Can affordable ‘Swiss-made’ watches make a comeback?

The Swiss watch industry boom of the past two decades has been accompanied by a collapse in the production of entry-level models. But inspired by Swatch, which rose from the ashes thanks to an unprecedented marketing coup, a few brands are still clinging to the idea of affordable Swiss-made watches.

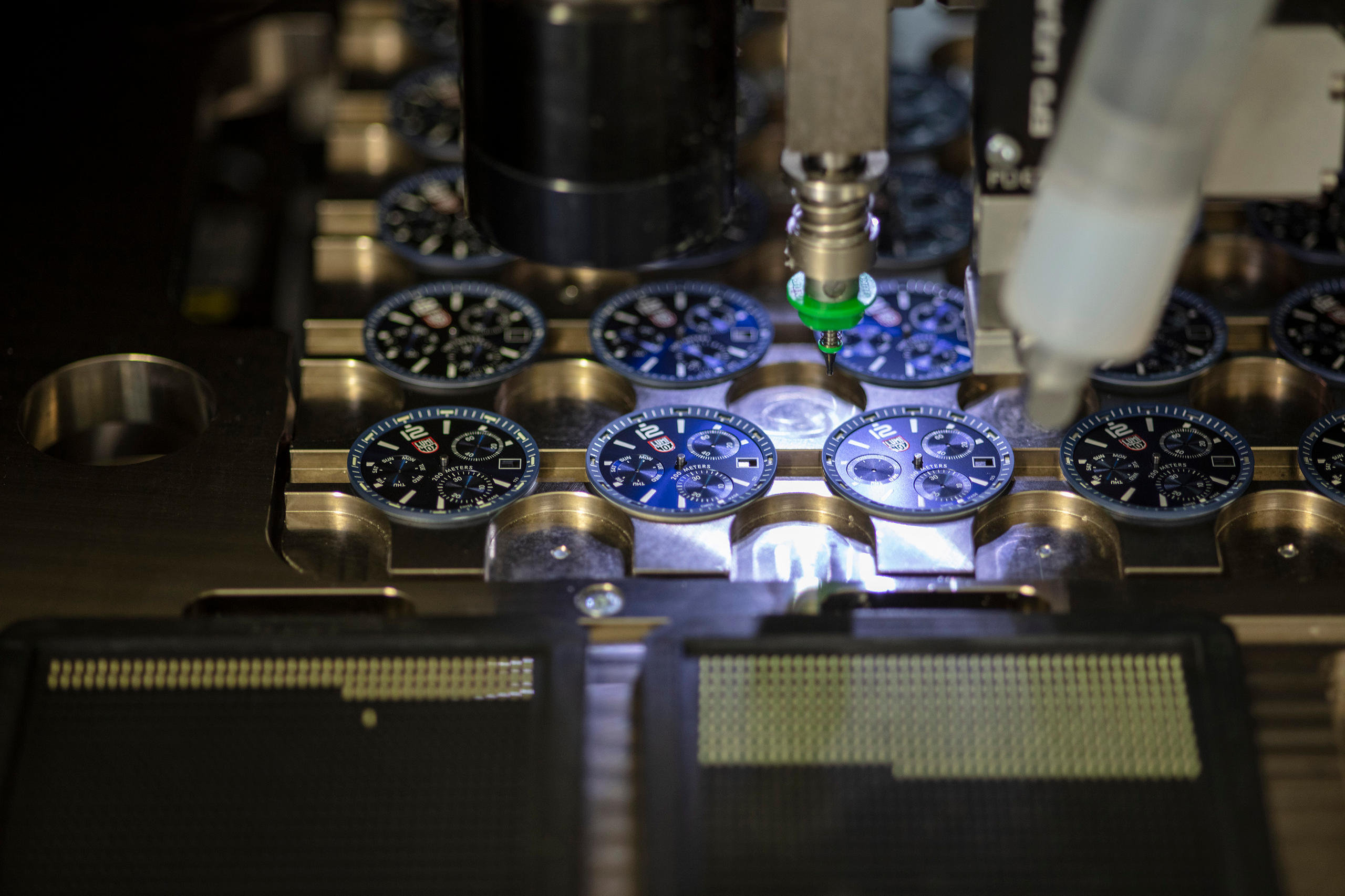

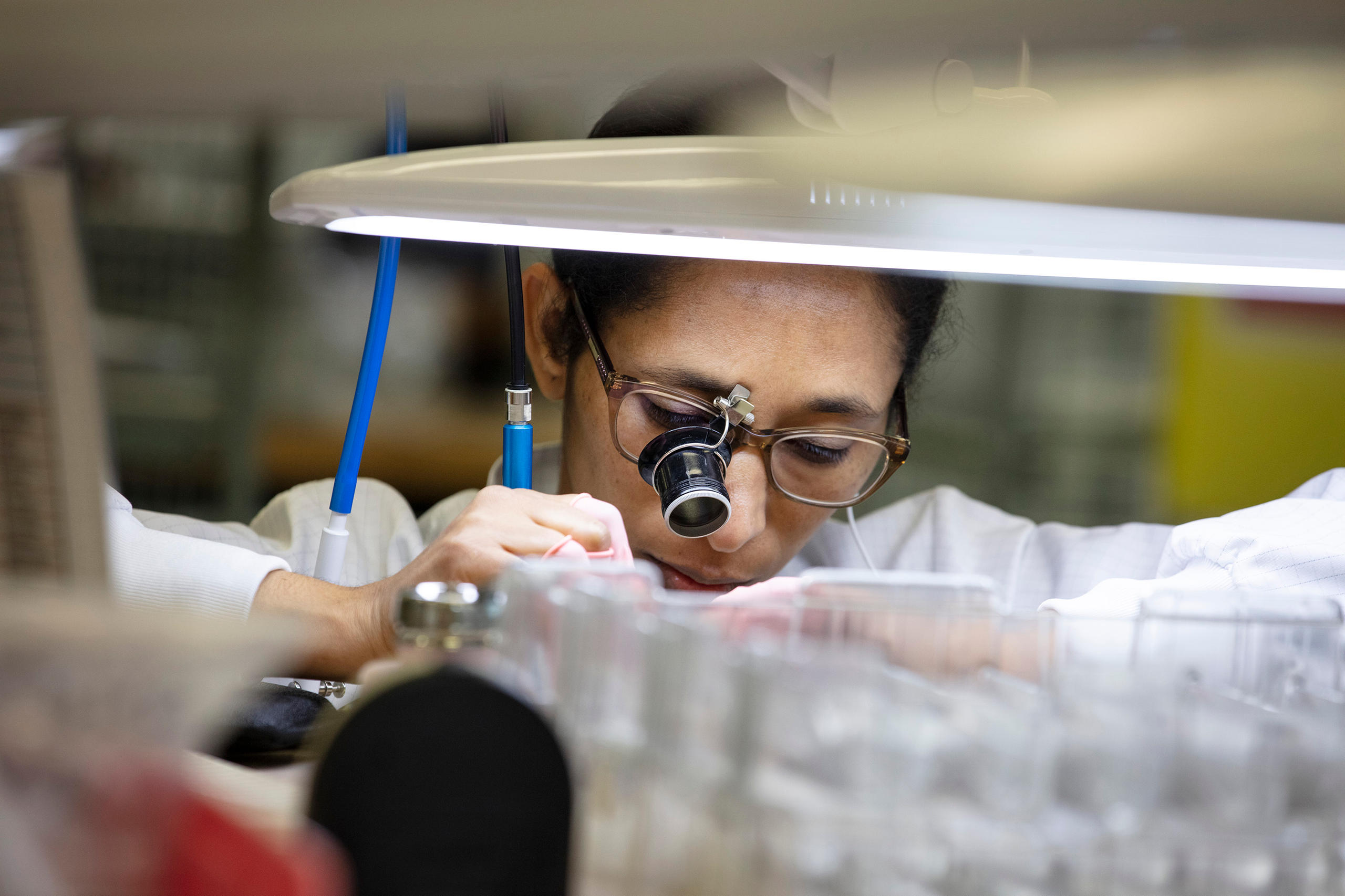

In almost complete silence, some 50 Mondaine machine operators repeat the same movements for hours on end in a carefully orchestrated choreography to produce watches bearing the Swiss-made label. Many tasks, including mounting the watch hands or inserting tiny fluorescent tubes that enable wearers to see the time at night, are still carried out manually at the Swiss watch brand’s Solothurn factory.

“Despite extraordinary progress in the field of robotics, some movements simply cannot be reproduced with the same precision by machines,” explains André Bernheim, co-owner of the Mondaine Group, which produces, among other things, wristwatches with the design of famous Swiss train station clocks, as well as watches for outdoor activities such as Luminox.

But Mondaine is a long way away from the world of artisan watchmakers, or luxury brands whose marketing takes the image of craftsmanship and tradition to extremes. At this company, automated manufacturing processes are not taboo. Bernheim takes his visitors into the immense storage space where the spare parts necessary for watch manufacturing arrive, many of them from Asia. This transparency contrasts with a certain cult of secrecy that permeates the industry.

No bling

Mondaine is now a rare breed in a Swiss watchmaking landscape that has undergone a spectacular rise in quality over the past 20 years. The total number of exports of timepieces with a sale price lower than CHF500 ($540) has dropped by more than half, falling from CHF22.8 million in 2000 to CHF8 million in 2021, while the number of luxury watches (those priced above CHF7,500) has almost quadrupled in the same period, increasing from 488,000 to 1.7 million units. Victorinox, Festina, Raymond Weil, Swatch, Tissot and Mondaine are the only watchmaking brands that still target ordinary people.

Created in 1951, Mondaine is a family-owned company. It began with Erwin Bernheim, the father of the current co-owners André and Ronnie. They have remained faithful to the company’s original values – namely, to offer robust watches for a few dozen or a few hundred Swiss francs. “In this family we don’t like bling,” Bernheim replies when asked why he has not tried to take advantage of the craze for top-of-the-range Swiss-made watches.

The fact remains that the entry-level segment, which was already struggling, was badly shaken by the arrival of the Apple Watch and other smart watches in the mid-2010s. “Smart watches have had a major psychological impact on customers,” says Bernheim. “We didn’t have the financial and technological capacity to enter this market and confront the American or Asian tech giants.”

He declined to comment on how his company’s sales are developing.

The green argument

Bernheim guides us through the ultramodern premises of his factory with pride. The temperature and humidity are carefully controlled, and dust is eliminated thanks to a system that increases air pressure. He is convinced that his group’s two flagship brands, Mondaine and Luminox, still have significant growth potential in Asia, Europe and North America.

“Nowadays, people no longer just wear the watch they received as a wedding or confirmation gift,” he says, referencing a Christian rite of passage. “Many people have several timepieces that they change according to their what they are doing. I am convinced that a solid, durable and inexpensive watch, with the guarantee of a reliable after-sales service, will be a natural part of every new generation’s collection.”

Mondaine has one iconic product: the faithful reproduction of Swiss railway station clocks in a miniaturised version. “[The company] is locked into a single-product segment, like Audemars Piguet with its Royal Oak,” says Olivier Müller, founder of the luxeconsult agency. The challenge for the brand, therefore, is to create endless derivatives of the same product. “Mondaine manages to do this rather well,” the watchmaking expert says.

With the title of chief sustainability officer (CSO), Bernheim is banking on a selling point that is increasingly popular with customers around the world: the sustainability of his products. Mondaine launched its first analogue solar watch in 1973, so its concern for the environment dates back almost 50 years, Bernheim says. It claims to have been a carbon-neutral company across its supply chain since 2020.

“We are probably one of the most environmentally friendly watchmaking companies in the world,” says Bernheim. He criticises the luxury goods industry, which stands accused of “not doing much about the environment but trumpeting the smallest detail.”

Swatch as a model?

The latest statisticsExternal link from the Federation of the Swiss Watch Industry show a glimmer of hope on the horizon for Bernheim and other watchmakers active in the entry-level segment. After years of decline, volumes have risen again slightly this year. This growth is mainly due to the success of the MoonSwatch, an affordable version (costing around CHF250) of the Omega Speedmaster Moonwatch sold by Swatch since the spring.

Thanks to a marketing coup hailed by almost all watchmaking experts, Swatch has restored the lustre of quartz watches. Pictures of tens of thousands of people queuing outside Swatch shops were a flashback to the brand’s heyday – it sold nearly 20 million watches a year at its peak in the 1990s (compared to 3 million today).

While Bernheim declined to comment on a campaign carried out by a direct competitor, Müller stressed the “phenomenal commercial success” of the Moonswatch. Despite delays in production, this ceramic watch should generate sales of 500,000 units this year and probably double that figure by 2023, according to the watchmaking expert. “Beyond the success of this model, the entire Swatch range is benefiting from the craze for this watch, as it has created traffic in the brand’s boutiques that I never thought I would see again,” Müller says.

Will this by extension give a boost to all the watchmaking companies active in this price segment? “Thanks to this initiative, a conventional watch is once again attractive to customers who had lost the habit of wearing them,” Müller says. “However, beyond the one-off collaboration between two brands, I don’t think we will see a new boom in the entry-level conventional watch segment,”

Translated from French by Catherine Hickley

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.