Swiss start-up funding quadruples within five years

The volume of venture capital that helps aspiring companies get off the ground in Switzerland quadrupled to CHF4 billion ($3.7 billion) between 2017 and 2022.

The main beneficiaries last year were ICT start-ups, including financial technology, and cleantech innovators, according to the latest Swiss Venture Capital Report.

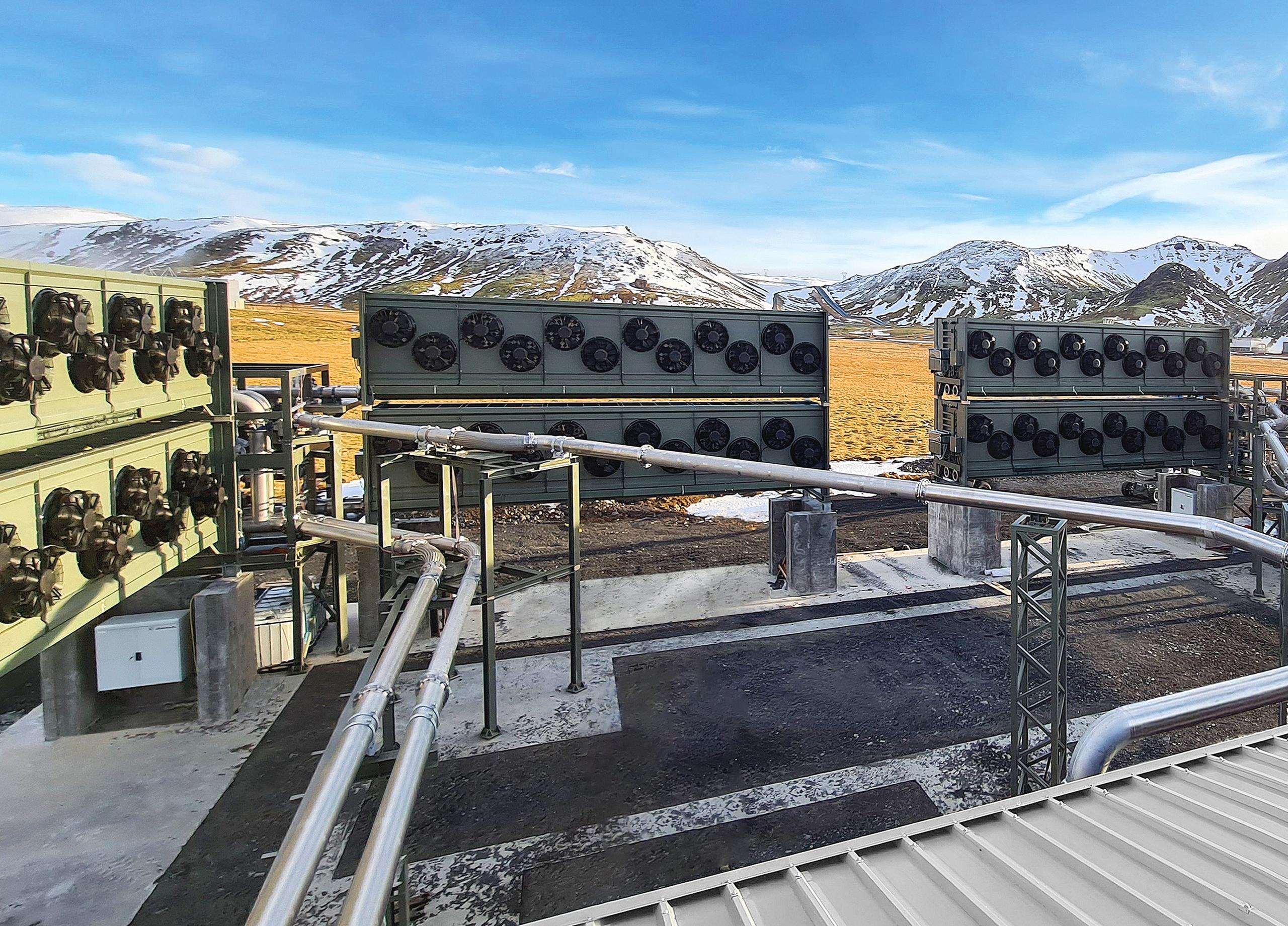

The largest single investment was the CHF600 million pumped into Climeworks, an early stage company that operates a carbon capture and storage plant in Iceland.

Climeworks was one of three Swiss companies that attracted so-called ‘mega-rounds’ of financing in excess of CHF200 million last year.

More

Carbon capture: ‘The road to gigatonne capacity is an ambitious journey’

ICT companies attracted the most funding (CHF1.16 billion) and fintech firms accrued nearly a billion francs. The Climeworks funding round boosted cleantech capital raising to CHF827 million.

The clear loser in the last couple of years has been the biotech sector that has seen venture funding drop in half to around CHF400 million in 2022.

The report, published by the portal Startupticker.ch and the Swiss Private Equity & Corporate Finance Association in cooperation with startup.ch, expressed satisfaction that VC funding continued to rise despite global economic distress last year.

Funding rose by a third last year from a level of CHF3 billion in 2021.

“In 2022, the market underwent its first serious stress test, which it passed with flying colours,” the report stated. “Investment continued to grow, despite adverse circumstances.”

“The upswing in Swiss venture capital investment is definitely not a bubble that collapses without a murmur at the first sign of a change in sentiment.”

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.