Switzerland’s secrecy blind spot hinders sanctions enforcement

The Swiss government has long resisted calls to change laws that would improve transparency and force the disclosure of the ultimate owners of secretive companies. Russian sanctions could be a turning point.

When digging for information about Solway Investment Group, an international metals and mining group with headquarters in the Swiss canton of Zug, there’s no escaping mention of Russia. A Reuters headlineExternal link in 2011 said that “Russia’s Solway” was building a nickel smelter in Indonesia. A major media investigationExternal link in March 2022 alleged the world’s largest privately owned nickel producer had ties to Russian businesses.

Russia’s invasion of Ukraine prompted a series of sanctions on Russian individuals, companies and trade by the European Union, the United States and wealthy G7 nations. Switzerland has kept in line with the EU, implementing its tenth package of sanctions in March.

That has not stopped the international community — including NGOs and more recently the G7 — from criticising Switzerland for not doing enough. They particularly point the finger at the limited amount of Russian assets frozen in Switzerland and argue the Alpine nation could do a better job enforcing sanctions.

In this series we look at what steps Switzerland has taken to conform to international standards and where it lags behind. We question the grounds for sanctions and their consequences for commodity traders based in Switzerland. We also analyse Russian assets in the county and understand how some oligarchs are navigating sanctions.

Last November, the US Treasury labelled the company a “Russian enterprise” and slapped sanctionsExternal link on two Solway employees and subsidiaries under the Magnitsky Act, which targets foreign nationals who commit human rights abuses and corruption. It alleged one of the employees – a Belarusian national – “conducted corrupt acts in furtherance of Russian influence” in the Guatemalan mining industry.

Yet in a rare media interview (see article here), Denis Gerasev, one of two Solway board members, denied the company is linked in any way to the Russian government or oligarchs.

More

‘We didn’t believe we weren’t being transparent’

In an effort to validate his claims, SWI swissinfo.ch embarked on its own investigation. We navigated a maze of company registries across Cyprus, Switzerland, Malta, and St. Vincent and the Grenadines, unearthing a web of sophisticated corporate structures and individuals with multiple nationalities.

Trying to uncover who ultimately owns and controls a company based in Switzerland is like peeling back layers of an onion. While the identity of the ultimate owners of companies has long been of interest to banks and financial regulators to fight money laundering, the difficulty accessing this information has become a major blind spot in Switzerland’s enforcement of sanctions against Russia.

Only by identifying beneficial owners is it possible to cut off the flow of money to the Russian state that’s financing the war against Ukraine, said Tom Keatinge, a sanctions expert and the director of the Centre for Financial Crime and Security Studies at RUSI, a UK-based thinktank. “How can a country claim there isn’t a connection between a sanctioned person and a company operating in their jurisdiction if they don’t have all the information at their disposal,” he said. “It’s a fundamental part of sanctions enforcement.”

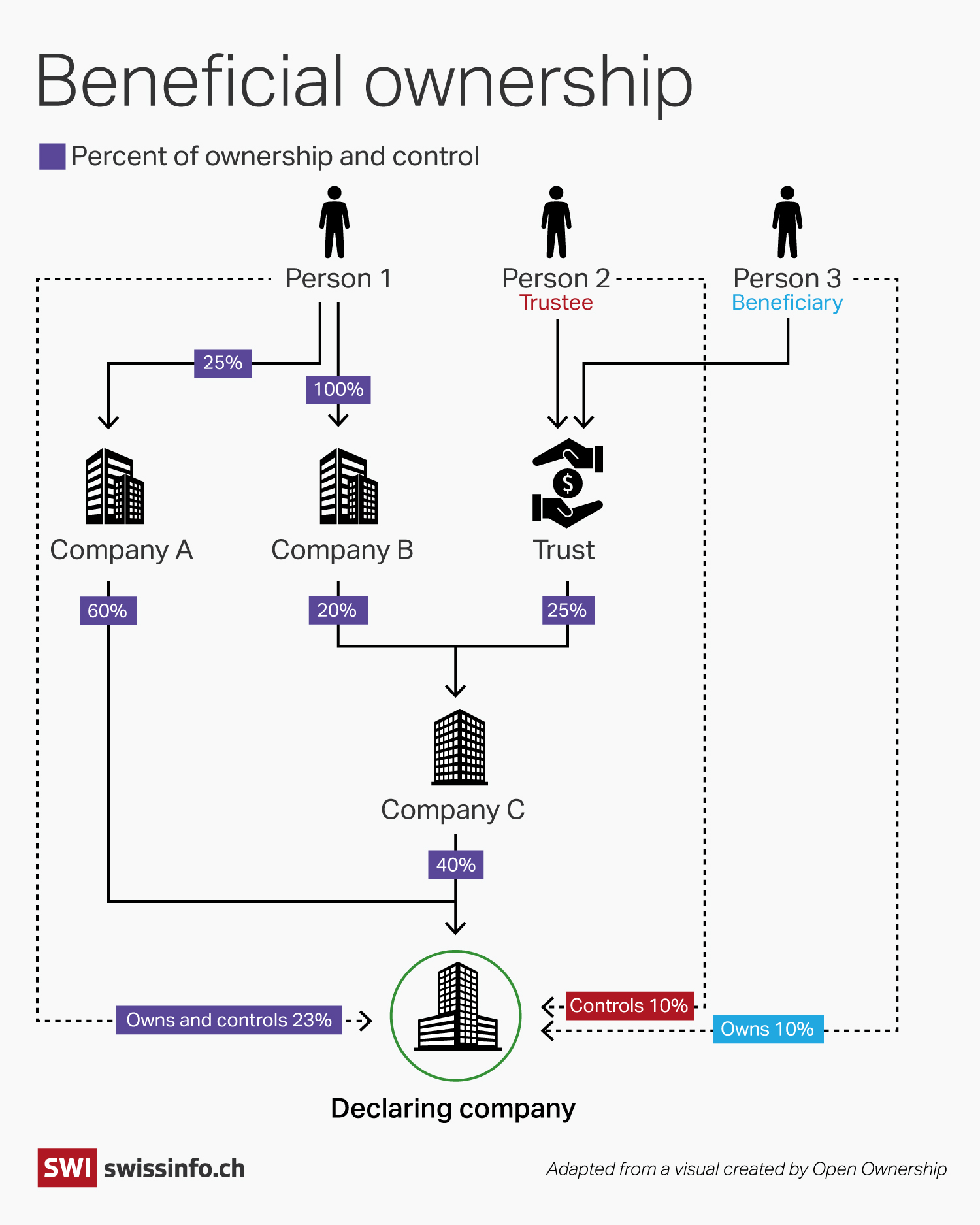

If a Russian oligarch or official is put on the Swiss sanctions list in the context of the war in Ukraine, any entity they control or own is also sanctioned. But the use of complex, opaque corporate structures means it’s difficult, if not impossible, to identify the people at the end of the chain.

Playing catch up

Switzerland has a long history of financial secrecy and the government itself admits that transparency is sorely lacking. In an interview in the Aargauer Zeitung in May, Helen Budlinger Artieda, the head of the State Secretariat for Economic Affairs (SECO), acknowledged that “a major challenge for our sanctions teams is finding out the beneficial owner of any company structure”.

While this is a taxing endeavour everywhere, many other countries were aggressively pushing to unlock the black box of beneficial ownership before the Ukraine war broke out in February 2022.

A beneficial owner (sometimes called a person of significant control) refers to the natural personExternal link or persons, who ultimately has rights over some share of a legal entity’s income or assets, or the ability to control its activities. How control and ownership are defined varies slightly across jurisdictions, legal instruments, and according to the purpose for identification.

Article 697j in the Swiss Code of Obligations requires shareholders to give notice to the company if they acquire more than 25% of a company’s share capital or voting rights. The Swiss Anti-Money Laundering Act requires financial intermediaries to identify and verify beneficial owners.

Beneficial ownership is also important for sanctions enforcement. EU and Swiss sanctions rules state that majority ownership or control by sanctioned individuals, even if they own less than 50% of the shares, means the entity is also sanctioned, although implementation varies across EU member states. Under the US sanctions regime, if 50% of an entity is owned in aggregate, directly or indirectly, by one or more sanctioned persons, the entity itself is sanctioned.

“With regard to the availability and use by authorities of beneficial ownership information of companies, it’s fair to say that Switzerland lags behind EU member states,” said Louise Russell-Prywata, who leads policy and advocacy at Open Ownership, a UK-based organization campaigning for transparency.

There’s no general requirement in Switzerland to share beneficial ownership information with the authorities. Switzerland has adopted recommendations from the Financial Action Task Force (FATF), a global money laundering and terrorist financing watchdog. These require banks to identify and verify the ultimate owners of accounts and compel shareholders to report to company boards of directors when they buy a certain percentage of its shares or voting rights.

But the rules are for internal due diligence and risk management purposes rather than policing by the authorities, said Dario Galli, a lawyer specialising in anti-money laundering regulation compliance at law firm Walder Wyss in Zurich.

The fourth EU anti-money laundering directiveExternal link, passed in 2015, called for governments to create central registers of beneficial owners. FATF made a similar recommendation, prompting offshore financial centres such as Panama to set up central registers.

These changes have put Switzerland under pressure. “Switzerland has to find a way to apply the anti-money laundering rules for its own stability and credibility,” said Alex Nikitine, a partner at Walder Wyss.

More

Switzerland defends its sanctions track record against Russia

Last October, the government announced the finance ministry was making plans for a central register of beneficial owners, but it has yet to be launched. A draft bill for a register should be presented in August, a ministry spokesperson told SWI in an emailed statement.

While compliance with anti-money laundering rules is a key reason for the register, Russian sanctions provide added impetus as Switzerland tries to stem criticism from G7 countries that it isn’t doing enough to catch evaders.

“Switzerland is one of those jurisdictions that has to go above and beyond to prove that it isn’t guilty. If you don’t have a decent company register, you’re not going to persuade people of this,” said Keatinge.

Loopholes and access

But even though a central register has been agreed in principle, what information should be included, how it’s verified, and who should have access to it are all being hotly debated.

The fifth EU anti-money laundering directive, published in 2018, called for the registries to be publicly available. However, in November 2022, the EU Court of JusticeExternal link declared access by the general public as invalid, arguing that it interfered rights to privacy and personal data protection.

EU countries known for financial secrecy and opaque companies, including Malta, Cyprus, and Luxembourg, restricted access to their registries within days.

The Swiss government has no plans to make its register public, a decision that doesn’t surprise Philip Zünd, director of tax and legal at the consulting firm KPMG in Zurich. “There is a tradition of financial privacy in this country. It’s in our DNA,” said Zünd.

But transparency advocates including Maíra Martini, who leads Transparency International’s work on illicit financial flows, argue that public access is necessary to track down sanctions evaders.

“It’s not just about the information about ownership, it also needs to be verified and authorities need to make proper use of it,” said Martini. “Very often, authorities don’t have the capacity or the mandate to analyse the data and investigate. It’s been journalists or activists that have identified assets of oligarchs not the authorities.”

More

Swiss banks accused of hiding data behind secrecy laws

This is especially true given loopholes and gray areas in sanctions rules that allow red flags to slip through the cracks of sanctions enforcers, said Martini.

One example is the use of what’s known as a straw man to conceal ultimate ownership. One such case was Russian cellist Sergei Roldugin, who was listed as the beneficial owner of bank accounts in Zurich that were suspected of channeling millions of francs to Russian President Vladimir Putin.

“Self-declaration isn’t enough, there also needs to be a way to verify this information and understand the entirety of the situation,” said Simone Nadelhofer, a partner at Swiss law firm LALIVE, who specialises in white collar crime and compliance.

More

Commodity trading in Switzerland, explained

Some sanctioned individuals have also reduced shareholdings or transferred ownership to a family member to stay under the radar. Russian oligarch Andrey Melnichenko resigned as a beneficiary and his wife automatically became the new one on March 8, a day before he was sanctioned by the EU. She was eventually sanctioned by the EU and Switzerland a few months later.

Trusts are another gray area. Confidential documents obtained by the Tages-Anzeiger newspaper revealedExternal link that Melnichenko’s ownership was transferred through a Cyprus-based trust that holds a large majority stake in EuroChem. It can be difficult to identify which party benefits from or exercises control over a trust and many countries don’t even register all parties to a trust.

Corporate entities that span different jurisdictions also create challenges because some jurisdictions provide no transparency about beneficial owners,” Nadelhofer said.

Solway is a case in point. The firm is owned by a holding company in Malta, where the corporate registry lists four shareholders – all companies with the same address on St. Vincent and the Grenadines, jurisdictions that provide no beneficial ownership information.

Beneficial ownership information was available on the Malta business registry until the EU court ruling, which was made, coincidentally, four days after the US Treasury announced its sanctions.

In early June, Solway’s legal team provided an extract from the Malta registry to SWI, which indicates that Dan and Christian Bronstein, German citizens and sons of Solway founder Aleksander Bronstein, are the beneficial owners of the company.

But betting on the goodwill and honesty of companies isn’t the answer. “We’ve been relying on the private sector and banks to provide us with ownership information,” said Martini. “But that’s not how you catch criminals.”

Correction: This story was updated on April 5, 2024 to specify that Andrey Melnichenko did not cede his stake in EuroChem to his wife. Melnichenko resigned as a beneficiary and his wife automatically became the new beneficiary.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.