said.

Focus on company director

The Paramount case raises clear questions about the level of control exerted over foreign subsidiaries by parent companies and the reach of Switzerland’s sanctions. It also provides an insight into some of the measures some European commodity traders have taken to protect themselves from potential sanctions breaches while continuing to trade Russian oil.

UAE corporate records, reviewed by the FT, show Paramount DMCC was registered in 2020 by a Dubai-based Swiss national François Edouard Mauron, who was the sole director and only shareholder on incorporation. Mauron transferred his shares to Paramount SA in April last year but remained a director.

Paramount SA told the FT in March that Troost, a Dutch citizen, had no role in establishing Paramount DMCC and no management role in the company.

However, a nominee agreement, signed by Troost in February 2022, described Mauron as a “nominee director” obliged to “act upon the instructions” of the shareholder, Paramount SA, in return for an annual nominee fee of CHF350,000 ($390,000). Troost is described in the February 2022 contract, seen by the FT, as the ultimate beneficial owner of Paramount SA.

“The Nominee shall report to and consult with the Shareholder on any matter concerning the company,” it said. “In case of doubt he shall request instructions in writing.”

Paramount SA said the nominee agreement was terminated in November, one month before the price cap was introduced, to ensure Paramount DMCC met the requirements of a legally independent subsidiary under Swiss law. That included giving “full authority” to the management of Paramount DMCC for the “development and execution of [its] international commodity trading activity”, according to minutes of a Paramount SA board meeting on November 2 2022, which the company shared with the FT.

Paramount SA added that “all payments and instructions relating to the relevant trading activities were conducted by DMCC completely independently from Paramount SA”.

Mauron told the FT he was no longer a director or manager at Paramount DMCC. He shared a letter dated May 18, 2023 identifying an Indian national as the company’s sole current director.

Copyright The Financial Times Limited 2023

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.